You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

lower NAND prices, the availability of larger capacity mobile NAND, rapidly rising screen resolutions, higher<br />

resolution video, games content and cannibalisation of media players.<br />

Worth a look? When and what?<br />

Timing – over the next 1-2 quarters<br />

Despite lowering forecasts for our companies, valuations are close to trough levels for many stocks. Has the<br />

market priced in all industry-wide negativity? For commodity DRAM, it is close to doing so – a weak 4Q10<br />

earnings outlook for industry participants, possibly extending out to 1Q11, is the consensus view now.<br />

We expect to see sentiment starting to turn more positive by end-4Q10 or early 1Q11 as potential easing<br />

of DRAM ASP declines by 2Q11 starts pricing in; the PC market would require a couple of quarters to<br />

absorb Taiwanese vendors’ bit growth during 4Q10/1Q11. By the end of this year we think price<br />

elasticity will restart stunted growth in DRAM content/system. This should become evident in PC OEM<br />

results and market data, boosting confidence that future DRAM ASP declines could be more muted.<br />

For NAND, key catalysts would include firmer-than-expected ASPs starting in 4Q10/1Q11e. This would<br />

reflect soaring demand especially from smartphones. Firmer ASPs could also arise from orders of larger<br />

density units towards 1Q-2Q11 as tablet releases accelerate in 2H11. By 3Q11 we could see prices<br />

softening more as Samsung and Toshiba start mass production at new fabs in earnest.<br />

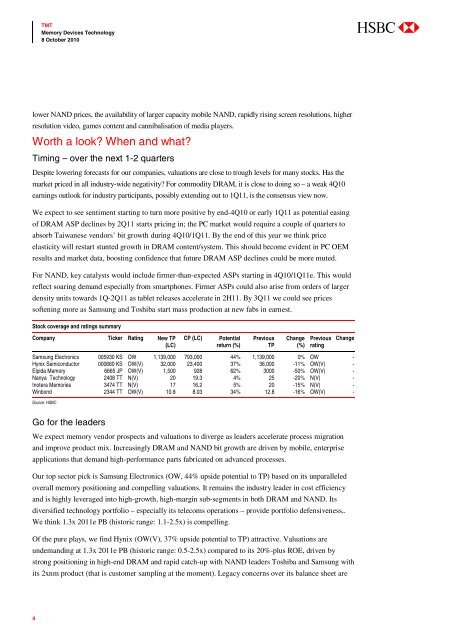

Stock coverage and ratings summary<br />

Company Ticker Rating New TP<br />

(LC)<br />

CP (LC)<br />

Potential<br />

return (%)<br />

Previous<br />

TP<br />

Change<br />

(%)<br />

Previous<br />

rating<br />

Change<br />

Samsung Electronics 005930 KS OW 1,139,000 793,000 44% 1,139,000 0% OW -<br />

Hynix Semiconductor 000660 KS OW(V) 32,000 23,400 37% 36,000 -11% OW(V) -<br />

Elpida <strong>Memory</strong> 6665 JP OW(V) 1,500 928 62% 3000 -50% OW(V) -<br />

Nanya Technology 2408 TT N(V) 20 19.3 4% 25 -20% N(V) -<br />

Inotera Memories 3474 TT N(V) 17 16.2 5% 20 -15% N(V) -<br />

Winbond 2344 TT OW(V) 10.8 8.03 34% 12.8 -16% OW(V) -<br />

Source: HSBC<br />

Go for the leaders<br />

We expect memory vendor prospects and valuations to diverge as leaders accelerate process migration<br />

and improve product mix. Increasingly DRAM and NAND bit growth are driven by mobile, enterprise<br />

applications that demand high-performance parts fabricated on advanced processes.<br />

Our top sector pick is Samsung Electronics (OW, 44% upside potential to TP) based on its unparalleled<br />

overall memory positioning and compelling valuations. It remains the industry leader in cost efficiency<br />

and is highly leveraged into high-growth, high-margin sub-segments in both DRAM and NAND. Its<br />

diversified technology portfolio – especially its telecoms operations – provide portfolio defensiveness,.<br />

We think 1.3x 2011e PB (historic range: 1.1-2.5x) is compelling.<br />

Of the pure plays, we find Hynix (OW(V), 37% upside potential to TP) attractive. Valuations are<br />

undemanding at 1.3x 2011e PB (historic range: 0.5-2.5x) compared to its 20%-plus ROE, driven by<br />

strong positioning in high-end DRAM and rapid catch-up with NAND leaders Toshiba and Samsung with<br />

its 2xnm product (that is customer sampling at the moment). Legacy concerns over its balance sheet are<br />

4