Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

Annual Report 2010 - Christchurch City Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial instrument<br />

risks (continued)<br />

Financial statements<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>Christchurch</strong> Otautahi<br />

<strong>2010</strong><br />

p229.<br />

Notes to financial statements<br />

39. Financial instrument risks (continued)<br />

Liquidity risk<br />

Liquidity risk is the risk that the group will encounter difficulty<br />

raising liquid funds to meet commitments as they fall due. Prudent<br />

liquidity risk management implies maintaining sufficient cash, the<br />

availability of funding through an adequate amount of committed<br />

credit facilities and the ability to close out market positions.<br />

In meeting its liquidity requirements, the group manages its<br />

investments and borrowings in accordance with its written<br />

investment policies. In general the group generates sufficient cash<br />

flows from its operating activities to meet its obligations arising<br />

from its financial liabilities and has funding arrangements in place<br />

to cover potential shortfalls.<br />

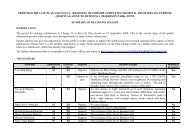

The following tables analyse the parent company’s and group’s<br />

contractual cash flows for its financial assets and liabilities into<br />

relevant maturity groupings based on the remaining period at year<br />

end to the contractual maturity date. The amounts disclosed in the<br />

tables are the contractual undiscounted cash flows:<br />

Parent<br />

Balance<br />

sheet<br />

Contractual<br />

cash flows<br />

Less than<br />

1 year<br />

1-2 years 2-5 years 5 years +<br />

$000s $000s $000s $000s $000s $000s<br />

Jun 10<br />

Financial liabilities:<br />

Creditors and other payables 75,626 75,626 75,626 - - -<br />

Net settled derivative liabilities 9,963 7,261 512 4,834 1,534 381<br />

Commercial paper 5,000 5,000 5,000 - - -<br />

Bonds and other fixed rate borrowing 81,566 97,132 5,481 4,713 86,936 2<br />

Floating rate notes 100,000 123,598 5,837 7,378 110,383 -<br />

Loans from external parties 79,623 100,546 41,430 6,038 17,952 35,126<br />

Loans from group entities 41,194 52,804 5,190 2,644 29,484 15,486<br />

392,972 461,967 139,076 25,607 246,289 50,995<br />

Financial assets:<br />

Cash and cash equivalents 80,892 80,892 80,892 - - -<br />

Bank deposits with maturity > 1 year 8,000 8,000 - 8,000 - -<br />

CCC - short term deposits 98,243 100,090 100,090 - - -<br />

Debtors and other receivables 43,954 44,454 44,454 - - -<br />

Related party receivables 2,132 2,132 2,132 - - -<br />

Local authority stock 33,000 38,884 15,867 1,257 16,422 5,338<br />

Stocks and bonds 26,106 34,290 4,813 9,977 8,395 11,105<br />

Loans and advances 876 3,959 48 53 2,787 1,071<br />

Related party loans 188,110 350,861 21,037 17,542 65,283 246,999<br />

Net settled derivative assets 1,609 (1,100) 986 (595) (1,491) -<br />

Financial guarantee - 200 200 - - -<br />

482,922 662,662 270,519 36,234 91,396 264,513