You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

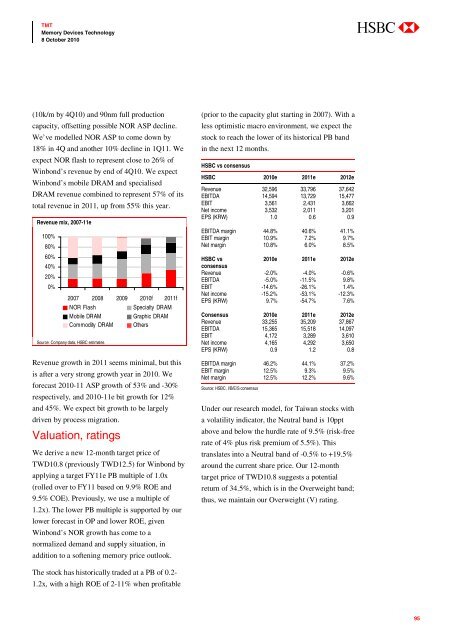

(10k/m by 4Q10) and 90nm full production<br />

capacity, offsetting possible NOR ASP decline.<br />

We’ve modelled NOR ASP to come down by<br />

18% in 4Q and another 10% decline in 1Q11. We<br />

expect NOR flash to represent close to 26% of<br />

Winbond’s revenue by end of 4Q10. We expect<br />

Winbond’s mobile DRAM and specialised<br />

DRAM revenue combined to represent 57% of its<br />

total revenue in 2011, up from 55% this year.<br />

Revenue mix, 2007-11e<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

2007 2008 2009 2010f 2011f<br />

NOR Flash<br />

Specialty DRAM<br />

Mobile DRAM<br />

Graphic DRAM<br />

Commodity DRAM Others<br />

Source: Company data, HSBC estimates<br />

Revenue growth in 2011 seems minimal, but this<br />

is after a very strong growth year in 2010. We<br />

forecast 2010-11 ASP growth of 53% and -30%<br />

respectively, and 2010-11e bit growth for 12%<br />

and 45%. We expect bit growth to be largely<br />

driven by process migration.<br />

Valuation, ratings<br />

We derive a new 12-month target price of<br />

TWD10.8 (previously TWD12.5) for Winbond by<br />

applying a target FY11e PB multiple of 1.0x<br />

(rolled over to FY11 based on 9.9% ROE and<br />

9.5% COE). Previously, we use a multiple of<br />

1.2x). The lower PB multiple is supported by our<br />

lower forecast in OP and lower ROE, given<br />

Winbond’s NOR growth has come to a<br />

normalized demand and supply situation, in<br />

addition to a softening memory price outlook.<br />

(prior to the capacity glut starting in 2007). With a<br />

less optimistic macro environment, we expect the<br />

stock to reach the lower of its historical PB band<br />

in the next 12 months.<br />

HSBC vs consensus<br />

HSBC 2010e 2011e 2012e<br />

Revenue 32,596 33,796 37,642<br />

EBITDA 14,594 13,729 15,477<br />

EBIT 3,561 2,431 3,662<br />

Net income 3,532 2,011 3,201<br />

EPS (KRW) 1.0 0.6 0.9<br />

EBITDA margin 44.8% 40.6% 41.1%<br />

EBIT margin 10.9% 7.2% 9.7%<br />

Net margin 10.8% 6.0% 8.5%<br />

HSBC vs<br />

2010e 2011e 2012e<br />

consensus<br />

Revenue -2.0% -4.0% -0.6%<br />

EBITDA -5.0% -11.5% 9.8%<br />

EBIT -14.6% -26.1% 1.4%<br />

Net income -15.2% -53.1% -12.3%<br />

EPS (KRW) 9.7% -54.7% 7.6%<br />

Consensus 2010e 2011e 2012e<br />

Revenue 33,255 35,209 37,867<br />

EBITDA 15,365 15,518 14,097<br />

EBIT 4,172 3,289 3,610<br />

Net income 4,165 4,292 3,650<br />

EPS (KRW) 0.9 1.2 0.8<br />

EBITDA margin 46.2% 44.1% 37.2%<br />

EBIT margin 12.5% 9.3% 9.5%<br />

Net margin 12.5% 12.2% 9.6%<br />

Source: HSBC, I/B/E/S consensus<br />

Under our research model, for Taiwan stocks with<br />

a volatility indicator, the Neutral band is 10ppt<br />

above and below the hurdle rate of 9.5% (risk-free<br />

rate of 4% plus risk premium of 5.5%). This<br />

translates into a Neutral band of -0.5% to +19.5%<br />

around the current share price. Our 12-month<br />

target price of TWD10.8 suggests a potential<br />

return of 34.5%, which is in the Overweight band;<br />

thus, we maintain our Overweight (V) rating.<br />

The stock has historically traded at a PB of 0.2-<br />

1.2x, with a high ROE of 2-11% when profitable<br />

95