bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

179<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

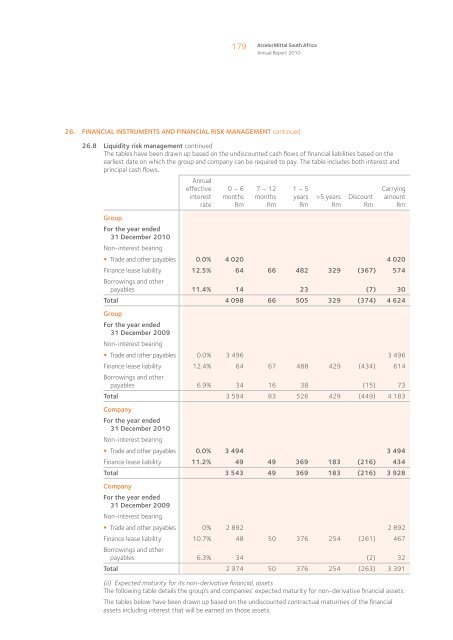

26. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT continued<br />

26.8 Liquidity risk management continued<br />

The tables have been drawn up based on the undiscounted cash flows of financial liabilities based on the<br />

earliest date on which the group and company can be required to pay. The table includes both interest and<br />

principal cash flows.<br />

Annual<br />

effective<br />

interest<br />

rate<br />

0 – 6<br />

months<br />

Rm<br />

7 – 12<br />

months<br />

Rm<br />

1 – 5<br />

years<br />

Rm<br />

>5 years<br />

Rm<br />

Discount<br />

Rm<br />

Carrying<br />

amount<br />

Rm<br />

Group<br />

For the year ended<br />

31 December 2010<br />

Non-interest bearing<br />

• Trade and other payables 0.0% 4 020 4 020<br />

Finance lease liability 12.5% 64 66 482 329 (367) 574<br />

Borrowings and other<br />

payables 11.4% 14 23 (7) 30<br />

Total 4 098 66 505 329 (374) 4 624<br />

Group<br />

For the year ended<br />

31 December 2009<br />

Non-interest bearing<br />

• Trade and other payables 0.0% 3 496 3 496<br />

Finance lease liability 12.4% 64 67 488 429 (434) 614<br />

Borrowings and other<br />

payables 6.9% 34 16 38 (15) 73<br />

Total 3 594 83 526 429 (449) 4 183<br />

Company<br />

For the year ended<br />

31 December 2010<br />

Non-interest bearing<br />

• Trade and other payables 0.0% 3 494 3 494<br />

Finance lease liability 11.2% 49 49 369 183 (216) 434<br />

Total 3 543 49 369 183 (216) 3 928<br />

Company<br />

For the year ended<br />

31 December 2009<br />

Non-interest bearing<br />

• Trade and other payables 0% 2 892 2 892<br />

Finance lease liability 10.7% 48 50 376 254 (261) 467<br />

Borrowings and other<br />

payables 6.3% 34 (2) 32<br />

Total 2 974 50 376 254 (263) 3 391<br />

(ii) Expected maturity for its non-derivative financial, assets<br />

The following table details the group’s and companies’ expected maturity for non-derivative financial assets.<br />

The tables below have been drawn up based on the undiscounted contractual maturities of the financial<br />

assets including interest that will be earned on those assets.