Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5. Analysis of performance<br />

This chapter analyses investors’ self assessment of the<br />

performance in their investments and discusses these<br />

ratings in the light of growth rates of their operations. It<br />

goes on to analyse future sales growth forecasts, capital<br />

intensity and labour productivity.<br />

<strong>Survey</strong> participants were asked to rate the overall performance<br />

of their operations during the past three years<br />

as either well below expectations; below expectations; inline<br />

with expectations; above expectations or well above<br />

expectations. They were also asked to report the percentage<br />

growth of sales over the previous fiscal year and<br />

forecast the annual increase in sales for the next three<br />

years. This chapter provides an analysis of this selfassessment<br />

and the past and predicted future sales<br />

growth rates. In particular, the performance selfappraisal<br />

will be looked at in the framework of sales<br />

growth as reported last year.<br />

In the 2003 survey it was observed that some classes<br />

of investors, for example those in the garments and textile<br />

sectors had very high growth rates and yet assessed<br />

their overall performance as below expectations<br />

(UNIDO, 2003). The question left unanswered was<br />

whether these investors had very high expectations that<br />

left them unsatisfied with even exceptionally high growth<br />

rates or whether they were recent investors just beginning<br />

to expand into recently installed capacity, thus<br />

growing from a very low output base.<br />

The chapter will go further into the analysis of growth<br />

to see which investor groups have the strongest growth<br />

rates and which expect to grow the fastest over the next<br />

three years.This analysis will be concluded with discussions<br />

about the relative efficiencies of the different<br />

investor categories.<br />

Evaluation of past performance<br />

The growing evidence that foreign investment flows into<br />

sub-Saharan <strong>Africa</strong> are improving, as presented in chapters<br />

3 and 4, is further supported through trends in perceptions<br />

of enterprise-level performance. In each of the<br />

UNIDO surveys of 2001, 2003 and <strong>2005</strong>, participants<br />

were asked to evaluate their company’s performance over<br />

the previous three years against their expectations.<br />

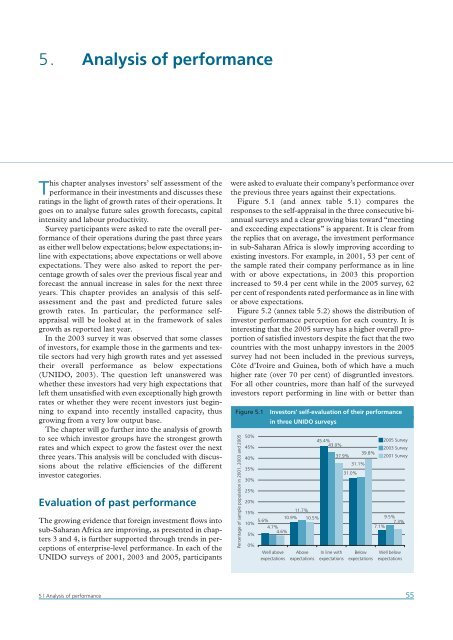

Figure 5.1 (and annex table 5.1) compares the<br />

responses to the self-appraisal in the three consecutive biannual<br />

surveys and a clear growing bias toward “meeting<br />

and exceeding expectations” is apparent. It is clear from<br />

the replies that on average, the investment performance<br />

in sub-Saharan <strong>Africa</strong> is slowly improving according to<br />

existing investors. For example, in 2001, 53 per cent of<br />

the sample rated their company performance as in line<br />

with or above expectations, in 2003 this proportion<br />

increased to 59.4 per cent while in the <strong>2005</strong> survey, 62<br />

per cent of respondents rated performance as in line with<br />

or above expectations.<br />

Figure 5.2 (annex table 5.2) shows the distribution of<br />

investor performance perception for each country. It is<br />

interesting that the <strong>2005</strong> survey has a higher overall proportion<br />

of satisfied investors despite the fact that the two<br />

countries with the most unhappy investors in the <strong>2005</strong><br />

survey had not been included in the previous surveys,<br />

Côte d’Ivoire and Guinea, both of which have a much<br />

higher rate (over 70 per cent) of disgruntled investors.<br />

For all other countries, more than half of the surveyed<br />

investors report performing in line with or better than<br />

Figure 5.1<br />

Percentage of sample population in 2001, 2003 and <strong>2005</strong><br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

<strong>Investor</strong>s' self-evaluation of their performance<br />

in three UNIDO surveys<br />

15%<br />

11.7%<br />

10%<br />

5.6%<br />

10.9% 10.5%<br />

4.7%<br />

5%<br />

4.6%<br />

0%<br />

Well above<br />

expectations<br />

Above<br />

expectations<br />

45.4%<br />

43.0%<br />

37.9%<br />

In line with<br />

expectations<br />

31.0%<br />

31.1%<br />

39.8%<br />

Below<br />

expectations<br />

<strong>2005</strong> <strong>Survey</strong><br />

2003 <strong>Survey</strong><br />

2001 <strong>Survey</strong><br />

9.5%<br />

7.3%<br />

7.1%<br />

Well below<br />

expectations<br />

5 | Analysis of performance<br />

55