bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

177<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

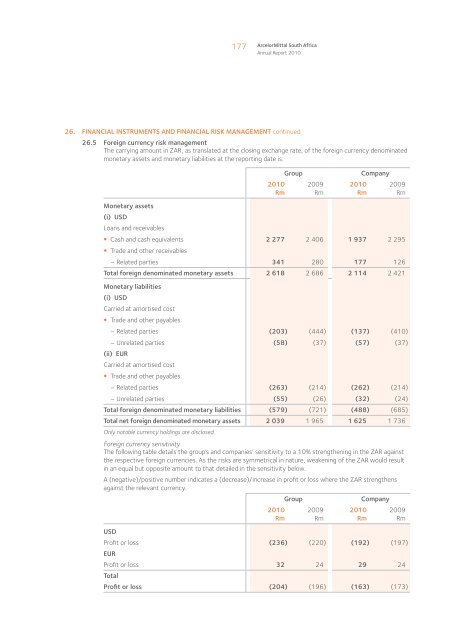

26. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT continued<br />

26.5 Foreign currency risk management<br />

The carrying amount in ZAR, as translated at the closing exchange rate, of the foreign currency denominated<br />

monetary assets and monetary liabilities at the reporting date is:<br />

Group<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

Company<br />

2009<br />

Rm<br />

Monetary assets<br />

(i) USD<br />

Loans and receivables<br />

• Cash and cash equivalents 2 277 2 406 1 937 2 295<br />

• Trade and other receivables<br />

– Related parties 341 280 177 126<br />

Total foreign denominated monetary assets 2 618 2 686 2 114 2 421<br />

Monetary liabilities<br />

(i) USD<br />

Carried at amortised cost<br />

• Trade and other payables<br />

– Related parties (203) (444) (137) (410)<br />

– Unrelated parties (58) (37) (57) (37)<br />

(ii) EUR<br />

Carried at amortised cost<br />

• Trade and other payables<br />

– Related parties (263) (214) (262) (214)<br />

– Unrelated parties (55) (26) (32) (24)<br />

Total foreign denominated monetary liabilities (579) (721) (488) (685)<br />

Total net foreign denominated monetary assets 2 039 1 965 1 625 1 736<br />

Only notable currency holdings are disclosed.<br />

Foreign currency sensitivity<br />

The following table details the group’s and companies’ sensitivity to a 10% strengthening in the ZAR against<br />

the respective foreign currencies. As the risks are symmetrical in nature, weakening of the ZAR would result<br />

in an equal but opposite amount to that detailed in the sensitivity below.<br />

A (negative)/positive number indicates a (decrease)/increase in profit or loss where the ZAR strengthens<br />

against the relevant currency.<br />

Group<br />

Company<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

USD<br />

Profit or loss (236) (220) (192) (197)<br />

EUR<br />

Profit or loss 32 24 29 24<br />

Total<br />

Profit or loss (204) (196) (163) (173)