You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TMT<br />

<strong>Memory</strong> Devices Technology<br />

8 October 2010<br />

abc<br />

DRAM – price elasticity drives<br />

higher content/box<br />

We expect DRAM price declines to start slowing in<br />

2Q11 as lower ASPs from sharply higher supply<br />

during 4Q10-1Q11 stimulate higher content/system<br />

and as supply increases peak out. Overall, we expect<br />

content/system to rise 33% next year, following a<br />

27% y-o-y rise in 2010; high ASPs this year<br />

depressed content growth this year.<br />

DRAM demand and ASPs<br />

2009 2010e 2011e 2012e<br />

ASP (USD) -18% 20% -32% -25%<br />

Content/system (MB) 27% 27% 33% 32%<br />

Units shipments (m) 2% 14% 7% 9%<br />

Demand (MB bn) 30% 46% 42% 43%<br />

Source: HSBC estimates<br />

Bit growth in the coming quarters could surprise<br />

on the upside. We expect PC OEMs to gradually<br />

start raising content/box starting in 3Q on steep<br />

price declines; 2GB DDR3 modules now cost<br />

around USD36, 23% below the peak of USD46.5<br />

in May. We expect price elasticity to kick in<br />

meaningfully in 4Q10 on persistent DRAM<br />

pricing weakness arising from expanded supply.<br />

We model 18% q-o-q average ASP decline for<br />

DDR3 contract prices in 4Q10, implying an<br />

average price of USD32 per 2GB module for the<br />

quarter. At that level, 4GB content/system on<br />

desktops should accessible to the majority of PC<br />

OEMs. By 1Q11, 2GB modules could have fallen<br />

to around USD28, starting to drive real increase in<br />

content/system above the 4GB level. For higherend<br />

PCs, we expect content/box climbing to 6-<br />

8GB next year to competitively differentiate.<br />

We also expect accelerating adoption of higherend<br />

4GB modules based on 4x-5xnm 2Gb parts.<br />

Leading DRAM vendors such as Samsung and<br />

Hynix that are rapidly shifting production of 2Gb<br />

parts to 4xnm and below from 5xnm will benefit<br />

the most from this trend.<br />

NAND<br />

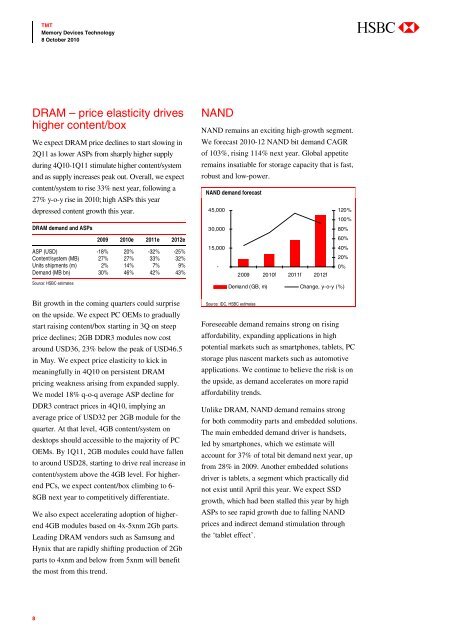

NAND remains an exciting high-growth segment.<br />

We forecast 2010-12 NAND bit demand CAGR<br />

of 103%, rising 114% next year. Global appetite<br />

remains insatiable for storage capacity that is fast,<br />

robust and low-power.<br />

NAND demand forecast<br />

45,000<br />

120%<br />

100%<br />

30,000<br />

80%<br />

60%<br />

15,000<br />

40%<br />

20%<br />

-<br />

0%<br />

2009 2010f 2011f 2012f<br />

Demand ( GB, m) Change, y-o-y (%)<br />

Source: IDC, HSBC estimates<br />

Foreseeable demand remains strong on rising<br />

affordability, expanding applications in high<br />

potential markets such as smartphones, tablets, PC<br />

storage plus nascent markets such as automotive<br />

applications. We continue to believe the risk is on<br />

the upside, as demand accelerates on more rapid<br />

affordability trends.<br />

Unlike DRAM, NAND demand remains strong<br />

for both commodity parts and embedded solutions.<br />

The main embedded demand driver is handsets,<br />

led by smartphones, which we estimate will<br />

account for 37% of total bit demand next year, up<br />

from 28% in 2009. Another embedded solutions<br />

driver is tablets, a segment which practically did<br />

not exist until April this year. We expect SSD<br />

growth, which had been stalled this year by high<br />

ASPs to see rapid growth due to falling NAND<br />

prices and indirect demand stimulation through<br />

the ‘tablet effect’.<br />

8