Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Madagascar and Ethiopia firms on average employed<br />

the most people. Overall, firms located in Burkina Faso,<br />

Guinea and Mozambique were significantly smaller<br />

than the survey average. Annex table 3.5 gives a composite<br />

ranking of average firm sizes referring to sales,<br />

book value and employment together.<br />

Figures 3.24 and annex table 3.4 give the size of firms<br />

for the 18 ISIC groups. According to total value of sales,<br />

firms in the food, beverage and tobacco sub-sector are<br />

the largest, and with the large number of companies in<br />

that sub sector as well, the sum is the highest.The next<br />

two largest sub-sectors by sales are in the service sector:<br />

transport and communication and marketing, sales,<br />

and distribution. In the manufacturing sector, chemicals,<br />

plastic and rubber sub sector is second to the food<br />

sub sector in overall sales. Looking at size in terms of<br />

number of workers (Fig. 3.24c) the manufacturing<br />

firms with the highest average employment are in the<br />

garments, apparel and leather sub-sector and textile sub<br />

sector. Construction and agriculture sub-sectors are the<br />

other two that consist of companies with large work<br />

forces.<br />

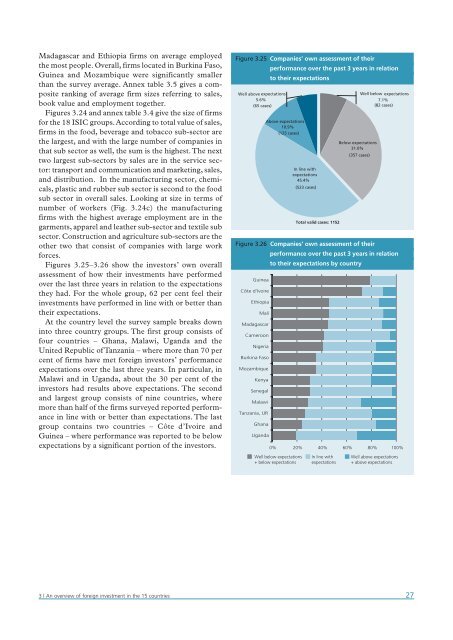

Figures 3.25–3.26 show the investors’ own overall<br />

assessment of how their investments have performed<br />

over the last three years in relation to the expectations<br />

they had. For the whole group, 62 per cent feel their<br />

investments have performed in line with or better than<br />

their expectations.<br />

At the country level the survey sample breaks down<br />

into three country groups. The first group consists of<br />

four countries – Ghana, Malawi, Uganda and the<br />

United Republic of Tanzania – where more than 70 per<br />

cent of firms have met foreign investors’ performance<br />

expectations over the last three years. In particular, in<br />

Malawi and in Uganda, about the 30 per cent of the<br />

investors had results above expectations. The second<br />

and largest group consists of nine countries, where<br />

more than half of the firms surveyed reported performance<br />

in line with or better than expectations. The last<br />

group contains two countries – Côte d’Ivoire and<br />

Guinea – where performance was reported to be below<br />

expectations by a significant portion of the investors.<br />

Figure 3.25 Companies’ own assessment of their<br />

performance over the past 3 years in relation<br />

to their expectations<br />

Well above expectations<br />

5.6%<br />

(65 cases)<br />

Above expectations<br />

10.9%<br />

(125 cases)<br />

In line with<br />

expectations<br />

45.4%<br />

(523 cases)<br />

Total valid cases: 1152<br />

Below expectations<br />

31.0%<br />

Well below expectations<br />

7.1%<br />

(82 cases)<br />

(357 cases)<br />

Figure 3.26 Companies’ own assessment of their<br />

performance over the past 3 years in relation<br />

to their expectations by country<br />

Guinea<br />

Côte d'Ivoire<br />

Ethiopia<br />

Mali<br />

Madagascar<br />

Cameroon<br />

Nigeria<br />

Burkina Faso<br />

Mozambique<br />

Kenya<br />

Senegal<br />

Malawi<br />

Tanzania, UR<br />

Ghana<br />

Uganda<br />

0% 20% 40% 60% 80% 100%<br />

Well below expectations<br />

+ below expectations<br />

In line with<br />

expectations<br />

Well above expectations<br />

+ above expectations<br />

3 | An overview of foreign investment in the 15 countries<br />

27