Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

Samsung Electronics (005930)<br />

Leading DRAM and NAND technologies, market share, strong<br />

balance sheet and vertical integration make SEC our top pick<br />

Samsung’s strong product mix and accelerated process migration<br />

leverages into structural growth areas such as mobile, servers<br />

Remain OW, TP unchanged at KRW1,139,000. An HSBC <strong>Asia</strong><br />

Super Ten idea<br />

Investment summary<br />

For detailed analysis, please refer to our recent<br />

40-page report, Samsung Electronics – OW:<br />

Comprehensive health check, 24 September 2010.<br />

The memory leader<br />

Samsung Electronics is our preferred play in the<br />

memory sector. Samsung has:<br />

Highly competitive technologies and leading<br />

market share leadership in both DRAM and<br />

NAND (which is faster growing).<br />

Leading process migration, having started<br />

35nm DRAM production in 3Q10. We also<br />

expect 2xnm NAND production to start in<br />

4Q10.<br />

Strong presence in promising technologies<br />

such as phase change memory. Only Micron<br />

now has a comparable product portfolio post<br />

its recent acquisition of Numonyx.<br />

A massive balance sheet (cUSD10bn net cash<br />

at the parent level at end-2009) cash flow<br />

backing R&D and capex where necessary.<br />

currently playing out with rapid process<br />

migration and slew of advanced products.<br />

A level of vertical integration that is unique<br />

amongst its peers, giving it access to a vast<br />

internal market of electronics products.<br />

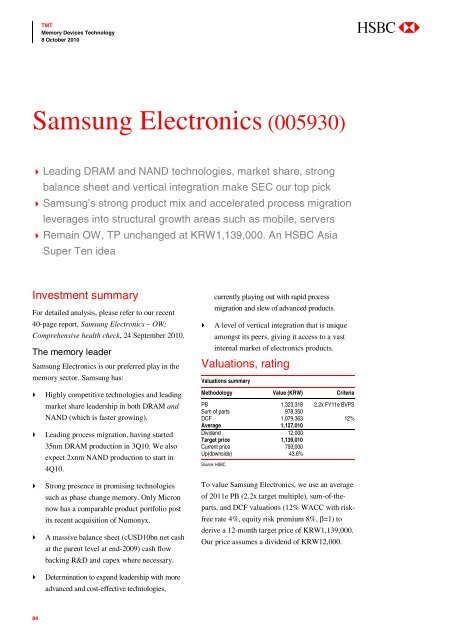

Valuations, rating<br />

Valuations summary<br />

Methodology Value (KRW) Criteria<br />

PB 1,323,318 2.2x FY11e BVPS<br />

Sum of parts 978,350<br />

DCF 1,079,363 12%<br />

Average 1,127,010<br />

Dividend 12,000<br />

Target price 1,139,010<br />

Current price 793,000<br />

Up(downside) 43.6%<br />

Source: HSBC<br />

To value Samsung Electronics, we use an average<br />

of 2011e PB (2.2x target multiple), sum-of-theparts,<br />

and DCF valuations (12% WACC with riskfree<br />

rate 4%, equity risk premium 8%, β=1) to<br />

derive a 12-month target price of KRW1,139,000.<br />

Our price assumes a dividend of KRW12,000.<br />

Determination to expand leadership with more<br />

advanced and cost-effective technologies,<br />

84