Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Figure 6.23<br />

Share and value of local content in material inputs for main investor categories<br />

46%<br />

Percentage of local content<br />

44%<br />

42%<br />

40%<br />

38%<br />

36%<br />

34%<br />

1981-1990<br />

2001 and after<br />

FE<br />

1991-2000<br />

South<br />

Global<br />

WOE<br />

Local<br />

Regional<br />

L-TNC<br />

JV<br />

North<br />

1980 and before<br />

32%<br />

30%<br />

28%<br />

0<br />

S-TNC<br />

50 100 150 200 250 300 350 400 450 500 550 600 650 700 750<br />

Note: The bubble size indicates the number of companies in each group<br />

Total expenditures on locally-sourced<br />

materials of the respective group, in Millions of USD<br />

cent of local content and TNCs 43 per cent; in textile,<br />

FEs use 45 per cent of local content and TNCs only 26<br />

per cent; in chemicals production, FEs use 30 per cent of<br />

local content and TNCs 26 per cent; and in auto components<br />

and machinery manufacture, FEs use 37 per cent<br />

of local content and TNCs just 16 per cent.These findings<br />

are also compatible with the thesis that TNCs do not<br />

use as much local content as independent foreign ownermanaged<br />

firms (FEs) do, if not conclusive, because of the<br />

relatively small size of the samples.<br />

Figure 6.24<br />

Auto, Machinery & Equipm.<br />

Non-Metalic Mineral prods.<br />

Food, Beverages & Tobacco<br />

Distribution of manufacturing firms according to<br />

share of expenditures on local material and<br />

subcontracting in total sales<br />

Textile<br />

Paper & Paper prods.<br />

Basic Metals<br />

Chemical, Plastic & Rubber<br />

Publishing & Media<br />

Garment, Apparel & Leather<br />

Wood prods. & Furniture<br />

Construction<br />

31<br />

6<br />

8<br />

11<br />

10<br />

Local expenditures<br />

less than10% of total sales<br />

between 10% and 50% of total sales<br />

exceed 50% of total sales<br />

11<br />

51<br />

10<br />

14<br />

5<br />

20<br />

0% 20% 40% 60% 80% 100%<br />

Percentage of cases<br />

3<br />

40<br />

7<br />

10<br />

4<br />

14<br />

41<br />

2<br />

6<br />

5<br />

5<br />

4<br />

5<br />

3<br />

4<br />

19<br />

Note: Numbers in columns represent<br />

frequency for each category<br />

1<br />

2<br />

1<br />

7<br />

1<br />

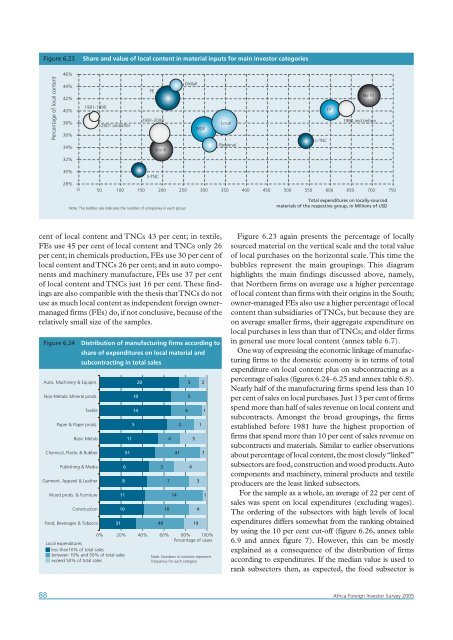

Figure 6.23 again presents the percentage of locally<br />

sourced material on the vertical scale and the total value<br />

of local purchases on the horizontal scale.This time the<br />

bubbles represent the main groupings. This diagram<br />

highlights the main findings discussed above, namely,<br />

that Northern firms on average use a higher percentage<br />

of local content than firms with their origins in the South;<br />

owner-managed FEs also use a higher percentage of local<br />

content than subsidiaries of TNCs, but because they are<br />

on average smaller firms, their aggregate expenditure on<br />

local purchases is less than that of TNCs; and older firms<br />

in general use more local content (annex table 6.7).<br />

One way of expressing the economic linkage of manufacturing<br />

firms to the domestic economy is in terms of total<br />

expenditure on local content plus on subcontracting as a<br />

percentage of sales (figures 6.24–6.25 and annex table 6.8).<br />

Nearly half of the manufacturing firms spend less than 10<br />

per cent of sales on local purchases. Just 13 per cent of firms<br />

spend more than half of sales revenue on local content and<br />

subcontracts. Amongst the broad groupings, the firms<br />

established before 1981 have the highest proportion of<br />

firms that spend more than 10 per cent of sales revenue on<br />

subcontracts and materials. Similar to earlier observations<br />

about percentage of local content, the most closely “linked”<br />

subsectors are food, construction and wood products.Auto<br />

components and machinery, mineral products and textile<br />

producers are the least linked subsectors.<br />

For the sample as a whole, an average of 22 per cent of<br />

sales was spent on local expenditures (excluding wages).<br />

The ordering of the subsectors with high levels of local<br />

expenditures differs somewhat from the ranking obtained<br />

by using the 10 per cent cut-off (figure 6.26, annex table<br />

6.9 and annex figure 7). However, this can be mostly<br />

explained as a consequence of the distribution of firms<br />

according to expenditures. If the median value is used to<br />

rank subsectors then, as expected, the food subsector is<br />

88 <strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>