Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

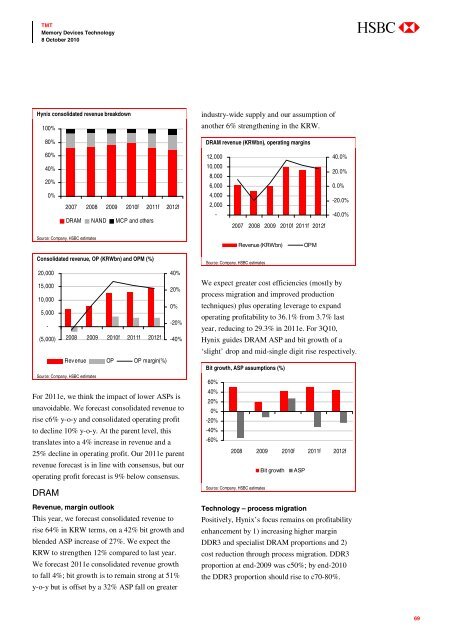

Hynix consolidated revenue breakdown<br />

100%<br />

80%<br />

industry-wide supply and our assumption of<br />

another 6% strengthening in the KRW.<br />

DRAM revenue (KRWbn), operating margins<br />

60%<br />

12,000<br />

40.0%<br />

40%<br />

20%<br />

10,000<br />

8,000<br />

6,000<br />

20.0%<br />

0.0%<br />

0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

DRAM NAND MCP and others<br />

4,000<br />

2,000<br />

-<br />

2007 2008 2009 2010f 2011f 2012f<br />

-20.0%<br />

-40.0%<br />

Source: Company, HSBC estimates<br />

Revenue (KRW bn)<br />

OPM<br />

Consolidated revenue, OP (KRWbn) and OPM (%)<br />

20,000<br />

40%<br />

15,000<br />

20%<br />

10,000<br />

0%<br />

5,000<br />

-<br />

-20%<br />

(5,000) 2008 2009 2010f 2011f 2012f -40%<br />

Revenue OP OP margin(%)<br />

Source: Company, HSBC estimates<br />

For 2011e, we think the impact of lower ASPs is<br />

unavoidable. We forecast consolidated revenue to<br />

rise c6% y-o-y and consolidated operating profit<br />

to decline 10% y-o-y. At the parent level, this<br />

translates into a 4% increase in revenue and a<br />

25% decline in operating profit. Our 2011e parent<br />

revenue forecast is in line with consensus, but our<br />

operating profit forecast is 9% below consensus.<br />

DRAM<br />

Revenue, margin outlook<br />

This year, we forecast consolidated revenue to<br />

rise 64% in KRW terms, on a 42% bit growth and<br />

blended ASP increase of 27%. We expect the<br />

KRW to strengthen 12% compared to last year.<br />

We forecast 2011e consolidated revenue growth<br />

to fall 4%; bit growth is to remain strong at 51%<br />

y-o-y but is offset by a 32% ASP fall on greater<br />

Source: Company, HSBC estimates<br />

We expect greater cost efficiencies (mostly by<br />

process migration and improved production<br />

techniques) plus operating leverage to expand<br />

operating profitability to 36.1% from 3.7% last<br />

year, reducing to 29.3% in 2011e. For 3Q10,<br />

Hynix guides DRAM ASP and bit growth of a<br />

‘slight’ drop and mid-single digit rise respectively.<br />

Bit growth, ASP assumptions (%)<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

2008 2009 2010f 2011f 2012f<br />

Bit growth ASP<br />

Source: Company, HSBC estimates<br />

Technology – process migration<br />

Positively, Hynix’s focus remains on profitability<br />

enhancement by 1) increasing higher margin<br />

DDR3 and specialist DRAM proportions and 2)<br />

cost reduction through process migration. DDR3<br />

proportion at end-2009 was c50%; by end-2010<br />

the DDR3 proportion should rise to c70-80%.<br />

69