Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sales, old L-TNC, is among the lowest of all groups for<br />

both past and future sales growth. Only 78 S-TNCs<br />

established before 1991 are growing output at an even<br />

lower rate.<br />

The six subgroupings of L-TNCs, S-TNCs and FEs<br />

each split into North and South components is plotted<br />

in figure 5.17 (annex table 5.15).The much higher past<br />

and future growth rates for South L-TNCs over North<br />

L-TNCs; and South S-TNCs over North S-TNCs is<br />

very striking. However, North FEs have grown and<br />

expect to grow faster than South FEs. Another observation<br />

from this graph is that only in the case of L-<br />

TNCs does South differ appreciably from North in<br />

terms of future growth. For all other subgroupings, the<br />

value of expected future growth is between 16 and 25<br />

per cent, but South L-TNCs have a future growth rate<br />

of almost 50 per cent. Similarly, in terms of past growth<br />

rate, South S-TNCs stand out with over 30 per cent<br />

growth.<br />

Last year’s sales and overall<br />

performance of investments<br />

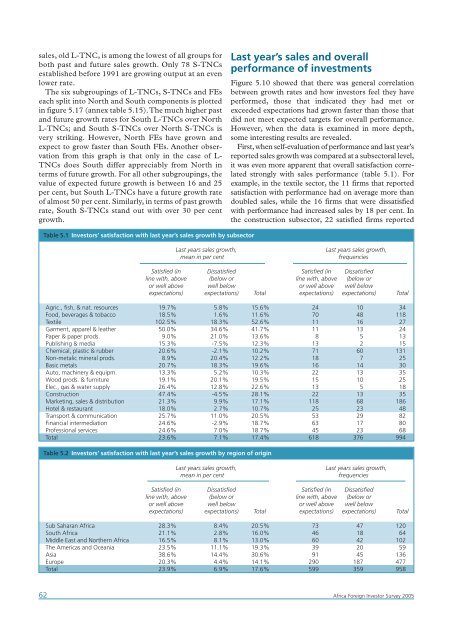

Figure 5.10 showed that there was general correlation<br />

between growth rates and how investors feel they have<br />

performed, those that indicated they had met or<br />

exceeded expectations had grown faster than those that<br />

did not meet expected targets for overall performance.<br />

However, when the data is examined in more depth,<br />

some interesting results are revealed.<br />

First, when self-evaluation of performance and last year’s<br />

reported sales growth was compared at a subsectoral level,<br />

it was even more apparent that overall satisfaction correlated<br />

strongly with sales performance (table 5.1). For<br />

example, in the textile sector, the 11 firms that reported<br />

satisfaction with performance had on average more than<br />

doubled sales, while the 16 firms that were dissatisfied<br />

with performance had increased sales by 18 per cent. In<br />

the construction subsector, 22 satisfied firms reported<br />

Table 5.1 <strong>Investor</strong>s’ satisfaction with last year’s sales growth by subsector<br />

Last years sales growth,<br />

mean in per cent<br />

Last years sales growth,<br />

frequencies<br />

Satisfied (in Dissatisfied Satisfied (in Dissatisfied<br />

line with, above (below or line with, above (below or<br />

or well above well below or well above well below<br />

expectations) expectations) Total expectations) expectations) Total<br />

Agric., fish, & nat. resources 19.7% 5.8% 15.6% 24 10 34<br />

Food, beverages & tobacco 18.5% 1.6% 11.6% 70 48 118<br />

Textile 102.5% 18.3% 52.6% 11 16 27<br />

Garment, apparel & leather 50.0% 34.6% 41.7% 11 13 24<br />

Paper & paper prods. 9.0% 21.0% 13.6% 8 5 13<br />

Publishing & media 15.3% -7.5% 12.3% 13 2 15<br />

Chemical, plastic & rubber 20.6% -2.1% 10.2% 71 60 131<br />

Non-metalic mineral prods. 8.9% 20.4% 12.2% 18 7 25<br />

Basic metals 20.7% 18.3% 19.6% 16 14 30<br />

Auto, machinery & equipm. 13.3% 5.2% 10.3% 22 13 35<br />

Wood prods. & furniture 19.1% 20.1% 19.5% 15 10 25<br />

Elec., gas & water supply 26.4% 12.8% 22.6% 13 5 18<br />

Construction 47.4% -4.5% 28.1% 22 13 35<br />

Marketing, sales & distribution 21.3% 9.9% 17.1% 118 68 186<br />

Hotel & restaurant 18.0% 2.7% 10.7% 25 23 48<br />

Transport & communication 25.7% 11.0% 20.5% 53 29 82<br />

Financial intermediation 24.6% -2.9% 18.7% 63 17 80<br />

Professional services 24.6% 7.0% 18.7% 45 23 68<br />

Total 23.6% 7.1% 17.4% 618 376 994<br />

Table 5.2 <strong>Investor</strong>s’ satisfaction with last year’s sales growth by region of origin<br />

Last years sales growth,<br />

mean in per cent<br />

Last years sales growth,<br />

frequencies<br />

Satisfied (in Dissatisfied Satisfied (in Dissatisfied<br />

line with, above (below or line with, above (below or<br />

or well above well below or well above well below<br />

expectations) expectations) Total expectations) expectations) Total<br />

Sub Saharan <strong>Africa</strong> 28.3% 8.4% 20.5% 73 47 120<br />

South <strong>Africa</strong> 21.1% 2.8% 16.0% 46 18 64<br />

Middle East and Northern <strong>Africa</strong> 16.5% 8.1% 13.0% 60 42 102<br />

The Americas and Oceania 23.5% 11.1% 19.3% 39 20 59<br />

Asia 38.6% 14.4% 30.6% 91 45 136<br />

Europe 20.3% 4.4% 14.1% 290 187 477<br />

Total 23.9% 6.9% 17.6% 599 359 958<br />

62<br />

<strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>