Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

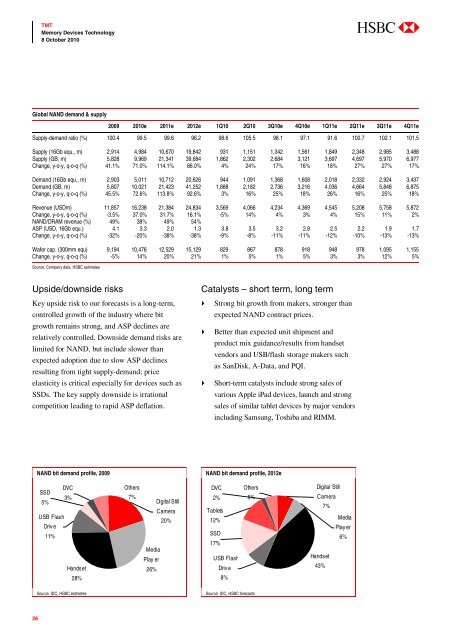

Global NAND demand & supply<br />

2009 2010e 2011e 2012e 1Q10 2Q10 3Q10e 4Q10e 1Q11e 2Q11e 3Q11e 4Q11e<br />

Supply-demand ratio (%) 100.4 99.5 99.6 96.2 98.6 105.5 98.1 97.1 91.6 100.7 102.1 101.5<br />

Supply (16Gb equ., m) 2,914 4,984 10,670 19,842 931 1,151 1,342 1,561 1,849 2,348 2,985 3,488<br />

Supply (GB, m) 5,828 9,969 21,341 39,684 1,862 2,302 2,684 3,121 3,697 4,697 5,970 6,977<br />

Change, y-o-y, q-o-q (%) 41.1% 71.0% 114.1% 86.0% 4% 24% 17% 16% 18% 27% 27% 17%<br />

Demand (16Gb equ., m) 2,903 5,011 10,712 20,626 944 1,091 1,368 1,608 2,018 2,332 2,924 3,437<br />

Demand (GB, m) 5,807 10,021 21,423 41,252 1,888 2,182 2,736 3,216 4,036 4,664 5,848 6,875<br />

Change, y-o-y, q-o-q (%) 45.5% 72.6% 113.8% 92.6% 3% 16% 25% 18% 26% 16% 25% 18%<br />

Revenue (USDm) 11,857 16,238 21,384 24,834 3,569 4,066 4,234 4,369 4,545 5,208 5,758 5,872<br />

Change, y-o-y, q-o-q (%) -3.5% 37.0% 31.7% 16.1% -5% 14% 4% 3% 4% 15% 11% 2%<br />

NAND/DRAM revenue (%) 49% 38% 49% 54%<br />

ASP (USD, 16Gb equ.) 4.1 3.3 2.0 1.3 3.8 3.5 3.2 2.8 2.5 2.2 1.9 1.7<br />

Change, y-o-y, q-o-q (%) -32% -20% -38% -38% -9% -8% -11% -11% -12% -10% -13% -13%<br />

Wafer cap. (300mm equ) 9,194 10,476 12,529 15,129 829 867 878 918 948 978 1,095 1,155<br />

Change, y-o-y, q-o-q (%) -5% 14% 20% 21% 1% 5% 1% 5% 3% 3% 12% 5%<br />

Source: Company data, HSBC estimates<br />

Upside/downside risks<br />

Key upside risk to our forecasts is a long-term,<br />

controlled growth of the industry where bit<br />

growth remains strong, and ASP declines are<br />

relatively controlled. Downside demand risks are<br />

limited for NAND, but include slower than<br />

expected adoption due to slow ASP declines<br />

resulting from tight supply-demand; price<br />

elasticity is critical especially for devices such as<br />

SSDs. The key supply downside is irrational<br />

competition leading to rapid ASP deflation.<br />

Catalysts – short term, long term<br />

Strong bit growth from makers, stronger than<br />

expected NAND contract prices.<br />

Better than expected unit shipment and<br />

product mix guidance/results from handset<br />

vendors and USB/flash storage makers such<br />

as SanDisk, A-Data, and PQI.<br />

Short-term catalysts include strong sales of<br />

various Apple iPad devices, launch and strong<br />

sales of similar tablet devices by major vendors<br />

including Samsung, Toshiba and RIMM.<br />

NAND bit demand profile, 2009<br />

NAND bit demand profile, 2012e<br />

DVC<br />

SSD<br />

3%<br />

5%<br />

USB Flash<br />

Driv e<br />

11%<br />

Handset<br />

28%<br />

Others<br />

7%<br />

Digital S till<br />

Camera<br />

20%<br />

Media<br />

Play er<br />

26%<br />

DVC<br />

2%<br />

Tablets<br />

12%<br />

SSD<br />

17%<br />

USB Flash<br />

Driv e<br />

8%<br />

Others<br />

5%<br />

Digital Still<br />

Camera<br />

7%<br />

Media<br />

Play er<br />

6%<br />

Handset<br />

43%<br />

Source: IDC, HSBC estimates<br />

Source: IDC, HSBC forecasts<br />

26