Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

and higher end servers. We also expect leading<br />

vendors’ increased production of 2Gb parts to<br />

stimulate demand for larger memory modules.<br />

Here we look at the potential impact of corporate<br />

servers, which account for c10% of global bit<br />

demand, but we believe accounts for a much<br />

larger proportion of global DRAM revenue;<br />

server DRAM is c2.5-6x more expensive<br />

compared to ‘regular’ memory modules.<br />

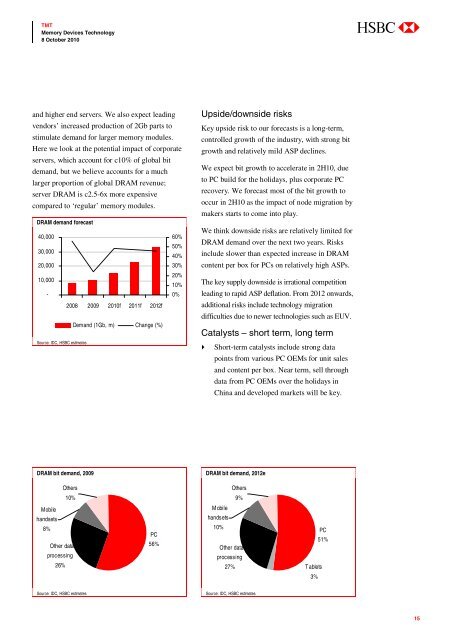

DRAM demand forecast<br />

40,000<br />

60%<br />

50%<br />

30,000<br />

40%<br />

20,000<br />

30%<br />

10,000<br />

20%<br />

10%<br />

-<br />

0%<br />

2008 2009 2010f 2011f 2012f<br />

Demand (1Gb, m) Change (%)<br />

Source: IDC, HSBC estimates<br />

Upside/downside risks<br />

Key upside risk to our forecasts is a long-term,<br />

controlled growth of the industry, with strong bit<br />

growth and relatively mild ASP declines.<br />

We expect bit growth to accelerate in 2H10, due<br />

to PC build for the holidays, plus corporate PC<br />

recovery. We forecast most of the bit growth to<br />

occur in 2H10 as the impact of node migration by<br />

makers starts to come into play.<br />

We think downside risks are relatively limited for<br />

DRAM demand over the next two years. Risks<br />

include slower than expected increase in DRAM<br />

content per box for PCs on relatively high ASPs.<br />

The key supply downside is irrational competition<br />

leading to rapid ASP deflation. From 2012 onwards,<br />

additional risks include technology migration<br />

difficulties due to newer technologies such as EUV.<br />

Catalysts – short term, long term<br />

Short-term catalysts include strong data<br />

points from various PC OEMs for unit sales<br />

and content per box. Near term, sell through<br />

data from PC OEMs over the holidays in<br />

China and developed markets will be key.<br />

DRAM bit demand, 2009<br />

DRAM bit demand, 2012e<br />

Others<br />

10%<br />

Others<br />

9%<br />

Mobile<br />

handsets<br />

Mobile<br />

handsets<br />

8% 10%<br />

PC<br />

PC<br />

51%<br />

Other data<br />

56%<br />

Other data<br />

processing<br />

26%<br />

processing<br />

27%<br />

Tablets<br />

3%<br />

Source: IDC, HSBC estimates<br />

Source: IDC, HSBC estimates<br />

15