- Page 1 and 2:

District Budget September 1, 2011 -

- Page 3 and 4:

Significant Financial Policies and

- Page 5 and 6:

Project Status and Financial Detail

- Page 7 and 8:

Curriculum Management .............

- Page 9:

WHAT ARE PROPERTY TAXES? Property t

- Page 12 and 13:

INTRODUCTION SECTION

- Page 14 and 15:

Our most important objective in the

- Page 16 and 17:

public school finance system. The c

- Page 18 and 19:

Analysis of Adopted Budget The comp

- Page 20 and 21:

Debt Service Fund The following tab

- Page 22 and 23: San Antonio ISD's ADA Trend 52,000

- Page 24 and 25: 2011-12 District Budget Highlights

- Page 26: ADDENDUM This budget report was pre

- Page 30 and 31: Budget Highlights 2011-2012 • •

- Page 32 and 33: SAISD District Recognitions and Acc

- Page 34 and 35: District campuses recognized for co

- Page 36 and 37: That individualized attention will

- Page 38 and 39: MEET THE SEVEN TRUSTEES OF OUR DIST

- Page 40 and 41: SCHOOL BOARD HIGHLIGHTS The Board o

- Page 42 and 43: 2011- 2012 MEETING SCHEDULE Work Se

- Page 44 and 45: CONSULTANTS & ADVISORS LEGAL COUNSE

- Page 46 and 47: OUR MISSION, BELIEFS AND CORE VALUE

- Page 48 and 49: • People support what they help c

- Page 50 and 51: CAMPUS AND OPERATIONS Presently the

- Page 52 and 53: Rudy Martinez-Interim, Leadership E

- Page 54 and 55: WHAT SAISD OFFERS STUDENTS • Trav

- Page 56 and 57: FINANCIAL STRUCTURE AND BASIS OF AC

- Page 58 and 59: DISTRICT REVENUE SOURCES The San An

- Page 60 and 61: DEBT SERVICE FUND The Debt Service

- Page 62 and 63: BASIS OF ACCOUNTING CODE STRUCTURE

- Page 64 and 65: Function codes are grouped accordin

- Page 66 and 67: Major Object Code Major Expenditure

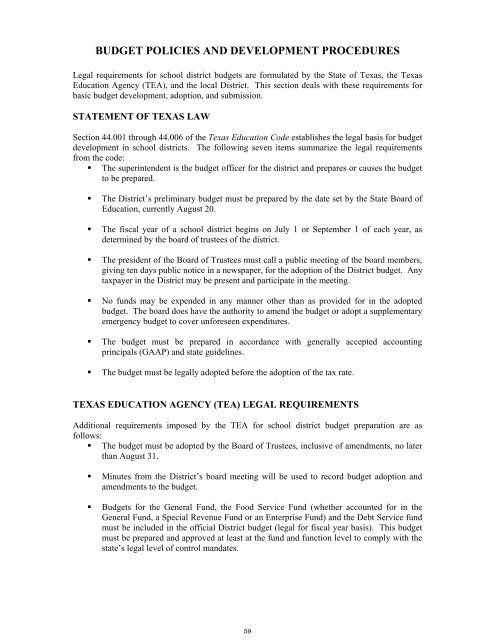

- Page 68 and 69: SIGNIFICANT FINANCIAL POLICIES AND

- Page 70 and 71: CAPITAL IMPROVEMENTS The District d

- Page 74 and 75: BUDGET MEETING The annual public me

- Page 76 and 77: • Level I makes use of modified z

- Page 78 and 79: BUDGET ADMINISTRATION AND MANAGEMEN

- Page 80 and 81: BUDGET CALENDAR FOR FISCAL YEAR 201

- Page 83 and 84: GOVERNMENTAL FUNDS* SUMMARY OF REVE

- Page 85 and 86: GOVERNMENTAL FUNDS* SUMMARY OF REVE

- Page 87 and 88: San Antonio Independent School Dist

- Page 89 and 90: GOVERNMENTAL FUNDS REVENUES BY FUND

- Page 91 and 92: Governmental Funds Expenditures per

- Page 94 and 95: Vision 2012 Budget Enhancements 201

- Page 96 and 97: Vision 2012 Budget Enhancements 201

- Page 98 and 99: SUMMARY OF ESTIMATED REVENUES, EXPE

- Page 100 and 101: SUMMARY OF ESTIMATED REVENUES, EXPE

- Page 102 and 103: 2011-2012 Budget by Major Object Co

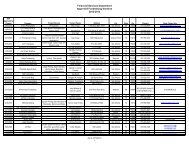

- Page 104 and 105: Appropriations Budget 2011-2012 TEA

- Page 106 and 107: Summary of Estimated Revenues by Fu

- Page 108 and 109: Estimated Expenditures by Function

- Page 111 and 112: GENERAL FUND This fund group accoun

- Page 113 and 114: GENERAL FUND REVENUE TRENDS Last Te

- Page 115 and 116: San Antonio Independent School Dist

- Page 117 and 118: GENERAL FUND PAYROLL EXPENDITURES A

- Page 119 and 120: GENERAL FUND REVENUES AND EXPENDITU

- Page 121 and 122: General Fund Estimated Expenditures

- Page 123 and 124:

General Fund Function Comparison FI

- Page 125 and 126:

General Fund by Program Intent and

- Page 127:

CHANGES IN FUND BALANCE - GENERAL F

- Page 130 and 131:

FOOD & CHILD NUTRITION SERVICES OVE

- Page 132 and 133:

FOODS OF MINIMAL NUTRITIONAL VALUE

- Page 134 and 135:

SCHOOL BREAKFAST PROGRAM The Food a

- Page 136 and 137:

PROGRAM PARTICIPATION One of the an

- Page 139 and 140:

SPECIAL REVENUE FUND This fund grou

- Page 141 and 142:

Special Revenue Fund Estimated Reve

- Page 143:

Special Revenue by Function and Maj

- Page 146 and 147:

DEBT SERVICE FUND REVENUES AND EXPE

- Page 148 and 149:

Debt Service Fund Charts Estimated

- Page 150 and 151:

COMPUTATION OF DIRECT AND ESTIMATED

- Page 152:

RATIO OF NET GENERAL OBLIGATION BON

- Page 155 and 156:

CAPITAL PROJECTS FUND REVENUES AND

- Page 157 and 158:

1997 BOND PROGRAM UPDATE Through th

- Page 159 and 160:

SAISD ENERGY EFFICIENCY INITIATIVES

- Page 161 and 162:

SAISD Bond 2010 Program Administrat

- Page 163 and 164:

SAISD Bond 2010 Program Administrat

- Page 165 and 166:

SAISD Bond 2010 Program Administrat

- Page 167 and 168:

SAISD Bond 2010 Program Administrat

- Page 169 and 170:

Program Administrator: Munoz Jacobs

- Page 171 and 172:

Program Administrator: Munoz Jacobs

- Page 173 and 174:

Program Administrator: Munoz Jacobs

- Page 175 and 176:

Program Administrator: SAISD Projec

- Page 177 and 178:

SAISD Bond 2010 Program Administrat

- Page 179 and 180:

Program Administrator: Munoz Jacobs

- Page 181 and 182:

Program Administrator: SAISD Projec

- Page 183 and 184:

Program Administrator: SAISD Projec

- Page 185 and 186:

Program Administrator: Munoz Jacobs

- Page 187 and 188:

Program Administrator: SAISD Projec

- Page 189 and 190:

Program Administrator: SAISD Projec

- Page 191 and 192:

Program Administrator: SAISD Projec

- Page 193 and 194:

Program Administrator: SAISD Projec

- Page 195 and 196:

Program Administrator: SAISD Projec

- Page 197 and 198:

Program Administrator: SAISD Projec

- Page 199 and 200:

SAISD Bond 2010 Program Administrat

- Page 201 and 202:

Program Administrator: SAISD Projec

- Page 203 and 204:

Program Administrator: SAISD Projec

- Page 205 and 206:

Program Administrator: Munoz Jacobs

- Page 207 and 208:

Program Administrator: SAISD Projec

- Page 209 and 210:

Program Administrator: Munoz Jacobs

- Page 211 and 212:

Program Administrator: SAISD Projec

- Page 213 and 214:

Program Administrator: SAISD Projec

- Page 215 and 216:

Program Administrator: SAISD Projec

- Page 217 and 218:

Program Administrator: Munoz Jacobs

- Page 219 and 220:

Program Administrator: Munoz Jacobs

- Page 221 and 222:

Program Administrator: SAISD Projec

- Page 223 and 224:

SAISD Bond 2010 Program Administrat

- Page 225 and 226:

Program Administrator: SAISD Projec

- Page 227 and 228:

Program Administrator: Munoz Jacobs

- Page 229 and 230:

Program Administrator: Munoz Jacobs

- Page 231 and 232:

Program Administrator: SAISD Projec

- Page 233 and 234:

SAISD Bond 2010 Program Administrat

- Page 235 and 236:

Program Administrator: Munoz Jacobs

- Page 237 and 238:

Program Administrator: Munoz Jacobs

- Page 239 and 240:

Program Administrator: SAISD Projec

- Page 241 and 242:

Program Administrator: SAISD Projec

- Page 243 and 244:

Program Administrator: SAISD Projec

- Page 245:

INFORMATIONAL SECTION

- Page 248 and 249:

COMPTROLLER'S CERTIFIED PROPERTY VA

- Page 250 and 251:

SAISD PROPERTY TAX RATE HISTORY * T

- Page 252 and 253:

PROPERTY TAXES FOR AN AVERAGE RESID

- Page 254 and 255:

PROPERTY TAX RATES DIRECT AND OVERL

- Page 256 and 257:

ALLOCATION OF PROPERTY TAX RATES AN

- Page 258:

PRINCIPAL TAXPAYERS * BUDGET YEAR 2

- Page 261 and 262:

San Antonio ISD Forecast of Budget

- Page 263 and 264:

FOOD SERVICE FUND FORECASTS REVENUE

- Page 265 and 266:

DEBT SERVICE FUND GENERAL OBLIGATIO

- Page 268 and 269:

STUDENT ENROLLMENT Over the years,

- Page 270 and 271:

Schools contributing to % of Grade

- Page 272 and 273:

SAISD EXTENDED PROJECTIONS Applying

- Page 274 and 275:

3 Years of Standardized Test Scores

- Page 276 and 277:

3 Years of Graduation and Dropout D

- Page 278 and 279:

3 Years of Goals and Objectives for

- Page 280 and 281:

Gold Performance Acknowledgements (

- Page 282 and 283:

Attendance Rate and Membership Dist

- Page 284 and 285:

2010 and 2011 TAKS Commended 29% 30

- Page 286 and 287:

Exit Level TAKS Cumulative Pass Rat

- Page 288 and 289:

English Language Learners The Engli

- Page 290 and 291:

Completion Rate I 2007 2008 2514 20

- Page 292 and 293:

SAISD Student College Entrance Exam

- Page 294 and 295:

DATA QUALITY • SAISD has consiste

- Page 297 and 298:

STAFF FULL TIME EQUIVALENTS (FTE) B

- Page 300 and 301:

MAJOR URBAN DISTRICTS COMPARISON BY

- Page 302 and 303:

URBAN DISTRICTS THREE-YEAR COMPARIS

- Page 304:

MAJOR URBAN DISTRICTS COMPARISON OF

- Page 307 and 308:

GENERAL FUND BY MAJOR OBJECT CODE &

- Page 309 and 310:

San Antonio Independent School Dist

- Page 311 and 312:

San Antonio Independent School Dist

- Page 313 and 314:

San Antonio Independent School Dist

- Page 315 and 316:

San Antonio Independent School Dist

- Page 317 and 318:

San Antonio Independent School Dist

- Page 319 and 320:

San Antonio Independent School Dist

- Page 321 and 322:

San Antonio Independent School Dist

- Page 323 and 324:

San Antonio Independent School Dist

- Page 325 and 326:

San Antonio Independent School Dist

- Page 327 and 328:

San Antonio Independent School Dist

- Page 329 and 330:

ENROLLMENT AND BUDGET MULTI-YEAR CO

- Page 331 and 332:

COMPARISON OF EXPENDITURES AND BUDG

- Page 333:

COMPARISON OF EXPENDITURES AND BUDG

- Page 336 and 337:

SPECIAL REVENUE FUND BUDGETS BY MAJ

- Page 338 and 339:

COMPARISON OF EXPENDITURES AND BUDG

- Page 340:

COMPARISON OF EXPENDITURES AND BUDG

- Page 344 and 345:

Superintendent's Office - Org. # 70

- Page 346 and 347:

Governmental & Community Relations

- Page 348 and 349:

Community & Parent Partners - Org.

- Page 350 and 351:

Safety & Security (Police) - Org. #

- Page 352:

Printing Services - Org. # 960 Budg

- Page 355:

Employee Benefits, Risk Management

- Page 358 and 359:

Teaching & Learning - Org. # 805 Bu

- Page 360 and 361:

School Leadership E.S. Team 2 - Org

- Page 362 and 363:

School Leadership E.S. Team 1 - Org

- Page 364 and 365:

Transitions Program - Org. # 851 Bu

- Page 366 and 367:

Professional Learning - Org. # 856

- Page 368 and 369:

Fine Arts - Org. # 858 Budget Year

- Page 370 and 371:

Grants Development, Management & Mo

- Page 372 and 373:

Academic Support - Org. # 865 Budge

- Page 374 and 375:

Early Childhood - Org. # 868 Budget

- Page 376 and 377:

Social Studies - Org. # 874 Budget

- Page 378 and 379:

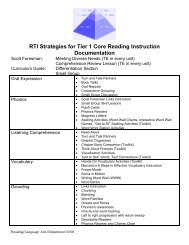

Curriculum Management - Org. # 876

- Page 380 and 381:

Advanced Academics/ Gifted & Talent

- Page 382 and 383:

Science - Org. # 881 Budget Year 20

- Page 384 and 385:

Health/PE, Safe & Drug Free Schools

- Page 386 and 387:

Teen Parenting Services - Org. # 88

- Page 388 and 389:

Student Health Services - Org. # 89

- Page 390:

Federal Programs - Org. # 946 Budge

- Page 393 and 394:

Planning & Budget - Org. # 741 Budg

- Page 395 and 396:

Materials Management/Purchasing, Wa

- Page 397 and 398:

Food & Child Nutrition Services - O

- Page 400:

Technology & Management Information

- Page 403 and 404:

PS Custodial Services - Org. # 932

- Page 405 and 406:

PS MEP Maintenance - Org. # 934 Bud

- Page 408 and 409:

COMMUNITY PROFILE * San Antonio is

- Page 410 and 411:

HISTORICAL ATTRACTIONS COMMUNITY PR

- Page 412 and 413:

COMMUNITY PROFILE * COMMUNITY PROFI

- Page 414 and 415:

The ten largest corporate headquart

- Page 416 and 417:

SAN ANTONIO, TEXAS MSA DEMOGRAPHICS

- Page 418 and 419:

BASSE RD E HOUSTON ST UTOPIA AVE Lo

- Page 420 and 421:

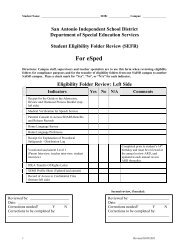

SAN ANTONIO INDEPENDENT SCHOOL DIST

- Page 422 and 423:

08-09 # 09-10 # Indicator Descripti

- Page 424:

Received Board approval for purchas

- Page 427 and 428:

ACRONYMS ELA ELL ELPS EOC ES ESL -F

- Page 429 and 430:

ACRONYMS TEA TEAMS TEEM TEKS TPRI T

- Page 431 and 432:

GLOSSARY OF FUNDS Carl D. Perkins,

- Page 433 and 434:

GLOSSARY OF FUNDS IDEA -B - Prescho

- Page 435 and 436:

GLOSSARY OF FUNDS Technology Fund T

- Page 437 and 438:

GLOSSARY OF FUNDS Title I, Part D -

- Page 439 and 440:

GLOSSARY OF TERMS AVERAGE DAILY MEM

- Page 441 and 442:

GLOSSARY OF TERMS COST PER PUPIL -

- Page 443 and 444:

GLOSSARY OF TERMS GENERALLY ACCEPTE

- Page 445 and 446:

GLOSSARY OF TERMS SCHOOL - A divisi

- Page 447:

Thank you for your interest in the