You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

Short-term oversupply<br />

After a series of years of declining revenue<br />

growth, we estimate global DRAM revenue to rise<br />

79% y-o-y this year, driven by 49% bit growth<br />

and blended ASP rise of c20%. For 2011, the<br />

situation is clearly different; we forecast global<br />

revenue to be flat (+1% y-o-y) as blended ASPs<br />

decline 32% y-o-y to below USD1.9, offsetting<br />

the c49% rise in bit supply. Over the next 2-3<br />

quarters we expect the DRAM industry to suffer<br />

from pricing pressure on greater supply as smaller<br />

players overcome process migration difficulties<br />

and as larger players accelerate their own process<br />

migrations, plus in the case of Samsung, adds<br />

wafer capacity. Nevertheless, we forecast DRAM<br />

industry revenue to reach cUSD46bn by 2012e,<br />

almost doubling from last year’s cUSD24bn.<br />

DRAM revenue, supply bit growth, ASP trends<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

-<br />

Source: IDC, HSBC estimates<br />

2008 2009 2010f 2011f 2012f<br />

Supply (1Gb, m)<br />

DRAM Sales (USDm)<br />

Blended ASP, 1Gb equ. (USD)<br />

Oversupply likely until 2Q11<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

-<br />

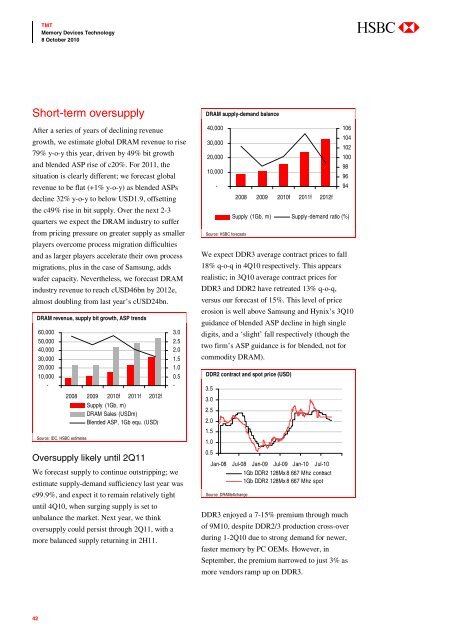

We forecast supply to continue outstripping; we<br />

estimate supply-demand sufficiency last year was<br />

c99.9%, and expect it to remain relatively tight<br />

until 4Q10, when surging supply is set to<br />

unbalance the market. Next year, we think<br />

oversupply could persist through 2Q11, with a<br />

more balanced supply returning in 2H11.<br />

DRAM supply-demand balance<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

-<br />

Source: HSBC forecasts<br />

2008 2009 2010f 2011f 2012f<br />

106<br />

104<br />

102<br />

100<br />

Supply (1Gb, m) Supply -demand ratio (%)<br />

We expect DDR3 average contract prices to fall<br />

18% q-o-q in 4Q10 respectively. This appears<br />

realistic; in 3Q10 average contract prices for<br />

DDR3 and DDR2 have retreated 13% q-o-q,<br />

versus our forecast of 15%. This level of price<br />

erosion is well above Samsung and Hynix’s 3Q10<br />

guidance of blended ASP decline in high single<br />

digits, and a ‘slight’ fall respectively (though the<br />

two firm’s ASP guidance is for blended, not for<br />

commodity DRAM).<br />

DDR2 contract and spot price (USD)<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10<br />

1Gb DDR2 128Mx 8 667 Mhz contract<br />

1Gb DDR2 128Mx 8 667 Mhz spot<br />

Source: DRAMeXchange<br />

DDR3 enjoyed a 7-15% premium through much<br />

of 9M10, despite DDR2/3 production cross-over<br />

during 1-2Q10 due to strong demand for newer,<br />

faster memory by PC OEMs. However, in<br />

September, the premium narrowed to just 3% as<br />

more vendors ramp up on DDR3.<br />

98<br />

96<br />

94<br />

42