bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

bold spirit - ArcelorMittal South Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

163<br />

<strong>ArcelorMittal</strong> <strong>South</strong> <strong>Africa</strong><br />

Annual Report 2010<br />

18. TRADE AND OTHER RECEIVABLES continued<br />

The credit risk management policy sets out the framework within which the customer credit risk is managed.<br />

The objectives of the credit risk management policy are to:<br />

• increase sales through investing in the customer base;<br />

• avoid extensions that could lead to the financial distress and default by customers;<br />

• maintain productive customer relationships within the framework of prudent risk management;<br />

• optimising cash collection periods; and<br />

• diversifying credit exposure over a broad client base.<br />

The Credit Policy is enacted by the Credit Management department (Credit Management). Credit Management<br />

ensures that credit extension and management is conducted within the approved frameworks, and adequately<br />

assesses and reports all credit exposures, which includes the maintenance of appropriate collateral, financial<br />

guarantees and credit insurance.<br />

Customer credit risk is assessed on a group-wide basis and refers to the risk that a customer will default on its<br />

contractual obligations resulting in financial loss to the group.<br />

Customers are independently rated. Independent rating agency, Experian <strong>South</strong> <strong>Africa</strong> (Proprietary) Limited, are<br />

used for domestic customers. If there is no independent rating, Credit Management assesses the credit quality of<br />

the specific customer, taking into account its financial position, past experience and other factors. Credit limits are<br />

regularly monitored.<br />

Credit insurance is placed with the Coface Group with a maximum liability of R1 800 million with a 10% excess.<br />

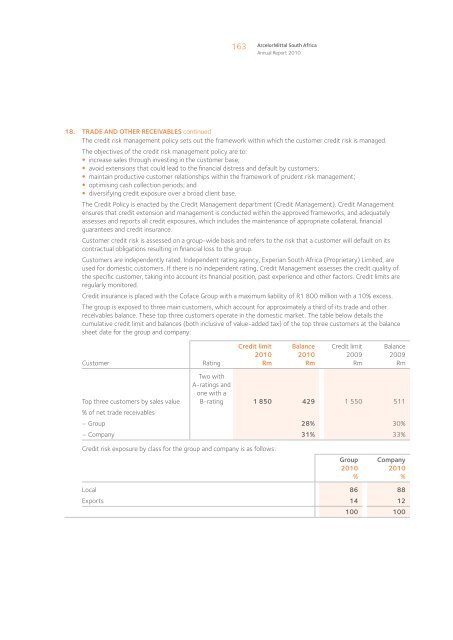

The group is exposed to three main customers, which account for approximately a third of its trade and other<br />

receivables balance. These top three customers operate in the domestic market. The table below details the<br />

cumulative credit limit and balances (both inclusive of value-added tax) of the top three customers at the balance<br />

sheet date for the group and company:<br />

Customer<br />

Rating<br />

Credit limit<br />

2010<br />

Rm<br />

Balance<br />

2010<br />

Rm<br />

Credit limit<br />

2009<br />

Rm<br />

Balance<br />

2009<br />

Rm<br />

Top three customers by sales value<br />

Two with<br />

A-ratings and<br />

one with a<br />

B-rating 1 850 429 1 550 511<br />

% of net trade receivables<br />

– Group 28% 30%<br />

– Company 31% 33%<br />

Credit risk exposure by class for the group and company is as follows:<br />

Group<br />

2010<br />

%<br />

Company<br />

2010<br />

%<br />

Local 86 88<br />

Exports 14 12<br />

100 100