You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

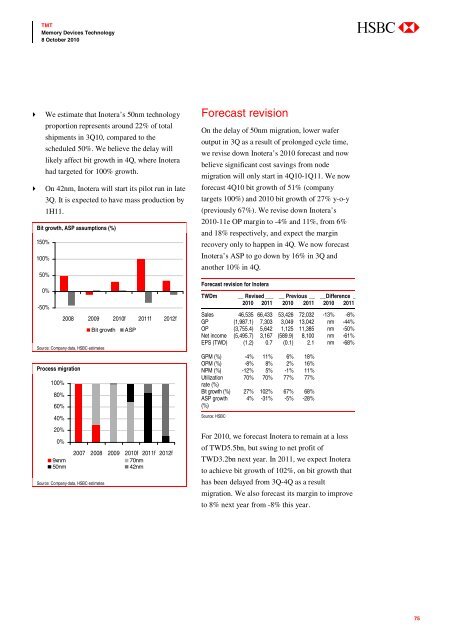

We estimate that Inotera’s 50nm technology<br />

proportion represents around 22% of total<br />

shipments in 3Q10, compared to the<br />

scheduled 50%. We believe the delay will<br />

likely affect bit growth in 4Q, where Inotera<br />

had targeted for 100% growth.<br />

On 42nm, Inotera will start its pilot run in late<br />

3Q. It is expected to have mass production by<br />

1H11.<br />

Bit growth, ASP assumptions (%)<br />

150%<br />

100%<br />

50%<br />

0%<br />

-50%<br />

2008 2009 2010f 2011f 2012f<br />

Bit growth ASP<br />

Source: Company data, HSBC estimates<br />

Process migration<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

9xnm<br />

70nm<br />

50nm<br />

42nm<br />

Source: Company data, HSBC estimates<br />

Forecast revision<br />

On the delay of 50nm migration, lower wafer<br />

output in 3Q as a result of prolonged cycle time,<br />

we revise down Inotera’s 2010 forecast and now<br />

believe significant cost savings from node<br />

migration will only start in 4Q10-1Q11. We now<br />

forecast 4Q10 bit growth of 51% (company<br />

targets 100%) and 2010 bit growth of 27% y-o-y<br />

(previously 67%). We revise down Inotera’s<br />

2010-11e OP margin to -4% and 11%, from 6%<br />

and 18% respectively, and expect the margin<br />

recovery only to happen in 4Q. We now forecast<br />

Inotera’s ASP to go down by 16% in 3Q and<br />

another 10% in 4Q.<br />

Forecast revision for Inotera<br />

TWDm __ Revised ___ __ Previous ___ __Difference _<br />

2010 2011 2010 2011 2010 2011<br />

Sales 46,535 66,433 53,426 72,032 -13% -8%<br />

GP (1,987.1) 7,303 3,049 13,042 nm -44%<br />

OP (3,755.4) 5,642 1,125 11,385 nm -50%<br />

Net income (5,495.7) 3,167 (589.9) 8,100 nm -61%<br />

EPS (TWD) (1.2) 0.7 (0.1) 2.1 nm -68%<br />

GPM (%) -4% 11% 6% 18%<br />

OPM (%) -8% 8% 2% 16%<br />

NPM (%) -12% 5% -1% 11%<br />

Utilization 70% 70% 77% 77%<br />

rate (%)<br />

Bit growth (%) 27% 102% 67% 68%<br />

ASP growth<br />

(%)<br />

4% -31% -5% -28%<br />

Source: HSBC<br />

For 2010, we forecast Inotera to remain at a loss<br />

of TWD5.5bn, but swing to net profit of<br />

TWD3.2bn next year. In 2011, we expect Inotera<br />

to achieve bit growth of 102%, on bit growth that<br />

has been delayed from 3Q-4Q as a result<br />

migration. We also forecast its margin to improve<br />

to 8% next year from -8% this year.<br />

75