You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

Technology migration<br />

Winbond has successfully migrated its NOR<br />

production from 130nm to 90nm. In 3Q10, all 10k<br />

NOR capacity are in 90nm. For DRAM,<br />

Winbond’s target is to migrate its 16k capacity to<br />

65nm.<br />

Ongoing migrations: Winbond has scheduled to<br />

further migrate 1) NOR capacity to 58nm by<br />

2H11 and 2) DRAM capacity to 46nm also by<br />

2H11.<br />

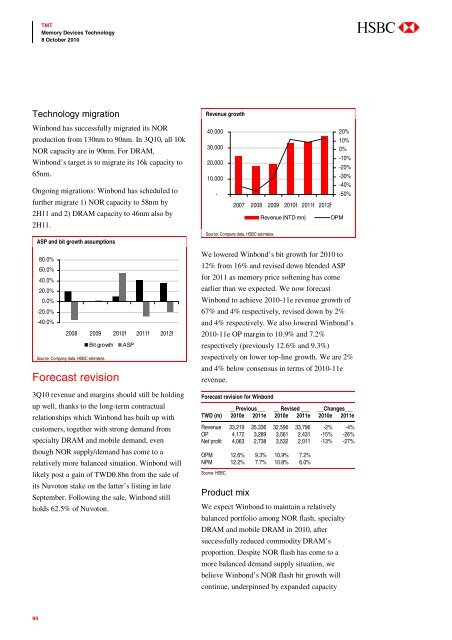

ASP and bit growth assumptions<br />

80.0%<br />

60.0%<br />

40.0%<br />

20.0%<br />

0.0%<br />

-20.0%<br />

-40.0%<br />

2008 2009 2010f 2011f 2012f<br />

Bit growth ASP<br />

Source: Company data, HSBC estimates<br />

Forecast revision<br />

3Q10 revenue and margins should still be holding<br />

up well, thanks to the long-term contractual<br />

relationships which Winbond has built up with<br />

customers, together with strong demand from<br />

specialty DRAM and mobile demand, even<br />

though NOR supply/demand has come to a<br />

relatively more balanced situation. Winbond will<br />

likely post a gain of TWD0.8bn from the sale of<br />

its Nuvoton stake on the latter’s listing in late<br />

September. Following the sale, Winbond still<br />

holds 62.5% of Nuvoton.<br />

Revenue growth<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

-<br />

2007 2008 2009 2010f 2011f 2012f<br />

Source: Company data, HSBC estimates<br />

Revenue (NTD mn)<br />

OPM<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

We lowered Winbond’s bit growth for 2010 to<br />

12% from 16% and revised down blended ASP<br />

for 2011 as memory price softening has come<br />

earlier than we expected. We now forecast<br />

Winbond to achieve 2010-11e revenue growth of<br />

67% and 4% respectively, revised down by 2%<br />

and 4% respectively. We also lowered Winbond’s<br />

2010-11e OP margin to 10.9% and 7.2%<br />

respectively (previously 12.6% and 9.3%)<br />

respectively on lower top-line growth. We are 2%<br />

and 4% below consensus in terms of 2010-11e<br />

revenue.<br />

Forecast revision for Winbond<br />

__Previous___ __ Revised ___ __ Changes___<br />

TWD (m) 2010e 2011e 2010e 2011e 2010e 2011e<br />

Revenue 33,219 35,336 32,596 33,796 -2% -4%<br />

OP 4,172 3,289 3,561 2,431 -15% -26%<br />

Net profit 4,063 2,738 3,532 2,011 -13% -27%<br />

OPM 12.6% 9.3% 10.9% 7.2%<br />

NPM 12.2% 7.7% 10.8% 6.0%<br />

Source: HSBC<br />

Product mix<br />

We expect Winbond to maintain a relatively<br />

balanced portfolio among NOR flash, specialty<br />

DRAM and mobile DRAM in 2010, after<br />

successfully reduced commodity DRAM’s<br />

proportion. Despite NOR flash has come to a<br />

more balanced demand supply situation, we<br />

believe Winbond’s NOR flash bit growth will<br />

continue, underpinned by expanded capacity<br />

94