You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

bring NAND capex/sales to 50%, still well below<br />

the 2005-8 average level of 67%. Other than<br />

accelerated process migration, we expect Samsung<br />

to expand its NAND production capacity probably<br />

at Fab 16, which we expect to be online next year,<br />

to compete with Toshiba’s new NAND fab (Fab 5)<br />

at its facility in Mie Prefecture, Japan; this is<br />

expected to come online in spring 2011.<br />

Global NAND capex (USDm)<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

-<br />

Source: Gartner, HSBC forecasts<br />

2009 2010f 2011f 2012f<br />

Total (HSBC) y-o-y (%)<br />

200%<br />

150%<br />

100%<br />

50%<br />

0%<br />

-50%<br />

-100%<br />

We are not alarmed by this increase. Based on our<br />

capacity assumptions for these two major new<br />

fabs and process migrations for the major vendors,<br />

we expect 2011 supply-demand balance to be<br />

similar to this year’s, at 99.6%. We expect waferdriven<br />

NAND capacity additions to hit in earnest<br />

during 2H11, by which time we believe strong<br />

demand growth can absorb the extra production.<br />

Indeed, we expect a major shortage of supply by<br />

next year, if Toshiba’s new Fab 5, and as appears<br />

possible, Samsung’s Fab 16 do not come online.<br />

Furthermore, we believe leading makers –<br />

Toshiba and Samsung – remain cautious on the<br />

rate of capacity ramp up, balancing it against bit<br />

gains from process migration and attempting to<br />

avoid the debilitating overcapacity that plagued<br />

the industry for years.<br />

From a capex/sales perspective, rising capex is<br />

not excessive, either in our view. We estimate<br />

capex/sales for the global NAND industry to<br />

approach and remain at c45-50% during 2010-11e.<br />

This is a steep increase over the anomalous c25%<br />

in 2009, but compares favourably compared to the<br />

over-build situation in 2006-08, when capex/sales<br />

varied between 58% (2008) and 82% (2007). The<br />

sharp forecast capex rise follows two consecutive<br />

years of severe cut backs, during which the vast<br />

majority of less efficient 200mm fab capacity was<br />

decommissioned.<br />

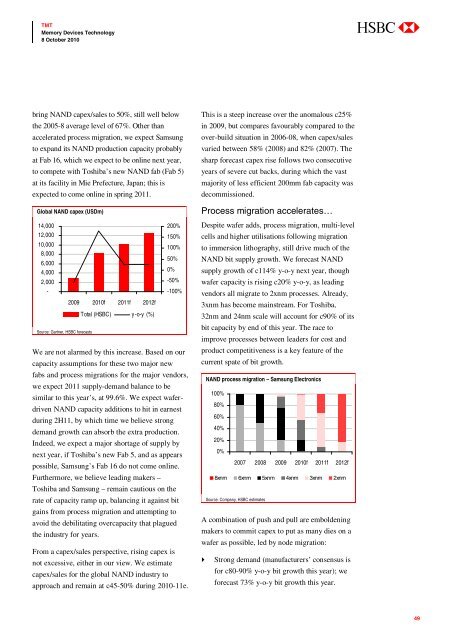

Process migration accelerates…<br />

Despite wafer adds, process migration, multi-level<br />

cells and higher utilisations following migration<br />

to immersion lithography, still drive much of the<br />

NAND bit supply growth. We forecast NAND<br />

supply growth of c114% y-o-y next year, though<br />

wafer capacity is rising c20% y-o-y, as leading<br />

vendors all migrate to 2xnm processes. Already,<br />

3xnm has become mainstream. For Toshiba,<br />

32nm and 24nm scale will account for c90% of its<br />

bit capacity by end of this year. The race to<br />

improve processes between leaders for cost and<br />

product competitiveness is a key feature of the<br />

current spate of bit growth.<br />

NAND process migration – Samsung Electronics<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

8xnm 6xnm 5xnm 4xnm 3xnm 2xnm<br />

Source: Company, HSBC estimates<br />

A combination of push and pull are emboldening<br />

makers to commit capex to put as many dies on a<br />

wafer as possible, led by node migration:<br />

Strong demand (manufacturers’ consensus is<br />

for c80-90% y-o-y bit growth this year); we<br />

forecast 73% y-o-y bit growth this year.<br />

49