You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

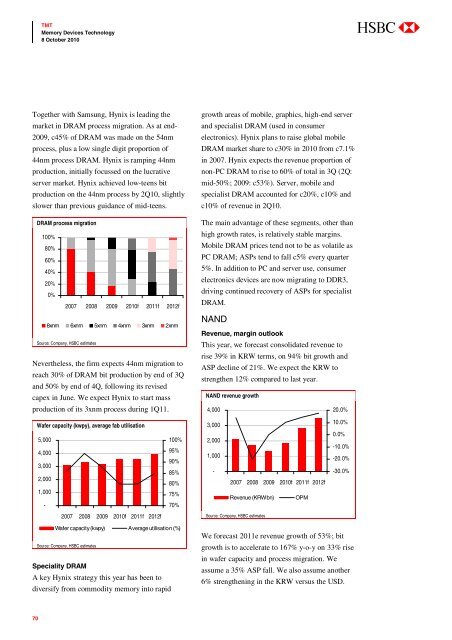

Together with Samsung, Hynix is leading the<br />

market in DRAM process migration. As at end-<br />

2009, c45% of DRAM was made on the 54nm<br />

process, plus a low single digit proportion of<br />

44nm process DRAM. Hynix is ramping 44nm<br />

production, initially focussed on the lucrative<br />

server market. Hynix achieved low-teens bit<br />

production on the 44nm process by 2Q10, slightly<br />

slower than previous guidance of mid-teens.<br />

DRAM process migration<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

8xnm 6xnm 5xnm 4xnm 3xnm 2xnm<br />

Source: Company, HSBC estimates<br />

Nevertheless, the firm expects 44nm migration to<br />

reach 30% of DRAM bit production by end of 3Q<br />

and 50% by end of 4Q, following its revised<br />

capex in June. We expect Hynix to start mass<br />

production of its 3xnm process during 1Q11.<br />

growth areas of mobile, graphics, high-end server<br />

and specialist DRAM (used in consumer<br />

electronics). Hynix plans to raise global mobile<br />

DRAM market share to c30% in 2010 from c7.1%<br />

in 2007. Hynix expects the revenue proportion of<br />

non-PC DRAM to rise to 60% of total in 3Q (2Q:<br />

mid-50%; 2009: c53%). Server, mobile and<br />

specialist DRAM accounted for c20%, c10% and<br />

c10% of revenue in 2Q10.<br />

The main advantage of these segments, other than<br />

high growth rates, is relatively stable margins.<br />

Mobile DRAM prices tend not to be as volatile as<br />

PC DRAM; ASPs tend to fall c5% every quarter<br />

5%. In addition to PC and server use, consumer<br />

electronics devices are now migrating to DDR3,<br />

driving continued recovery of ASPs for specialist<br />

DRAM.<br />

NAND<br />

Revenue, margin outlook<br />

This year, we forecast consolidated revenue to<br />

rise 39% in KRW terms, on 94% bit growth and<br />

ASP decline of 21%. We expect the KRW to<br />

strengthen 12% compared to last year.<br />

NAND revenue growth<br />

4,000<br />

20.0%<br />

Wafer capacity (kwpy), average fab utilisation<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

100%<br />

95%<br />

90%<br />

85%<br />

80%<br />

75%<br />

70%<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

2007 2008 2009 2010f 2011f 2012f<br />

Revenue (KRW bn) OPM<br />

10.0%<br />

0.0%<br />

-10.0%<br />

-20.0%<br />

-30.0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

Source: Company, HSBC estimates<br />

Wafer capacity (kwpy) Average utilisation (%)<br />

Source: Company, HSBC estimates<br />

Speciality DRAM<br />

A key Hynix strategy this year has been to<br />

diversify from commodity memory into rapid<br />

We forecast 2011e revenue growth of 53%; bit<br />

growth is to accelerate to 167% y-o-y on 33% rise<br />

in wafer capacity and process migration. We<br />

assume a 35% ASP fall. We also assume another<br />

6% strengthening in the KRW versus the USD.<br />

70