Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

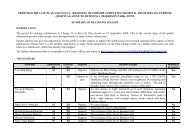

Income taxes Financial statements <strong>Annual</strong> <strong>Report</strong><br />

<strong>Christchurch</strong> Otautahi<br />

<strong>2010</strong><br />

p167.<br />

Notes to financial statements<br />

11. Income taxes<br />

(a) Components of tax expense<br />

Parent<br />

Group<br />

30 Jun 10 30 Jun 09 30 Jun 10 30 Jun 09<br />

Actual Actual Actual Actual<br />

$000s $000s $000s $000s<br />

Current tax expense/(income) - - 28,183 32,934<br />

Adjustments to current tax of prior years - - (231) (535)<br />

Deferred tax expense/(income) 2,038 788 75,892 (4,494)<br />

Deferred tax expense/(income) from change in tax rates (175) - (13,637) -<br />

Deferred tax expense relating to use of prior year losses - - 33 42<br />

Total tax expense/(income) 1,863 788 90,240 27,947<br />

Reconciliation of prima facie income tax:<br />

(Profit)/loss before tax 109,720 64,147 95,423 120,556<br />

Income tax expense calculated at standard tax rate 32,916 19,244 28,627 36,167<br />

Non-deductible expenses - - 882 412<br />

Non-assessable income and deductible items 18,412 (2,464) 5,552 (8,689)<br />

Effect on deferred tax balances of change in tax rate (175) - (13,637) -<br />

Tax loss not recognised as deferred tax asset - - - 138<br />

Previously unrecognised and unused tax losses now recognised as deferred<br />

- - (1,218) 42<br />

tax assets<br />

(Over)/under provision of income tax in previous year - - 788 127<br />

Imputation adjustment (49,290) (15,992) (499) (250)<br />

Deferred tax on removal of building depreciation - - 69,745 -<br />

Total tax expense/(income) 1,863 788 90,240 27,947<br />

The tax rate in the above reconciliation is the corporate tax rate of<br />

30% payable by New Zealand companies on taxable profits under<br />

New Zealand tax law.<br />

<strong>Council</strong>'s tax losses for the current financial year amount to $4.5<br />

million. These will be utilised by way of subvention receipt of $4.5<br />

million. The subvention receipts have been accrued as at 30 June<br />

<strong>2010</strong>. In May <strong>2010</strong>, the Government announced a reduction in the<br />

rate of company tax from 30% to 28%, effective from 1 April 2011.<br />

The effect of this on the Group’s deferred tax balances has been<br />

reflected in the tax expense for the year as shown above.<br />

The group deferred tax expense and provision were also affected<br />

as a result of a provision in the <strong>2010</strong> Government Budget that<br />

effectively removed the ability to claim tax depreciation on<br />

buildings with a useful life of 50 years or greater with effect from<br />

the 2012 financial year. This change has resulted in a substantial<br />

increase in the group deferred tax expense for the year, and a<br />

corresponding increase in the group deferred tax liability