bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

184<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

28. POST-EMPLOYMENT BENEFITS<br />

28.1 Pensions<br />

Independent funds provide pension and other benefits for all permanent employees and their dependants. At<br />

the end of the financial year the following funds were in existence:<br />

• <strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> Selector Pension Fund (Reg no. 12/8/35421) and <strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Selector Provident Fund (Reg no. 12/8/35423), both operating as defined contribution funds.<br />

• Iscor Employees' Provident Fund (Reg no. 12/8/27484), operating as a defined contribution fund.<br />

• <strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> Pension Fund (Reg no. 12/8/363), operating as a defined benefit fund. This<br />

fund is closed to new entrants.<br />

• Iscor Retirement Fund (Reg no. 12/8/5751), operating as a defined benefit fund. This fund is closed to<br />

new entrants.<br />

The assets of these plans are held separately from those of the company and group in funds under the<br />

control of the trustees. All funds are governed by the <strong>South</strong> <strong>Africa</strong>n Pension Funds Act of 1956.<br />

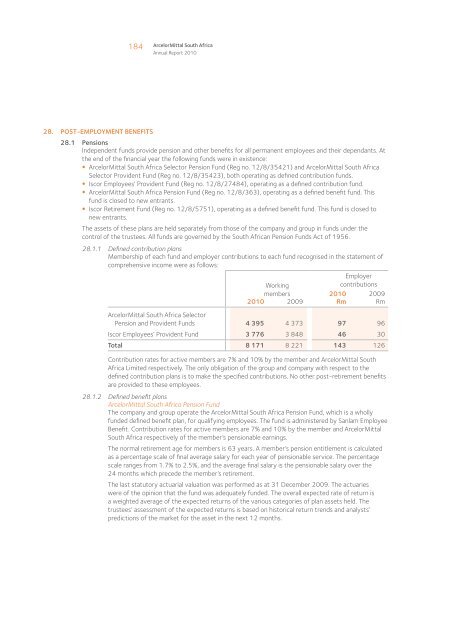

28.1.1 Defined contribution plans<br />

Membership of each fund and employer contributions to each fund recognised in the statement of<br />

comprehensive income were as follows:<br />

Employer<br />

Working<br />

contributions<br />

members<br />

2010 2009<br />

2010 2009 Rm Rm<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> Selector<br />

Pension and Provident Funds 4 395 4 373 97 96<br />

Iscor Employees’ Provident Fund 3 776 3 848 46 30<br />

Total 8 171 8 221 143 126<br />

Contribution rates for active members are 7% and 10% by the member and <strong>ArcelorMittal</strong> <strong>South</strong><br />

<strong>Africa</strong> Limited respectively. The only obligation of the group and company with respect to the<br />

defined contribution plans is to make the specified contributions. No other post-retirement benefits<br />

are provided to these employees.<br />

28.1.2 Defined benefit plans<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> Pension Fund<br />

The company and group operate the <strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> Pension Fund, which is a wholly<br />

funded defined benefit plan, for qualifying employees. The fund is administered by Sanlam Employee<br />

Benefit. Contribution rates for active members are 7% and 10% by the member and <strong>ArcelorMittal</strong><br />

<strong>South</strong> <strong>Africa</strong> respectively of the member’s pensionable earnings.<br />

The normal retirement age for members is 63 years. A member’s pension entitlement is calculated<br />

as a percentage scale of final average salary for each year of pensionable service. The percentage<br />

scale ranges from 1.7% to 2.5%, and the average final salary is the pensionable salary over the<br />

24 months which precede the member’s retirement.<br />

The last statutory actuarial valuation was performed as at 31 December 2009. The actuaries<br />

were of the opinion that the fund was adequately funded. The overall expected rate of return is<br />

a weighted average of the expected returns of the various categories of plan assets held. The<br />

trustees’ assessment of the expected returns is based on historical return trends and analysts’<br />

predictions of the market for the asset in the next 12 months.