bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

196<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

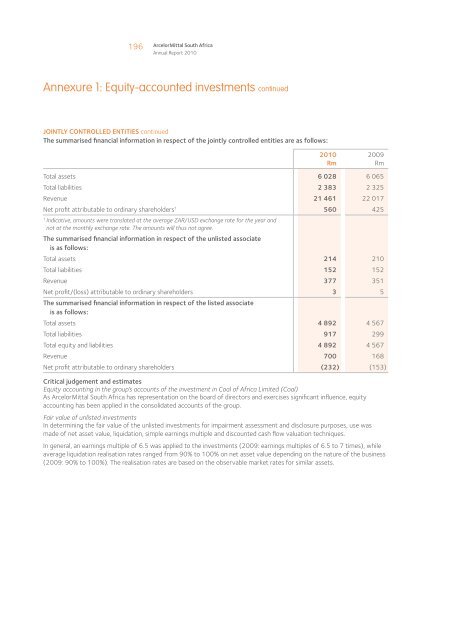

Annexure 1: Equity-accounted investments continued<br />

JOINTLY CONTROLLED ENTITIES continued<br />

The summarised financial information in respect of the jointly controlled entities are as follows:<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

Total assets 6 028 6 065<br />

Total liabilities 2 383 2 325<br />

Revenue 21 461 22 017<br />

Net profit attributable to ordinary shareholders 1 560 425<br />

1<br />

Indicative, amounts were translated at the average ZAR/USD exchange rate for the year and<br />

not at the monthly exchange rate. The amounts will thus not agree.<br />

The summarised financial information in respect of the unlisted associate<br />

is as follows:<br />

Total assets 214 210<br />

Total liabilities 152 152<br />

Revenue 377 351<br />

Net profit/(loss) attributable to ordinary shareholders 3 5<br />

The summarised financial information in respect of the listed associate<br />

is as follows:<br />

Total assets 4 892 4 567<br />

Total liabilities 917 299<br />

Total equity and liabilities 4 892 4 567<br />

Revenue 700 168<br />

Net profit attributable to ordinary shareholders (232) (153)<br />

Critical judgement and estimates<br />

Equity accounting in the group’s accounts of the investment in Coal of <strong>Africa</strong> Limited (Coal)<br />

As <strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong> has representation on the board of directors and exercises significant influence, equity<br />

accounting has been applied in the consolidated accounts of the group.<br />

Fair value of unlisted investments<br />

In determining the fair value of the unlisted investments for impairment assessment and disclosure purposes, use was<br />

made of net asset value, liquidation, simple earnings multiple and discounted cash flow valuation techniques.<br />

In general, an earnings multiple of 6.5 was applied to the investments (2009: earnings multiples of 6.5 to 7 times), while<br />

average liquidation realisation rates ranged from 90% to 100% on net asset value depending on the nature of the business<br />

(2009: 90% to 100%). The realisation rates are based on the observable market rates for similar assets.