bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

Finance report continued<br />

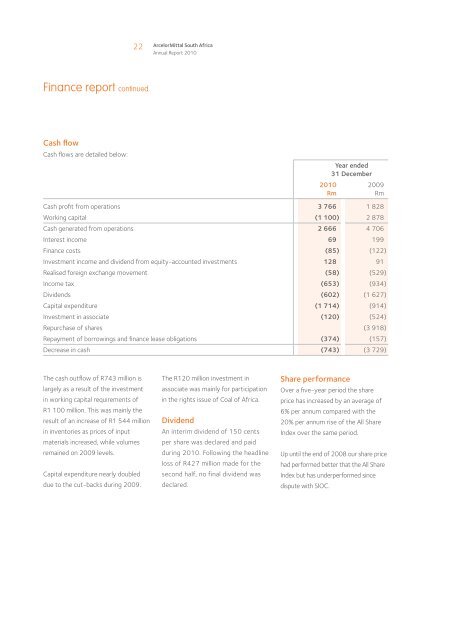

Cash flow<br />

Cash flows are detailed below:<br />

2010<br />

Rm<br />

Year ended<br />

31 December<br />

2009<br />

Rm<br />

Cash profit from operations 3 766 1 828<br />

Working capital (1 100) 2 878<br />

Cash generated from operations 2 666 4 706<br />

Interest income 69 199<br />

Finance costs (85) (122)<br />

Investment income and dividend from equity-accounted investments 128 91<br />

Realised foreign exchange movement (58) (529)<br />

Income tax (653) (934)<br />

Dividends (602) (1 627)<br />

Capital expenditure (1 714) (914)<br />

Investment in associate (120) (524)<br />

Repurchase of shares (3 918)<br />

Repayment of borrowings and finance lease obligations (374) (157)<br />

Decrease in cash (743) (3 729)<br />

The cash outflow of R743 million is<br />

largely as a result of the investment<br />

in working capital requirements of<br />

R1 100 million. This was mainly the<br />

result of an increase of R1 544 million<br />

in inventories as prices of input<br />

materials increased, while volumes<br />

remained on 2009 levels.<br />

Capital expenditure nearly doubled<br />

due to the cut-backs during 2009.<br />

The R120 million investment in<br />

associate was mainly for participation<br />

in the rights issue of Coal of <strong>Africa</strong>.<br />

Dividend<br />

An interim dividend of 150 cents<br />

per share was declared and paid<br />

during 2010. Following the headline<br />

loss of R427 million made for the<br />

second half, no final dividend was<br />

declared.<br />

Share performance<br />

Over a five-year period the share<br />

price has increased by an average of<br />

6% per annum compared with the<br />

20% per annum rise of the All Share<br />

Index over the same period.<br />

Up until the end of 2008 our share price<br />

had performed better that the All Share<br />

Index but has underperformed since<br />

dispute with SIOC.