bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

182<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

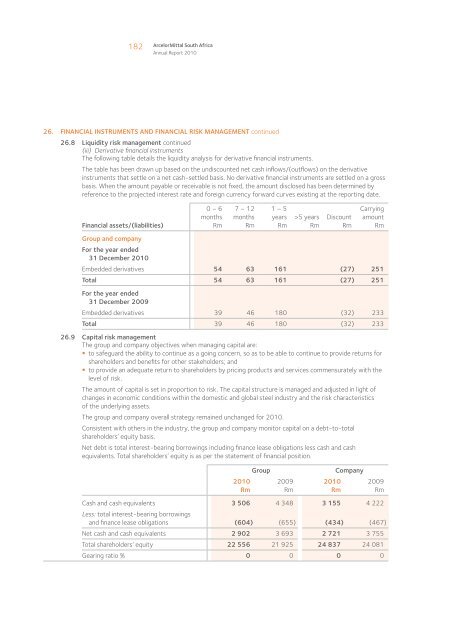

26. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT continued<br />

26.8 Liquidity risk management continued<br />

(iii) Derivative financial instruments<br />

The following table details the liquidity analysis for derivative financial instruments.<br />

The table has been drawn up based on the undiscounted net cash inflows/(outflows) on the derivative<br />

instruments that settle on a net cash-settled basis. No derivative financial instruments are settled on a gross<br />

basis. When the amount payable or receivable is not fixed, the amount disclosed has been determined by<br />

reference to the projected interest rate and foreign currency forward curves existing at the reporting date.<br />

Financial assets/(liabilities)<br />

0 – 6<br />

months<br />

Rm<br />

7 – 12<br />

months<br />

Rm<br />

1 – 5<br />

years<br />

Rm<br />

>5 years<br />

Rm<br />

Discount<br />

Rm<br />

Carrying<br />

amount<br />

Rm<br />

Group and company<br />

For the year ended<br />

31 December 2010<br />

Embedded derivatives 54 63 161 (27) 251<br />

Total 54 63 161 (27) 251<br />

For the year ended<br />

31 December 2009<br />

Embedded derivatives 39 46 180 (32) 233<br />

Total 39 46 180 (32) 233<br />

26.9 Capital risk management<br />

The group and company objectives when managing capital are:<br />

• to safeguard the ability to continue as a going concern, so as to be able to continue to provide returns for<br />

shareholders and benefits for other stakeholders; and<br />

• to provide an adequate return to shareholders by pricing products and services commensurately with the<br />

level of risk.<br />

The amount of capital is set in proportion to risk. The capital structure is managed and adjusted in light of<br />

changes in economic conditions within the domestic and global steel industry and the risk characteristics<br />

of the underlying assets.<br />

The group and company overall strategy remained unchanged for 2010.<br />

Consistent with others in the industry, the group and company monitor capital on a debt-to-total<br />

shareholders’ equity basis.<br />

Net debt is total interest-bearing borrowings including finance lease obligations less cash and cash<br />

equivalents. Total shareholders’ equity is as per the statement of financial position.<br />

Group<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

Company<br />

2009<br />

Rm<br />

Cash and cash equivalents 3 506 4 348 3 155 4 222<br />

Less: total interest-bearing borrowings<br />

and finance lease obligations (604) (655) (434) (467)<br />

Net cash and cash equivalents 2 902 3 693 2 721 3 755<br />

Total shareholders’ equity 22 556 21 925 24 837 24 081<br />

Gearing ratio % 0 0 0 0