You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

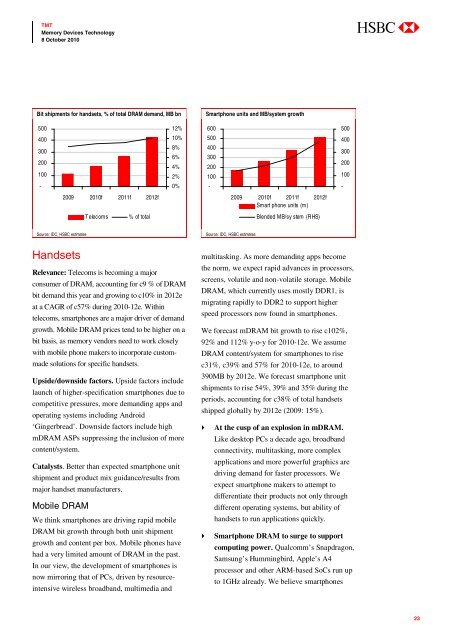

Bit shipments for handsets, % of total DRAM demand, MB bn<br />

Smartphone units and MB/system growth<br />

500<br />

400<br />

300<br />

200<br />

100<br />

-<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

-<br />

500<br />

400<br />

300<br />

200<br />

100<br />

-<br />

2009 2010f 2011f 2012f<br />

2009 2010f 2011f 2012f<br />

Smart phone units (m)<br />

Telecoms<br />

% of total<br />

Blended MB/sy stem (RHS)<br />

Source: IDC, HSBC estimates<br />

Source: IDC, HSBC estimates<br />

Handsets<br />

Relevance: Telecoms is becoming a major<br />

consumer of DRAM, accounting for c9 % of DRAM<br />

bit demand this year and growing to c10% in 2012e<br />

at a CAGR of c57% during 2010-12e. Within<br />

telecoms, smartphones are a major driver of demand<br />

growth. Mobile DRAM prices tend to be higher on a<br />

bit basis, as memory vendors need to work closely<br />

with mobile phone makers to incorporate custommade<br />

solutions for specific handsets.<br />

Upside/downside factors. Upside factors include<br />

launch of higher-specification smartphones due to<br />

competitive pressures, more demanding apps and<br />

operating systems including Android<br />

‘Gingerbread’. Downside factors include high<br />

mDRAM ASPs suppressing the inclusion of more<br />

content/system.<br />

Catalysts. Better than expected smartphone unit<br />

shipment and product mix guidance/results from<br />

major handset manufacturers.<br />

Mobile DRAM<br />

We think smartphones are driving rapid mobile<br />

DRAM bit growth through both unit shipment<br />

growth and content per box. Mobile phones have<br />

had a very limited amount of DRAM in the past.<br />

In our view, the development of smartphones is<br />

now mirroring that of PCs, driven by resourceintensive<br />

wireless broadband, multimedia and<br />

multitasking. As more demanding apps become<br />

the norm, we expect rapid advances in processors,<br />

screens, volatile and non-volatile storage. Mobile<br />

DRAM, which currently uses mostly DDR1, is<br />

migrating rapidly to DDR2 to support higher<br />

speed processors now found in smartphones.<br />

We forecast mDRAM bit growth to rise c102%,<br />

92% and 112% y-o-y for 2010-12e. We assume<br />

DRAM content/system for smartphones to rise<br />

c31%, c39% and 57% for 2010-12e, to around<br />

390MB by 2012e. We forecast smartphone unit<br />

shipments to rise 54%, 39% and 35% during the<br />

periods, accounting for c38% of total handsets<br />

shipped globally by 2012e (2009: 15%).<br />

At the cusp of an explosion in mDRAM.<br />

Like desktop PCs a decade ago, broadband<br />

connectivity, multitasking, more complex<br />

applications and more powerful graphics are<br />

driving demand for faster processors. We<br />

expect smartphone makers to attempt to<br />

differentiate their products not only through<br />

different operating systems, but ability of<br />

handsets to run applications quickly.<br />

Smartphone DRAM to surge to support<br />

computing power. Qualcomm’s Snapdragon,<br />

Samsung’s Hummingbird, Apple’s A4<br />

processor and other ARM-based SoCs run up<br />

to 1GHz already. We believe smartphones<br />

23