You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

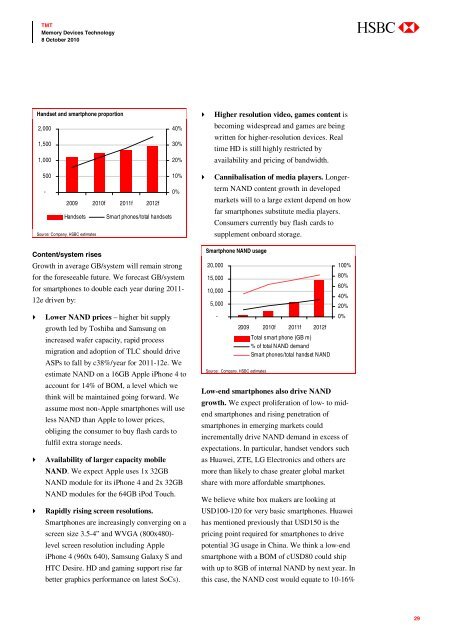

Handset and smartphone proportion<br />

2,000<br />

1,500<br />

1,000<br />

40%<br />

30%<br />

20%<br />

Higher resolution video, games content is<br />

becoming widespread and games are being<br />

written for higher-resolution devices. Real<br />

time HD is still highly restricted by<br />

availability and pricing of bandwidth.<br />

500<br />

10%<br />

-<br />

0%<br />

2009 2010f 2011f 2012f<br />

Handsets Smart phones/total handsets<br />

Source: Company, HSBC estimates<br />

Content/system rises<br />

Growth in average GB/system will remain strong<br />

for the foreseeable future. We forecast GB/system<br />

for smartphones to double each year during 2011-<br />

12e driven by:<br />

Lower NAND prices – higher bit supply<br />

growth led by Toshiba and Samsung on<br />

increased wafer capacity, rapid process<br />

migration and adoption of TLC should drive<br />

ASPs to fall by c38%/year for 2011-12e. We<br />

estimate NAND on a 16GB Apple iPhone 4 to<br />

account for 14% of BOM, a level which we<br />

think will be maintained going forward. We<br />

assume most non-Apple smartphones will use<br />

less NAND than Apple to lower prices,<br />

obliging the consumer to buy flash cards to<br />

fulfil extra storage needs.<br />

Availability of larger capacity mobile<br />

NAND. We expect Apple uses 1x 32GB<br />

NAND module for its iPhone 4 and 2x 32GB<br />

NAND modules for the 64GB iPod Touch.<br />

Rapidly rising screen resolutions.<br />

Smartphones are increasingly converging on a<br />

screen size 3.5-4” and WVGA (800x480)-<br />

level screen resolution including Apple<br />

iPhone 4 (960x 640), Samsung Galaxy S and<br />

HTC Desire. HD and gaming support rise far<br />

better graphics performance on latest SoCs).<br />

Cannibalisation of media players. Longerterm<br />

NAND content growth in developed<br />

markets will to a large extent depend on how<br />

far smartphones substitute media players.<br />

Consumers currently buy flash cards to<br />

supplement onboard storage.<br />

Smartphone NAND usage<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

-<br />

Source: Company, HSBC estimates<br />

2009 2010f 2011f 2012f<br />

Total smart phone (GB m)<br />

% of total NAND demand<br />

Smart phones/total handset NAND<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

Low-end smartphones also drive NAND<br />

growth. We expect proliferation of low- to midend<br />

smartphones and rising penetration of<br />

smartphones in emerging markets could<br />

incrementally drive NAND demand in excess of<br />

expectations. In particular, handset vendors such<br />

as Huawei, ZTE, LG Electronics and others are<br />

more than likely to chase greater global market<br />

share with more affordable smartphones.<br />

We believe white box makers are looking at<br />

USD100-120 for very basic smartphones. Huawei<br />

has mentioned previously that USD150 is the<br />

pricing point required for smartphones to drive<br />

potential 3G usage in China. We think a low-end<br />

smartphone with a BOM of cUSD80 could ship<br />

with up to 8GB of internal NAND by next year. In<br />

this case, the NAND cost would equate to 10-16%<br />

0%<br />

29