Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

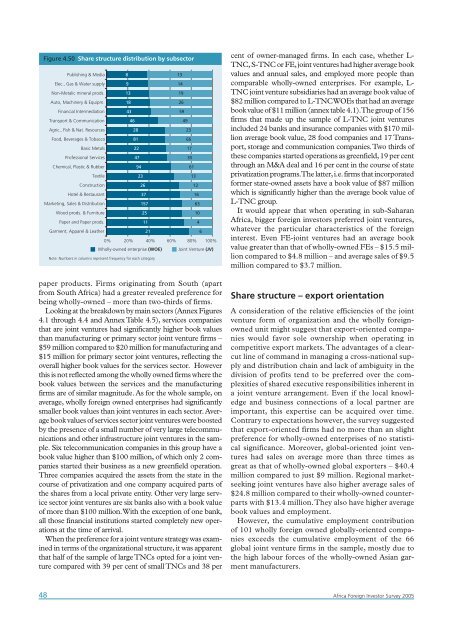

Figure 4.50 Share structure distribution by subsector<br />

Publishing & Media<br />

Elec., Gas & Water supply<br />

Non-Metalic mineral prods.<br />

Auto, Machinery & Equipm.<br />

Financial Intermediation<br />

Transport & Communication<br />

Agric., Fish & Nat. Resources<br />

Food, Beverages & Tobacco<br />

Basic Metals<br />

Professional Services<br />

Chemical, Plastic & Rubber<br />

Textile<br />

Construction<br />

Hotel & Restaurant<br />

Marketing, Sales & Distribution<br />

Wood prods. & Furniture<br />

Paper and Paper prods.<br />

Garment, Apparel & Leather<br />

8<br />

9<br />

13<br />

18<br />

43<br />

46<br />

paper products. Firms originating from South (apart<br />

from South <strong>Africa</strong>) had a greater revealed preference for<br />

being wholly-owned – more than two-thirds of firms.<br />

Looking at the breakdown by main sectors (Annex Figures<br />

4.1 through 4.4 and Annex Table 4.5), services companies<br />

that are joint ventures had significantly higher book values<br />

than manufacturing or primary sector joint venture firms –<br />

$59 million compared to $20 million for manufacturing and<br />

$15 million for primary sector joint ventures, reflecting the<br />

overall higher book values for the services sector. However<br />

this is not reflected among the wholly owned firms where the<br />

book values between the services and the manufacturing<br />

firms are of similar magnitude. As for the whole sample, on<br />

average, wholly foreign owned enterprises had significantly<br />

smaller book values than joint ventures in each sector. Average<br />

book values of services sector joint ventures were boosted<br />

by the presence of a small number of very large telecommunications<br />

and other infrastructure joint ventures in the sample.<br />

Six telecommunication companies in this group have a<br />

book value higher than $100 million, of which only 2 companies<br />

started their business as a new greenfield operation.<br />

Three companies acquired the assets from the state in the<br />

course of privatization and one company acquired parts of<br />

the shares from a local private entity. Other very large service<br />

sector joint ventures are six banks also with a book value<br />

of more than $100 million.With the exception of one bank,<br />

all those financial institutions started completely new operations<br />

at the time of arrival.<br />

When the preference for a joint venture strategy was examined<br />

in terms of the organizational structure, it was apparent<br />

that half of the sample of large TNCs opted for a joint venture<br />

compared with 39 per cent of small TNCs and 38 per<br />

28<br />

81<br />

22<br />

47<br />

94<br />

23<br />

26<br />

37<br />

157<br />

25<br />

11<br />

21<br />

0% 20% 40% 60% 80% 100%<br />

Wholly-owned enterprise (WOE)<br />

Note: Numbers in columns represent frequency for each category<br />

13<br />

14<br />

19<br />

26<br />

59<br />

49<br />

23<br />

66<br />

17<br />

35<br />

61<br />

13<br />

12<br />

16<br />

63<br />

10<br />

4<br />

6<br />

Joint Venture (JV)<br />

cent of owner-managed firms. In each case, whether L-<br />

TNC,S-TNC or FE,joint ventures had higher average book<br />

values and annual sales, and employed more people than<br />

comparable wholly-owned enterprises. For example, L-<br />

TNC joint venture subsidiaries had an average book value of<br />

$82 million compared to L-TNC WOEs that had an average<br />

book value of $11 million (annex table 4.1).The group of 156<br />

firms that made up the sample of L-TNC joint ventures<br />

included 24 banks and insurance companies with $170 million<br />

average book value, 28 food companies and 17 Transport,<br />

storage and communication companies.Two thirds of<br />

these companies started operations as greenfield,19 per cent<br />

through an M&A deal and 16 per cent in the course of state<br />

privatization programs.The latter,i.e.firms that incorporated<br />

former state-owned assets have a book value of $87 million<br />

which is significantly higher than the average book value of<br />

L-TNC group.<br />

It would appear that when operating in sub-Saharan<br />

<strong>Africa</strong>, bigger foreign investors preferred joint ventures,<br />

whatever the particular characteristics of the foreign<br />

interest. Even FE-joint ventures had an average book<br />

value greater than that of wholly-owned FEs – $15.5 million<br />

compared to $4.8 million – and average sales of $9.5<br />

million compared to $3.7 million.<br />

Share structure – export orientation<br />

A consideration of the relative efficiencies of the joint<br />

venture form of organization and the wholly foreignowned<br />

unit might suggest that export-oriented companies<br />

would favor sole ownership when operating in<br />

competitive export markets.The advantages of a clearcut<br />

line of command in managing a cross-national supply<br />

and distribution chain and lack of ambiguity in the<br />

division of profits tend to be preferred over the complexities<br />

of shared executive responsibilities inherent in<br />

a joint venture arrangement. Even if the local knowledge<br />

and business connections of a local partner are<br />

important, this expertise can be acquired over time.<br />

Contrary to expectations however, the survey suggested<br />

that export-oriented firms had no more than an slight<br />

preference for wholly-owned enterprises of no statistical<br />

significance. Moreover, global-oriented joint ventures<br />

had sales on average more than three times as<br />

great as that of wholly-owned global exporters – $40.4<br />

million compared to just $9 million. Regional marketseeking<br />

joint ventures have also higher average sales of<br />

$24.8 million compared to their wholly-owned counterparts<br />

with $13.4 million.They also have higher average<br />

book values and employment.<br />

However, the cumulative employment contribution<br />

of 101 wholly foreign owned globally-oriented companies<br />

exceeds the cumulative employment of the 66<br />

global joint venture firms in the sample, mostly due to<br />

the high labour forces of the wholly-owned Asian garment<br />

manufacturers.<br />

48 <strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>