Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

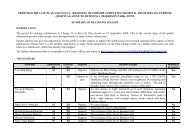

Financial instrument<br />

risks (continued)<br />

Financial statements<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>Christchurch</strong> Otautahi<br />

<strong>2010</strong><br />

p227.<br />

Notes to financial statements<br />

39. Financial instrument risks (continued)<br />

Credit risk management<br />

Credit risk refers to the risk that a counterparty will default<br />

on its contractual obligations resulting in financial loss to the<br />

entity. Financial instruments that potentially subject the group<br />

to concentrations of credit risk consist principally of cash and<br />

short-term investments, trade receivables, loans and interest<br />

rate swaps. The <strong>Council</strong> and group places its cash and short-term<br />

investments with high credit quality financial institutions and<br />

sovereign bodies and limits the amount of credit exposure to any<br />

one financial institution in accordance with the treasury policies of<br />

the respective members of the group.<br />

The <strong>Council</strong>’s Investment policy includes parameters for investing<br />

in financial institutions and other organisations including where<br />

applicable entities that have required Standard and Poor’s credit<br />

ratings.<br />

<strong>Council</strong> receivables mainly arise from statutory functions,<br />

therefore there are no procedures in place to monitor or report the<br />

credit quality of debtors and other receivables with reference to<br />

internal or external credit ratings. The <strong>Council</strong> has no significant<br />

concentrations of credit risk in relation to these receivables, as it<br />

has a large number of credit customers, mainly ratepayers, and the<br />

<strong>Council</strong> has powers under the Local Government (Rating) Act 2002<br />

to recover outstanding debts.<br />

Orion New Zealand Ltd has a concentration of credit risk with<br />

regard to its trade receivables, as it only has a small number of<br />

electricity retailed customers. <strong>Christchurch</strong> International Airport<br />

Ltd also has a concentration of credit risk on a small number of<br />

customers, with 71.0% (2009: 62.0%) of trade receivables due from<br />

10 customers. <strong>City</strong> Care Ltd also has a concentration of credit risk<br />

in respect of its transactions with 47% (2009: 47.0%) of its revenue<br />

derived from its ultimate shareholder, the <strong>Council</strong>. Red Bus Ltd has<br />

a concentration of credit risk with Environment Canterbury, which<br />

provides 59% (2009: 51%) of the company’s revenue.<br />

The group manages its exposure to credit risk arising from trade<br />

receivables by performing credit evaluations on all significant<br />

customers requiring credit, wherever practicable, and continuously<br />

monitors the outstanding credit exposure to individual customers.<br />

With the exception of Orion New Zealand Ltd, which generally<br />

requires collateral security (such as bank letters of credit) from its<br />

electricity retailer customers against credit risk, the group does not<br />

generally require collateral security from its customers.<br />

The carrying value is the maximum exposure to credit risk for bank<br />

balances, accounts receivable and interest rate swaps. No collateral<br />

is held in respect of these financial assets.<br />

The group has not renegotiated the terms of any financial assets<br />

which would result in the carrying amount no longer being past<br />

due or avoid a possible past due status other than trade receivables.