bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

174<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

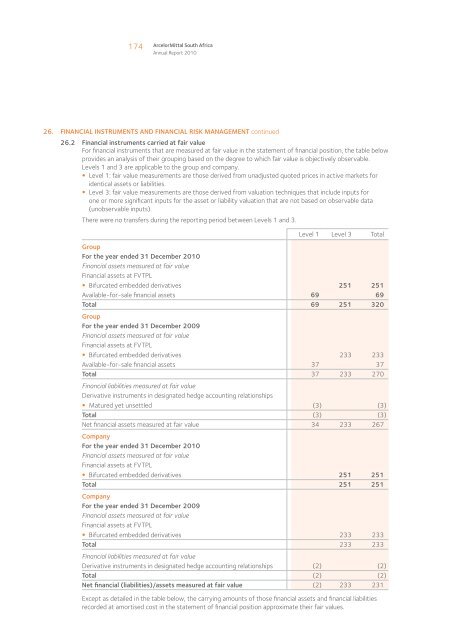

26. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT continued<br />

26.2 Financial instruments carried at fair value<br />

For financial instruments that are measured at fair value in the statement of financial position, the table below<br />

provides an analysis of their grouping based on the degree to which fair value is objectively observable.<br />

Levels 1 and 3 are applicable to the group and company.<br />

• Level 1: fair value measurements are those derived from unadjusted quoted prices in active markets for<br />

identical assets or liabilities.<br />

• Level 3: fair value measurements are those derived from valuation techniques that include inputs for<br />

one or more significant inputs for the asset or liability valuation that are not based on observable data<br />

(unobservable inputs).<br />

There were no transfers during the reporting period between Levels 1 and 3.<br />

Level 1 Level 3 Total<br />

Group<br />

For the year ended 31 December 2010<br />

Financial assets measured at fair value<br />

Financial assets at FVTPL<br />

• Bifurcated embedded derivatives 251 251<br />

Available-for-sale financial assets 69 69<br />

Total 69 251 320<br />

Group<br />

For the year ended 31 December 2009<br />

Financial assets measured at fair value<br />

Financial assets at FVTPL<br />

• Bifurcated embedded derivatives 233 233<br />

Available-for-sale financial assets 37 37<br />

Total 37 233 270<br />

Financial liabilities measured at fair value<br />

Derivative instruments in designated hedge accounting relationships<br />

• Matured yet unsettled (3) (3)<br />

Total (3) (3)<br />

Net financial assets measured at fair value 34 233 267<br />

Company<br />

For the year ended 31 December 2010<br />

Financial assets measured at fair value<br />

Financial assets at FVTPL<br />

• Bifurcated embedded derivatives 251 251<br />

Total 251 251<br />

Company<br />

For the year ended 31 December 2009<br />

Financial assets measured at fair value<br />

Financial assets at FVTPL<br />

• Bifurcated embedded derivatives 233 233<br />

Total 233 233<br />

Financial liabilities measured at fair value<br />

Derivative instruments in designated hedge accounting relationships (2) (2)<br />

Total (2) (2)<br />

Net financial (liabilities)/assets measured at fair value (2) 233 231<br />

Except as detailed in the table below, the carrying amounts of those financial assets and financial liabilities<br />

recorded at amortised cost in the statement of financial position approximate their fair values.