Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

p122. <strong>Annual</strong> <strong>Report</strong><br />

<strong>Christchurch</strong> Otautahi<br />

<strong>2010</strong><br />

Financial statements<br />

Financial highlights<br />

Financial statements<br />

Financial highlights<br />

Financial result<br />

This year’s <strong>Annual</strong> <strong>Report</strong> shows that the <strong>Council</strong> remain in a<br />

strong financial position, with an accounting surplus of $107.9<br />

million. This is $16.8 million below plan. The <strong>Council</strong> budgets for<br />

an accounting surplus because under accounting standards we are<br />

required to show all revenue, including capital revenue as income<br />

received for the year. Capital revenues include development<br />

contributions, some of which are used to fund future development;<br />

New Zealand Transport Agency (NZTA) subsidies, and vested<br />

assets, (footpaths, water and drainage infrastructure and reserves<br />

land), which are vested to <strong>Council</strong> by developers. The surplus also<br />

includes interest received on funds that are held in the balance<br />

sheet for special purposes.<br />

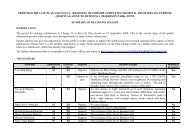

The $16.8 million shortfall is a result of the following variances:<br />

• an under-recovery in vested assets of $9.2 million<br />

• higher than planned depreciation, amortisation and<br />

impairment costs of $4.3 million due to higher impairment of<br />

assets $9.8 million, offset by lower than planned depreciation<br />

and amortisation of $5.5 million. The impaired assets are the<br />

loan to Tuam Limited and several minor investments, the lower<br />

depreciation and amortisation is largely the result of the shortfall<br />

in the previous year’s capital programme.<br />

• higher than planned personnel costs, $2.8 million<br />

• hedging impairment costs of $3.2 million which were not<br />

planned<br />

• higher than planned income tax expense of $1.9 million<br />

• these were offset by lower than planned finance costs of $3.8<br />

million due to timing of the capital programme and lower<br />

interest rates.<br />

After adjusting for non-cash items we have made a cash operating<br />

surplus for the year of $10.3 million of which $4.1 million was<br />

retained to meet operational costs of projects which will be<br />

completed in <strong>2010</strong>/11. <strong>Council</strong> allocated a further $1.7 million of<br />

the surplus to specific projects. The remaining $4.5 million will be<br />

moved into a reserve and used to fund capital expenditure, thereby<br />

reducing future borrowing costs.<br />

Sources of operating income<br />

Total income for the year ended 30 June <strong>2010</strong> is $567 million. It was<br />

received from the following sources:<br />

Actual Plan<br />

$m $m<br />

Rates revenue 257.4 256.1<br />

Sale of goods / services 43.9 33.9<br />

Rental revenue 26.9 29.4<br />

Interest revenue 22.7 23.4<br />

Dividends 115.1 117.6<br />

Development contributions 12.8 18.7<br />

NZ Transport Agency subsidies 27.4 26.4<br />

Other revenue 53.7 55.3<br />

Vested assets 7.1 16.2