You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

We are positive on Hynix’s NAND prospects on<br />

two accounts – rising fab capacity and accelerated<br />

process migration. Hynix lost market share in the<br />

past two years as it shut down uneconomical<br />

200mm fabs. But with strong NAND demand and<br />

removal of excess global capacity, and the<br />

financial ability to build capacity, Hynix is in a<br />

favourable environment to raise NAND<br />

production. This year’s capex includes capacity<br />

expansion of M11 (currently 50-60kwpm at<br />

300mm) to 80kwpm by year-end.<br />

Technology – process migration<br />

Following a couple years of production stagnation,<br />

Hynix’s priority is to narrow the technology gap<br />

with the NAND leaders. By this year-end, Hynix<br />

aims to have over 50% of NAND production on<br />

the 32nm process with another c35% on 41nm.<br />

Still, Hynix’s margins remain lower than rivals’.<br />

The current ramp up to 32nm process should<br />

partially close this gap. Hynix targets >50% of<br />

NAND bit production of 32nm by year-end.<br />

NAND process migration<br />

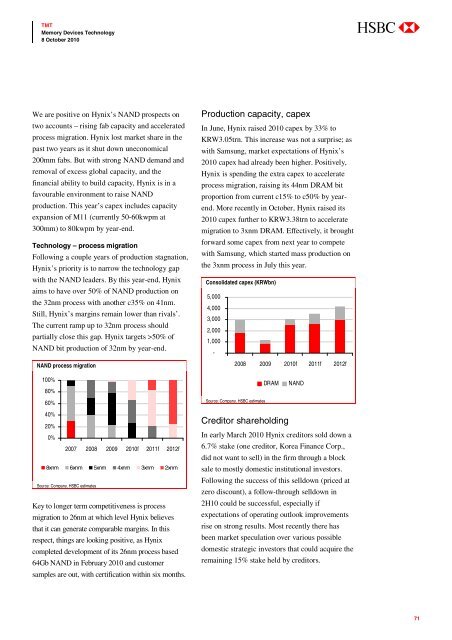

Production capacity, capex<br />

In June, Hynix raised 2010 capex by 33% to<br />

KRW3.05trn. This increase was not a surprise; as<br />

with Samsung, market expectations of Hynix’s<br />

2010 capex had already been higher. Positively,<br />

Hynix is spending the extra capex to accelerate<br />

process migration, raising its 44nm DRAM bit<br />

proportion from current c15% to c50% by yearend.<br />

More recently in October, Hynix raised its<br />

2010 capex further to KRW3.38trn to accelerate<br />

migration to 3xnm DRAM. Effectively, it brought<br />

forward some capex from next year to compete<br />

with Samsung, which started mass production on<br />

the 3xnm process in July this year.<br />

Consolidated capex (KRWbn)<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

2008 2009 2010f 2011f 2012f<br />

100%<br />

80%<br />

60%<br />

Source: Company, HSBC estimates<br />

DRAM<br />

NAND<br />

40%<br />

20%<br />

0%<br />

2007 2008 2009 2010f 2011f 2012f<br />

8xnm 6xnm 5xnm 4xnm 3xnm 2xnm<br />

Source: Company, HSBC estimates<br />

Key to longer term competitiveness is process<br />

migration to 26nm at which level Hynix believes<br />

that it can generate comparable margins. In this<br />

respect, things are looking positive, as Hynix<br />

completed development of its 26nm process based<br />

64Gb NAND in February 2010 and customer<br />

samples are out, with certification within six months.<br />

Creditor shareholding<br />

In early March 2010 Hynix creditors sold down a<br />

6.7% stake (one creditor, Korea Finance Corp.,<br />

did not want to sell) in the firm through a block<br />

sale to mostly domestic institutional investors.<br />

Following the success of this selldown (priced at<br />

zero discount), a follow-through selldown in<br />

2H10 could be successful, especially if<br />

expectations of operating outlook improvements<br />

rise on strong results. Most recently there has<br />

been market speculation over various possible<br />

domestic strategic investors that could acquire the<br />

remaining 15% stake held by creditors.<br />

71