Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

Valuations, ratings<br />

Maintain TP and OW rating on Samsung. Lower TP on Hynix, but<br />

maintain OW(V)<br />

Lower TP on Elpida, Nanya Tech, Winbond and Elpida. Maintain<br />

OW(V) for Elpida and Winbond, and N(V) for Inotera and Nanya<br />

We expect valuation divergence as product mix and cost structure<br />

drive profitability for leaders<br />

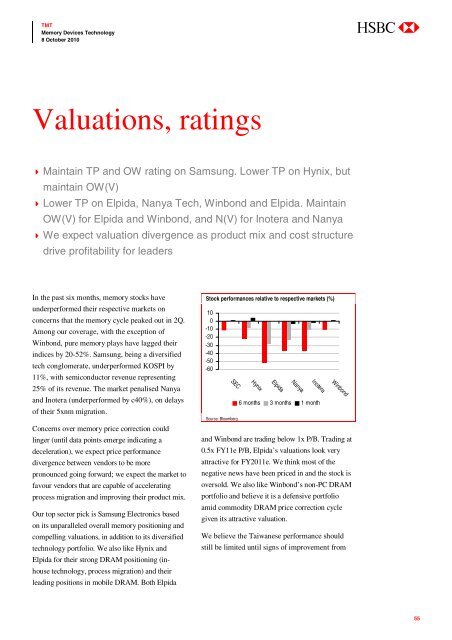

In the past six months, memory stocks have<br />

underperformed their respective markets on<br />

concerns that the memory cycle peaked out in 2Q.<br />

Among our coverage, with the exception of<br />

Winbond, pure memory plays have lagged their<br />

indices by 20-52%. Samsung, being a diversified<br />

tech conglomerate, underperformed KOSPI by<br />

11%, with semiconductor revenue representing<br />

25% of its revenue. The market penalised Nanya<br />

and Inotera (underperformed by c40%), on delays<br />

of their 5xnm migration.<br />

Concerns over memory price correction could<br />

linger (until data points emerge indicating a<br />

deceleration), we expect price performance<br />

divergence between vendors to be more<br />

pronounced going forward; we expect the market to<br />

favour vendors that are capable of accelerating<br />

process migration and improving their product mix.<br />

Our top sector pick is Samsung Electronics based<br />

on its unparalleled overall memory positioning and<br />

compelling valuations, in addition to its diversified<br />

technology portfolio. We also like Hynix and<br />

Elpida for their strong DRAM positioning (inhouse<br />

technology, process migration) and their<br />

leading positions in mobile DRAM. Both Elpida<br />

Stock performances relative to respective markets (%)<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

SEC<br />

Source: Bloomberg<br />

Hynix<br />

Elpida<br />

Nanya<br />

Inotera<br />

6 months 3 months 1 month<br />

Winbond<br />

and Winbond are trading below 1x P/B. Trading at<br />

0.5x FY11e P/B, Elpida’s valuations look very<br />

attractive for FY2011e. We think most of the<br />

negative news have been priced in and the stock is<br />

oversold. We also like Winbond’s non-PC DRAM<br />

portfolio and believe it is a defensive portfolio<br />

amid commodity DRAM price correction cycle<br />

given its attractive valuation.<br />

We believe the Taiwanese performance should<br />

still be limited until signs of improvement from<br />

55