bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

168<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

22. PROVISIONS continued<br />

Asset retirement obligation and environmental remediation obligation provisions<br />

Environmental obligations consist of asset retirement obligations and environmental remediation obligations.<br />

Environmental remediation obligations represent the present value of the cost of remedial action to clean-up and<br />

secure a site. These actions are primarily attributable to historical, that is legacy, waste disposal activities. Legal<br />

obligations exist to remediate these facilities.<br />

Estimating the future cash flows associated with these obligations and the related asset components is complex.<br />

In particular, judgement is required in distinguishing between asset retirement obligations and environmental<br />

remediation obligations.<br />

Existing laws and guidelines are not always clear as to the required end-state situation. The provisions are also<br />

affected by changing technologies, environmental, safety, business and legal considerations.<br />

Management assess long-term operational plans, technological and legislative developments, guidelines issued by<br />

the authorities, advice from external environmental experts, and computations provided by quantity surveyors in<br />

order to derive an estimated future cash flow profile to serve as basis for the computation of the obligations and<br />

related assets.<br />

The asset retirement obligations represent management’s best estimate of the present value of costs that will<br />

be required to retire plant and equipment. The majority of the obligation relates to ancillary plant and equipment<br />

that will be retired as part of the clean-up and closure of those facilities to be remediated via the environmental<br />

remediation obligation. The net carrying amount of the asset retirement obligation asset component, included in<br />

note 13, amounts to R46 million (December 2009: R26 million) for the group and R37 million (December 2009:<br />

R20 million) for the company.<br />

The term of the obligation assessment varies according to the site. The maximum term is 20 years.<br />

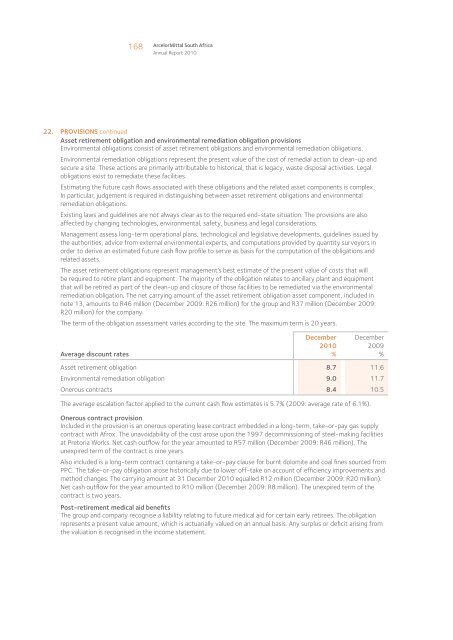

Average discount rates<br />

December<br />

2010<br />

%<br />

December<br />

2009<br />

%<br />

Asset retirement obligation 8.7 11.6<br />

Environmental remediation obligation 9.0 11.7<br />

Onerous contracts 8.4 10.5<br />

The average escalation factor applied to the current cash flow estimates is 5.7% (2009: average rate of 6.1%).<br />

Onerous contract provision<br />

Included in the provision is an onerous operating lease contract embedded in a long-term, take-or-pay gas supply<br />

contract with Afrox. The unavoidability of the cost arose upon the 1997 decommissioning of steel-making facilities<br />

at Pretoria Works. Net cash outflow for the year amounted to R57 million (December 2009: R46 million). The<br />

unexpired term of the contract is nine years.<br />

Also included is a long-term contract containing a take-or-pay clause for burnt dolomite and coal fines sourced from<br />

PPC. The take-or-pay obligation arose historically due to lower off-take on account of efficiency improvements and<br />

method changes. The carrying amount at 31 December 2010 equalled R12 million (December 2009: R20 million).<br />

Net cash outflow for the year amounted to R10 million (December 2009: R8 million). The unexpired term of the<br />

contract is two years.<br />

Post-retirement medical aid benefits<br />

The group and company recognise a liability relating to future medical aid for certain early retirees. The obligation<br />

represents a present value amount, which is actuarially valued on an annual basis. Any surplus or deficit arising from<br />

the valuation is recognised in the income statement.