bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

162<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

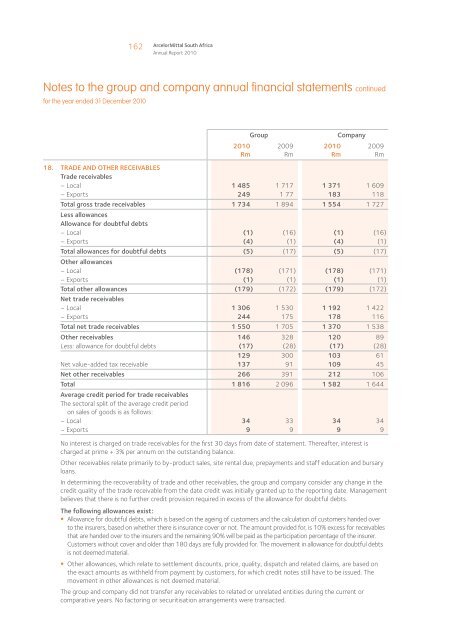

Notes to the group and company annual financial statements continued<br />

for the year ended 31 December 2010<br />

Group<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

2010<br />

Rm<br />

Company<br />

2009<br />

Rm<br />

18. TRADE AND OTHER RECEIVABLES<br />

Trade receivables<br />

– Local 1 485 1 717 1 371 1 609<br />

– Exports 249 1 77 183 118<br />

Total gross trade receivables 1 734 1 894 1 554 1 727<br />

Less allowances<br />

Allowance for doubtful debts<br />

– Local (1) (16) (1) (16)<br />

– Exports (4) (1) (4) (1)<br />

Total allowances for doubtful debts (5) (17) (5) (17)<br />

Other allowances<br />

– Local (178) (171) (178) (171)<br />

– Exports (1) (1) (1) (1)<br />

Total other allowances (179) (172) (179) (172)<br />

Net trade receivables<br />

– Local 1 306 1 530 1 192 1 422<br />

– Exports 244 175 178 116<br />

Total net trade receivables 1 550 1 705 1 370 1 538<br />

Other receivables 146 328 120 89<br />

Less: allowance for doubtful debts (17) (28) (17) (28)<br />

129 300 103 61<br />

Net value-added tax receivable 137 91 109 45<br />

Net other receivables 266 391 212 106<br />

Total 1 816 2 096 1 582 1 644<br />

Average credit period for trade receivables<br />

The sectoral split of the average credit period<br />

on sales of goods is as follows:<br />

– Local 34 33 34 34<br />

– Exports 9 9 9 9<br />

No interest is charged on trade receivables for the first 30 days from date of statement. Thereafter, interest is<br />

charged at prime + 3% per annum on the outstanding balance.<br />

Other receivables relate primarily to by-product sales, site rental due, prepayments and staff education and bursary<br />

loans.<br />

In determining the recoverability of trade and other receivables, the group and company consider any change in the<br />

credit quality of the trade receivable from the date credit was initially granted up to the reporting date. Management<br />

believes that there is no further credit provision required in excess of the allowance for doubtful debts.<br />

The following allowances exist:<br />

• Allowance for doubtful debts, which is based on the ageing of customers and the calculation of customers handed over<br />

to the insurers, based on whether there is insurance cover or not. The amount provided for, is 10% excess for receivables<br />

that are handed over to the insurers and the remaining 90% will be paid as the participation percentage of the insurer.<br />

Customers without cover and older than 180 days are fully provided for. The movement in allowance for doubtful debts<br />

is not deemed material.<br />

• Other allowances, which relate to settlement discounts, price, quality, dispatch and related claims, are based on<br />

the exact amounts as withheld from payment by customers, for which credit notes still have to be issued. The<br />

movement in other allowances is not deemed material.<br />

The group and company did not transfer any receivables to related or unrelated entities during the current or<br />

comparative years. No factoring or securitisation arrangements were transacted.