Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

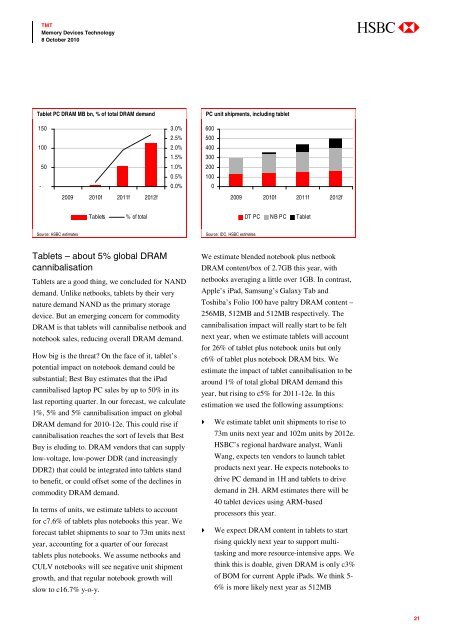

Tablet PC DRAM MB bn, % of total DRAM demand<br />

150<br />

100<br />

50<br />

-<br />

2009 2010f 2011f 2012f<br />

3.0%<br />

2.5%<br />

2.0%<br />

1.5%<br />

1.0%<br />

0.5%<br />

0.0%<br />

PC unit shipments, including tablet<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2009 2010f 2011f 2012f<br />

Tablets<br />

% of total<br />

DT PC NB PC Tablet<br />

Source: HSBC estimates<br />

Source: IDC, HSBC estimates<br />

Tablets – about 5% global DRAM<br />

cannibalisation<br />

Tablets are a good thing, we concluded for NAND<br />

demand. Unlike netbooks, tablets by their very<br />

nature demand NAND as the primary storage<br />

device. But an emerging concern for commodity<br />

DRAM is that tablets will cannibalise netbook and<br />

notebook sales, reducing overall DRAM demand.<br />

How big is the threat? On the face of it, tablet’s<br />

potential impact on notebook demand could be<br />

substantial; Best Buy estimates that the iPad<br />

cannibalised laptop PC sales by up to 50% in its<br />

last reporting quarter. In our forecast, we calculate<br />

1%, 5% and 5% cannibalisation impact on global<br />

DRAM demand for 2010-12e. This could rise if<br />

cannibalisation reaches the sort of levels that Best<br />

Buy is eluding to. DRAM vendors that can supply<br />

low-voltage, low-power DDR (and increasingly<br />

DDR2) that could be integrated into tablets stand<br />

to benefit, or could offset some of the declines in<br />

commodity DRAM demand.<br />

In terms of units, we estimate tablets to account<br />

for c7.6% of tablets plus notebooks this year. We<br />

forecast tablet shipments to soar to 73m units next<br />

year, accounting for a quarter of our forecast<br />

tablets plus notebooks. We assume netbooks and<br />

CULV notebooks will see negative unit shipment<br />

growth, and that regular notebook growth will<br />

slow to c16.7% y-o-y.<br />

We estimate blended notebook plus netbook<br />

DRAM content/box of 2.7GB this year, with<br />

netbooks averaging a little over 1GB. In contrast,<br />

Apple’s iPad, Samsung’s Galaxy Tab and<br />

Toshiba’s Folio 100 have paltry DRAM content –<br />

256MB, 512MB and 512MB respectively. The<br />

cannibalisation impact will really start to be felt<br />

next year, when we estimate tablets will account<br />

for 26% of tablet plus notebook units but only<br />

c6% of tablet plus notebook DRAM bits. We<br />

estimate the impact of tablet cannibalisation to be<br />

around 1% of total global DRAM demand this<br />

year, but rising to c5% for 2011-12e. In this<br />

estimation we used the following assumptions:<br />

We estimate tablet unit shipments to rise to<br />

73m units next year and 102m units by 2012e.<br />

HSBC’s regional hardware analyst, Wanli<br />

Wang, expects ten vendors to launch tablet<br />

products next year. He expects notebooks to<br />

drive PC demand in 1H and tablets to drive<br />

demand in 2H. ARM estimates there will be<br />

40 tablet devices using ARM-based<br />

processors this year.<br />

We expect DRAM content in tablets to start<br />

rising quickly next year to support multitasking<br />

and more resource-intensive apps. We<br />

think this is doable, given DRAM is only c3%<br />

of BOM for current Apple iPads. We think 5-<br />

6% is more likely next year as 512MB<br />

21