Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

mean and median of the output per employee for the six<br />

investor type groups. The mean differences between<br />

group components are significant for four of them: organizational<br />

structure; North/South origin; main sectors<br />

and start-up period. Large TNCs’ output per employee<br />

is double that of S-TNCs which is about 75 per cent<br />

higher than that of FEs. North investors average $90,000<br />

sales per employee and South investors average $53,000.<br />

Services sector achieves output per employee double that<br />

of the manufacturers which is five-fold that of agro-business<br />

(primary). Firms established before 1981 on average<br />

achieved sales per employee last year of over<br />

$115,000 compared to between $40,000 and $70,000<br />

for the rest. Groups that exhibited slow sales growth rates<br />

seem to have the highest sales per employee. Evidently,<br />

different parameters were involved in driving high sales<br />

revenue per employee compared to those that determined<br />

whether a particular firm attained high sales<br />

growth. High labour productivity may be associated with<br />

stable, capital intensive, low growth market conditions<br />

where the firms command considerable market share and<br />

do not go after spectacular growth rates to compete.<br />

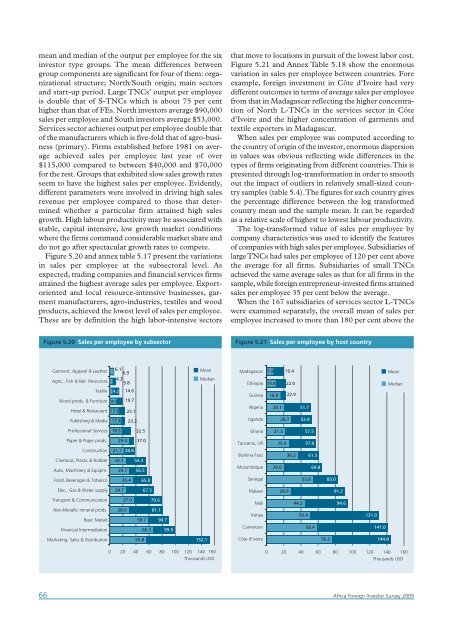

Figure 5.20 and annex table 5.17 present the variations<br />

in sales per employee at the subsectoral level. As<br />

expected, trading companies and financial services firms<br />

attained the highest average sales per employee. Exportoriented<br />

and local resource-intensive businesses, garment<br />

manufacturers, agro-industries, textiles and wood<br />

products, achieved the lowest level of sales per employee.<br />

These are by definition the high labor-intensive sectors<br />

that move to locations in pursuit of the lowest labor cost.<br />

Figure 5.21 and Annex Table 5.18 show the enormous<br />

variation in sales per employee between countries. Fore<br />

example, foreign investment in Côte d’Ivoire had very<br />

different outcomes in terms of average sales per employee<br />

from that in Madagascar reflecting the higher concentration<br />

of North L-TNCs in the services sector in Côte<br />

d’Ivoire and the higher concentration of garments and<br />

textile exporters in Madagascar.<br />

When sales per employee was computed according to<br />

the country of origin of the investor, enormous dispersion<br />

in values was obvious reflecting wide differences in the<br />

types of firms originating from different countries.This is<br />

presented through log-transformation in order to smooth<br />

out the impact of outliers in relatively small-sized country<br />

samples (table 5.4).The figures for each country gives<br />

the percentage difference between the log transformed<br />

country mean and the sample mean. It can be regarded<br />

as a relative scale of highest to lowest labour productivity.<br />

The log-transformed value of sales per employee by<br />

company characteristics was used to identify the features<br />

of companies with high sales per employee. Subsidiaries of<br />

large TNCs had sales per employee of 120 per cent above<br />

the average for all firms. Subsidiaries of small TNCs<br />

achieved the same average sales as that for all firms in the<br />

sample, while foreign entrepreneur-invested firms attained<br />

sales per employee 35 per cent below the average.<br />

When the 167 subsidiaries of services sector L-TNCs<br />

were examined separately, the overall mean of sales per<br />

employee increased to more than 180 per cent above the<br />

Figure 5.20 Sales per employee by subsector<br />

Figure 5.21 Sales per employee by host country<br />

Garment, Apparel & Leather<br />

6.1<br />

6.9<br />

Agric., Fish & Nat. Resources<br />

4.3<br />

9.8<br />

Textile 4.2 14.6<br />

Wood prods. & Furniture 10.5 19.7<br />

Hotel & Restaurant 13.3 23.1<br />

Mean<br />

Median<br />

Madagascar<br />

Ethiopia<br />

Guinea<br />

Nigeria<br />

7.9<br />

10.6<br />

16.0<br />

20.1<br />

19.4<br />

22.0<br />

22.9<br />

51.7<br />

Mean<br />

Median<br />

Publishing & Media<br />

17.4<br />

23.2<br />

Uganda<br />

28.7<br />

52.4<br />

Professional Services<br />

18.5<br />

32.5<br />

Ghana<br />

21.3<br />

57.5<br />

Paper & Paper prods.<br />

29.4<br />

37.0<br />

Tanzania, UR<br />

25.4<br />

57.9<br />

Construction<br />

Chemical, Plastic & Rubber<br />

Auto, Machinery & Equipm.<br />

21.7 38.8<br />

24.1 54.3<br />

29.7 56.5<br />

Burkina Faso<br />

Mozambique<br />

20.0<br />

36.2<br />

61.3<br />

64.8<br />

Food, Beverages & Tobacco<br />

35.4<br />

65.0<br />

Senegal<br />

53.8<br />

83.0<br />

Elec., Gas & Water supply<br />

24.7<br />

67.3<br />

Malawi<br />

28.0<br />

91.2<br />

Transport & Communication<br />

Non-Metallic mineral prods.<br />

Basic Metals<br />

28.9<br />

37.0<br />

58.7<br />

79.6<br />

81.1<br />

90.7<br />

Mali<br />

Kenya<br />

44.2<br />

50.4<br />

94.6<br />

131.0<br />

Financial Intermediation<br />

66.3<br />

99.9<br />

Cameroon<br />

58.4<br />

141.0<br />

Marketing, Sales & Distribution<br />

55.8<br />

152.1<br />

Côte d'Ivoire<br />

76.2<br />

144.8<br />

0 20 40 60 80 100 120 140 160<br />

Thousands USD<br />

0 20 40 60 80 100 120 140 160<br />

Thousands USD<br />

66<br />

<strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>