You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

HSBC vs consensus<br />

HSBC 2010e 2011e 2012e<br />

Revenue 46,535 66,433 79,103<br />

EBITDA 28,578 41,830 49,352<br />

EBIT (3,755) 5,642 10,072<br />

Netincome (5,496) 3,167 7,136<br />

EPS(TWD) (1.2) 0.7 1.5<br />

EBITDAmargin 61.4% 63.0% 62.4%<br />

EBITmargin -8.1% 8.5% 12.7%<br />

Netmargin -11.8% 4.8% 9.0%<br />

HSBC vs consensus 2010e 2011e 2012e<br />

Revenue -12.6% -3.1% 9.6%<br />

EBITDA -14.9% -7.7% 0.4%<br />

EBIT -329.6% -43.9% -33.7%<br />

Net income -2178.4% -60.5% -18.1%<br />

EPS (TWD) -761.2% -70.4% -37.9%<br />

Consensus 2010e 2011e 2012e<br />

Revenue 53,219 68,564 72,195<br />

EBITDA 33,583 45,319 49,158<br />

EBIT 1,636 10,050 15,188<br />

Net income 264 8,010 8,715<br />

EPS (TWD) 0.2 2.3 2.5<br />

EBITDA margin 63.1% 66.1% 68.1%<br />

EBIT margin 3.1% 14.7% 21.0%<br />

Net margin 0.5% 11.7% 12.1%<br />

Source: Company data, I/B/E/S consensus<br />

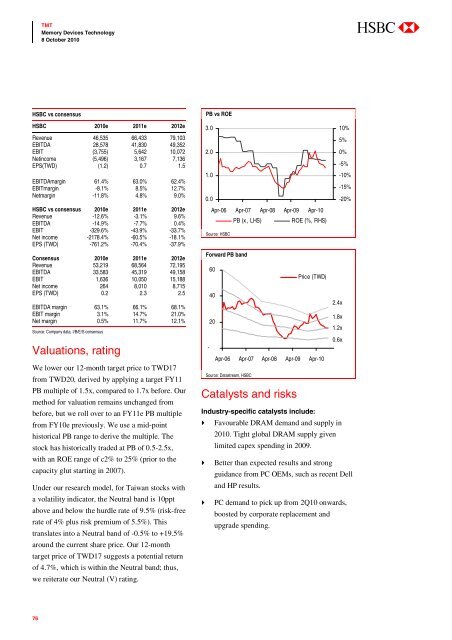

Valuations, rating<br />

We lower our 12-month target price to TWD17<br />

from TWD20, derived by applying a target FY11<br />

PB multiple of 1.5x, compared to 1.7x before. Our<br />

method for valuation remains unchanged from<br />

before, but we roll over to an FY11e PB multiple<br />

from FY10e previously. We use a mid-point<br />

historical PB range to derive the multiple. The<br />

stock has historically traded at PB of 0.5-2.5x,<br />

with an ROE range of c2% to 25% (prior to the<br />

capacity glut starting in 2007).<br />

Under our research model, for Taiwan stocks with<br />

a volatility indicator, the Neutral band is 10ppt<br />

above and below the hurdle rate of 9.5% (risk-free<br />

rate of 4% plus risk premium of 5.5%). This<br />

translates into a Neutral band of -0.5% to +19.5%<br />

around the current share price. Our 12-month<br />

target price of TWD17 suggests a potential return<br />

of 4.7%, which is within the Neutral band; thus,<br />

we reiterate our Neutral (V) rating.<br />

PB vs ROE<br />

3.0<br />

10%<br />

5%<br />

2.0<br />

0%<br />

-5%<br />

1.0<br />

-10%<br />

-15%<br />

0.0<br />

-20%<br />

Apr-06 Apr-07 Apr-08 Apr-09 Apr-10<br />

PB (x , LHS)<br />

ROE (%, RHS)<br />

Source: HSBC<br />

Forward PB band<br />

60<br />

Price (TWD)<br />

40<br />

2.4x<br />

1.8x<br />

20<br />

1.2x<br />

0.6x<br />

-<br />

Apr-06 Apr-07 Apr-08 Apr-09 Apr-10<br />

Source: Datastream, HSBC<br />

Catalysts and risks<br />

Industry-specific catalysts include:<br />

Favourable DRAM demand and supply in<br />

2010. Tight global DRAM supply given<br />

limited capex spending in 2009.<br />

Better than expected results and strong<br />

guidance from PC OEMs, such as recent Dell<br />

and HP results.<br />

PC demand to pick up from 2Q10 onwards,<br />

boosted by corporate replacement and<br />

upgrade spending.<br />

76