Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

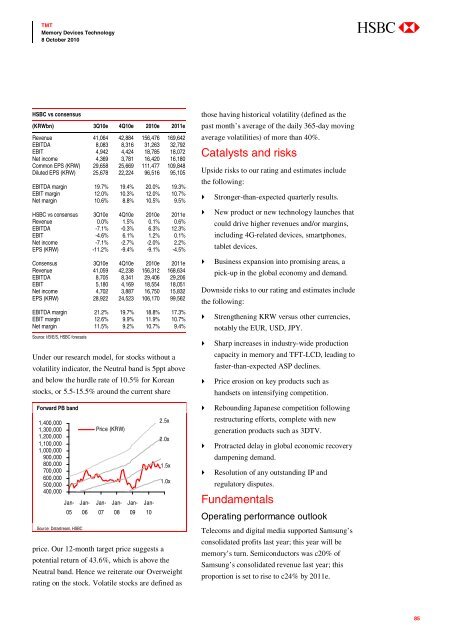

HSBC vs consensus<br />

(KRWbn) 3Q10e 4Q10e 2010e 2011e<br />

Revenue 41,064 42,884 156,476 169,642<br />

EBITDA 8,083 8,316 31,263 32,792<br />

EBIT 4,942 4,424 18,785 18,072<br />

Net income 4,369 3,781 16,420 16,180<br />

Common EPS (KRW) 29,658 25,669 111,477 109,848<br />

Diluted EPS (KRW) 25,678 22,224 96,516 95,105<br />

EBITDA margin 19.7% 19.4% 20.0% 19.3%<br />

EBIT margin 12.0% 10.3% 12.0% 10.7%<br />

Net margin 10.6% 8.8% 10.5% 9.5%<br />

HSBC vs consensus 3Q10e 4Q10e 2010e 2011e<br />

Revenue 0.0% 1.5% 0.1% 0.6%<br />

EBITDA -7.1% -0.3% 6.3% 12.3%<br />

EBIT -4.6% 6.1% 1.2% 0.1%<br />

Net income -7.1% -2.7% -2.0% 2.2%<br />

EPS (KRW) -11.2% -9.4% -9.1% -4.5%<br />

Consensus 3Q10e 4Q10e 2010e 2011e<br />

Revenue 41,059 42,238 156,312 168,634<br />

EBITDA 8,705 8,341 29,406 29,206<br />

EBIT 5,180 4,169 18,554 18,051<br />

Net income 4,702 3,887 16,750 15,832<br />

EPS (KRW) 28,922 24,523 106,170 99,562<br />

EBITDA margin 21.2% 19.7% 18.8% 17.3%<br />

EBIT margin 12.6% 9.9% 11.9% 10.7%<br />

Net margin 11.5% 9.2% 10.7% 9.4%<br />

Source: I/B/E/S, HSBC forecasts<br />

Under our research model, for stocks without a<br />

volatility indicator, the Neutral band is 5ppt above<br />

and below the hurdle rate of 10.5% for Korean<br />

stocks, or 5.5-15.5% around the current share<br />

Forward PB band<br />

1,400,000<br />

1,300,000<br />

1,200,000<br />

1,100,000<br />

1,000,000<br />

900,000<br />

800,000<br />

700,000<br />

600,000<br />

500,000<br />

400,000<br />

Source: Datastream, HSBC<br />

Price (KRW)<br />

Jan-<br />

05<br />

Jan-<br />

06<br />

Jan-<br />

07<br />

Jan-<br />

08<br />

Jan-<br />

09<br />

Jan-<br />

10<br />

2.5x<br />

2.0x<br />

1.5x<br />

1.0x<br />

price. Our 12-month target price suggests a<br />

potential return of 43.6%, which is above the<br />

Neutral band. Hence we reiterate our Overweight<br />

rating on the stock. Volatile stocks are defined as<br />

those having historical volatility (defined as the<br />

past month’s average of the daily 365-day moving<br />

average volatilities) of more than 40%.<br />

Catalysts and risks<br />

Upside risks to our rating and estimates include<br />

the following:<br />

Stronger-than-expected quarterly results.<br />

New product or new technology launches that<br />

could drive higher revenues and/or margins,<br />

including 4G-related devices, smartphones,<br />

tablet devices.<br />

Business expansion into promising areas, a<br />

pick-up in the global economy and demand.<br />

Downside risks to our rating and estimates include<br />

the following:<br />

Strengthening KRW versus other currencies,<br />

notably the EUR, USD, JPY.<br />

Sharp increases in industry-wide production<br />

capacity in memory and TFT-LCD, leading to<br />

faster-than-expected ASP declines.<br />

Price erosion on key products such as<br />

handsets on intensifying competition.<br />

Rebounding Japanese competition following<br />

restructuring efforts, complete with new<br />

generation products such as 3DTV.<br />

Protracted delay in global economic recovery<br />

dampening demand.<br />

Resolution of any outstanding IP and<br />

regulatory disputes.<br />

Fundamentals<br />

Operating performance outlook<br />

Telecoms and digital media supported Samsung’s<br />

consolidated profits last year; this year will be<br />

memory’s turn. Semiconductors was c20% of<br />

Samsung’s consolidated revenue last year; this<br />

proportion is set to rise to c24% by 2011e.<br />

85