Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

current share price. Our 12-month target price of<br />

JPY1,500 suggests a potential return of 61.6%,<br />

which is above the Neutral band; thus, we<br />

maintain an Overweight (V) rating on the stock.<br />

Volatile ratings are defined as stocks having<br />

historical volatility (defined as the past month’s<br />

average of the daily 365-day moving average<br />

volatilities) of more than 40%.<br />

HSBC versus consensus – Elpida<br />

JPY bn FY10e FY11e 2QFY10e 3QFY10e<br />

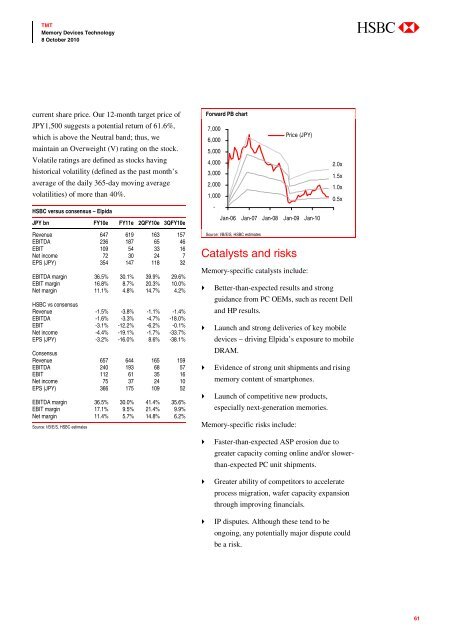

Forward PB chart<br />

7,000<br />

6,000<br />

Price (JPY)<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

Jan-06 Jan-07 Jan-08 Jan-09 Jan-10<br />

2.0x<br />

1.5x<br />

1.0x<br />

0.5x<br />

Revenue 647 619 163 157<br />

EBITDA 236 187 65 46<br />

EBIT 109 54 33 16<br />

Net income 72 30 24 7<br />

EPS (JPY) 354 147 118 32<br />

EBITDA margin 36.5% 30.1% 39.9% 29.6%<br />

EBIT margin 16.8% 8.7% 20.3% 10.0%<br />

Net margin 11.1% 4.8% 14.7% 4.2%<br />

HSBC vs consensus<br />

Revenue -1.5% -3.8% -1.1% -1.4%<br />

EBITDA -1.6% -3.3% -4.7% -18.0%<br />

EBIT -3.1% -12.2% -6.2% -0.1%<br />

Net income -4.4% -19.1% -1.7% -33.7%<br />

EPS (JPY) -3.2% -16.0% 8.6% -38.1%<br />

Consensus<br />

Revenue 657 644 165 159<br />

EBITDA 240 193 68 57<br />

EBIT 112 61 35 16<br />

Net income 75 37 24 10<br />

EPS (JPY) 366 175 109 52<br />

EBITDA margin 36.5% 30.0% 41.4% 35.6%<br />

EBIT margin 17.1% 9.5% 21.4% 9.9%<br />

Net margin 11.4% 5.7% 14.8% 6.2%<br />

Source: I/B/E/S, HSBC estimates<br />

Source: I/B/E/S, HSBC estimates<br />

Catalysts and risks<br />

<strong>Memory</strong>-specific catalysts include:<br />

Better-than-expected results and strong<br />

guidance from PC OEMs, such as recent Dell<br />

and HP results.<br />

Launch and strong deliveries of key mobile<br />

devices – driving Elpida’s exposure to mobile<br />

DRAM.<br />

Evidence of strong unit shipments and rising<br />

memory content of smartphones.<br />

Launch of competitive new products,<br />

especially next-generation <strong>memories</strong>.<br />

<strong>Memory</strong>-specific risks include:<br />

Faster-than-expected ASP erosion due to<br />

greater capacity coming online and/or slowerthan-expected<br />

PC unit shipments.<br />

Greater ability of competitors to accelerate<br />

process migration, wafer capacity expansion<br />

through improving financials.<br />

IP disputes. Although these tend to be<br />

ongoing, any potentially major dispute could<br />

be a risk.<br />

61