You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

comprising. specialty DRAM; 3xnm migration at<br />

Hiroshima is likely to be limited in the shorter term.<br />

Rexchip – the commodity DRAM arm<br />

Over time, Rexchip will manufacture all of<br />

Elpida’s commodity DRAM. Rexchip is to convert<br />

its entire 80kwpm 300mm capacity to Elpida’s<br />

4xnm process by end-2010. As at September, 10%<br />

of wafer input was based on 4xnm, with the<br />

remaining on 65nm XS. Positively, Rexchip should<br />

have received all the tools required for full 4xnm<br />

migration by the end of this November.<br />

Elpida completed development of 3xnm DDR3<br />

(30% smaller, 40% more efficiency compared to<br />

4xnm); engineering samples should be out by<br />

December. Mass production is to start by end-2010,<br />

with production ramp next spring. Production uses<br />

existing equipment with double patterning. Once<br />

satisfactory yields are achieved, the technology will<br />

be transferred to Rexchip, which will completely<br />

migrate to 3xnm in the longer term.<br />

Wafer capacity (kwpy)<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

2007 2008 2009 2010f 2011f 2012f<br />

Wafer capacity (kwpy)<br />

Source: Company, HSBC estimates<br />

Production capacity, capex<br />

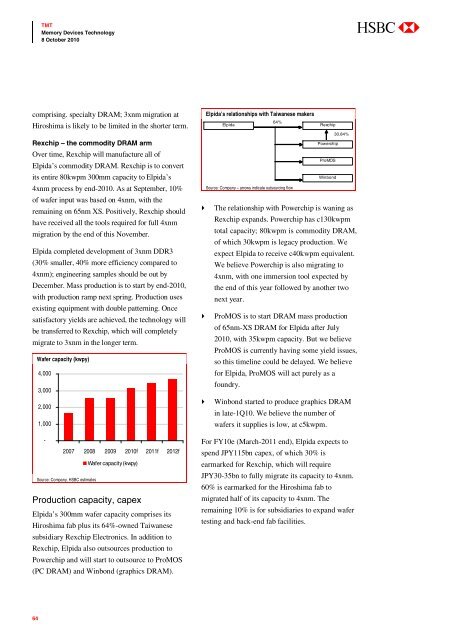

Elpida’s 300mm wafer capacity comprises its<br />

Hiroshima fab plus its 64%-owned Taiwanese<br />

subsidiary Rexchip Electronics. In addition to<br />

Rexchip, Elpida also outsources production to<br />

Powerchip and will start to outsource to ProMOS<br />

(PC DRAM) and Winbond (graphics DRAM).<br />

Elpida’s relationships with Taiwanese makers<br />

Elpida<br />

64%<br />

Rexchip<br />

30.84%<br />

Powerchip<br />

ProMOS<br />

Winbond<br />

Source: Company – arrows indicate outsourcing flow<br />

The relationship with Powerchip is waning as<br />

Rexchip expands. Powerchip has c130kwpm<br />

total capacity; 80kwpm is commodity DRAM,<br />

of which 30kwpm is legacy production. We<br />

expect Elpida to receive c40kwpm equivalent.<br />

We believe Powerchip is also migrating to<br />

4xnm, with one immersion tool expected by<br />

the end of this year followed by another two<br />

next year.<br />

ProMOS is to start DRAM mass production<br />

of 65nm-XS DRAM for Elpida after July<br />

2010, with 35kwpm capacity. But we believe<br />

ProMOS is currently having some yield issues,<br />

so this timeline could be delayed. We believe<br />

for Elpida, ProMOS will act purely as a<br />

foundry.<br />

Winbond started to produce graphics DRAM<br />

in late-1Q10. We believe the number of<br />

wafers it supplies is low, at c5kwpm.<br />

For FY10e (March-2011 end), Elpida expects to<br />

spend JPY115bn capex, of which 30% is<br />

earmarked for Rexchip, which will require<br />

JPY30-35bn to fully migrate its capacity to 4xnm.<br />

60% is earmarked for the Hiroshima fab to<br />

migrated half of its capacity to 4xnm. The<br />

remaining 10% is for subsidiaries to expand wafer<br />

testing and back-end fab facilities.<br />

64