bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

178<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

26. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT continued<br />

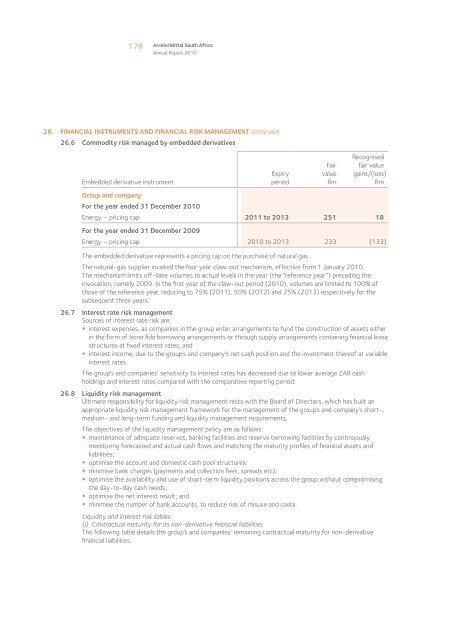

26.6 Commodity risk managed by embedded derivatives<br />

Embedded derivative instrument<br />

Expiry<br />

period<br />

Fair<br />

value<br />

Rm<br />

Recognised<br />

fair value<br />

gains/(loss)<br />

Rm<br />

Group and company<br />

For the year ended 31 December 2010<br />

Energy – pricing cap 2011 to 2013 251 18<br />

For the year ended 31 December 2009<br />

Energy – pricing cap 2010 to 2013 233 (133)<br />

The embedded derivative represents a pricing cap on the purchase of natural gas.<br />

The natural-gas supplier invoked the four year claw-out mechanism, effective from 1 January 2010.<br />

The mechanism limits off-take volumes to actual levels in the year (the “reference year”) preceding the<br />

invocation, namely 2009. In the first year of the claw-out period (2010), volumes are limited to 100% of<br />

those of the reference year, reducing to 75% (2011), 50% (2012) and 25% (2013) respectively for the<br />

subsequent three years.<br />

26.7 Interest rate risk management<br />

Sources of interest rate risk are:<br />

• interest expenses, as companies in the group enter arrangements to fund the construction of assets either<br />

in the form of bona fida borrowing arrangements or through supply arrangements containing financial lease<br />

structures at fixed interest rates; and<br />

• interest income, due to the group’s and company’s net cash position and the investment thereof at variable<br />

interest rates.<br />

The group’s and companies’ sensitivity to interest rates has decreased due to lower average ZAR cash<br />

holdings and interest rates compared with the comparative reporting period.<br />

26.8 Liquidity risk management<br />

Ultimate responsibility for liquidity risk management rests with the Board of Directors, which has built an<br />

appropriate liquidity risk management framework for the management of the group’s and company’s short-,<br />

medium- and long-term funding and liquidity management requirements.<br />

The objectives of the liquidity management policy are as follows:<br />

• maintenance of adequate reserves, banking facilities and reserve borrowing facilities by continuously<br />

monitoring forecasted and actual cash flows and matching the maturity profiles of financial assets and<br />

liabilities;<br />

• optimise the account and domestic cash pool structures;<br />

• minimise bank charges (payments and collection fees, spreads etc);<br />

• optimise the availability and use of short-term liquidity positions across the group without compromising<br />

the day-to-day cash needs;<br />

• optimise the net interest result; and<br />

• minimise the number of bank accounts, to reduce risk of misuse and costs.<br />

Liquidity and interest risk tables<br />

(i) Contractual maturity for its non-derivative financial liabilities<br />

The following table details the group’s and companies’ remaining contractual maturity for non-derivative<br />

financial liabilities.