Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Figure 4.15 Distribution of investor origin by subsector<br />

Garment, Apparel & Leather<br />

Chemical, Plastic & Rubber<br />

Paper and Paper prods.<br />

Auto, Machinery & Equipm .<br />

Financial Intermediation<br />

Basic Metals<br />

Textile<br />

Wood products & Furniture<br />

Non-Metalic mineral prods.<br />

Marketing, Sales & Distribution<br />

Publishing and Media<br />

Transport & Communication<br />

Food, Beverages & Tobacco<br />

Hotel & Restaurant<br />

Agric., Fish & Nat. Resources<br />

Professional Services<br />

Construction<br />

Elec., Gas & Water supply<br />

121<br />

Note: Numbers in columns represent frequency for each category<br />

5<br />

52<br />

6<br />

19<br />

50<br />

18<br />

18<br />

Business origin – organizational<br />

structure<br />

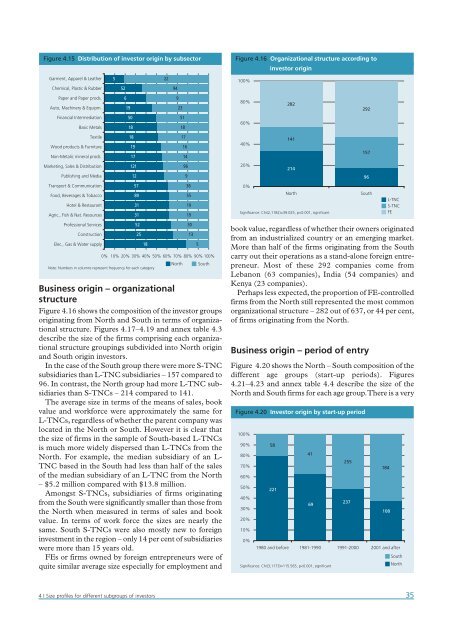

Figure 4.16 shows the composition of the investor groups<br />

originating from North and South in terms of organizational<br />

structure. Figures 4.17–4.19 and annex table 4.3<br />

describe the size of the firms comprising each organizational<br />

structure groupings subdivided into North origin<br />

and South origin investors.<br />

In the case of the South group there were more S-TNC<br />

subsidiaries than L-TNC subsidiaries – 157 compared to<br />

96. In contrast, the North group had more L-TNC subsidiaries<br />

than S-TNCs – 214 compared to 141.<br />

The average size in terms of the means of sales, book<br />

value and workforce were approximately the same for<br />

L-TNCs, regardless of whether the parent company was<br />

located in the North or South. However it is clear that<br />

the size of firms in the sample of South-based L-TNCs<br />

is much more widely dispersed than L-TNCs from the<br />

North. For example, the median subsidiary of an L-<br />

TNC based in the South had less than half of the sales<br />

of the median subsidiary of an L-TNC from the North<br />

– $5.2 million compared with $13.8 million.<br />

Amongst S-TNCs, subsidiaries of firms originating<br />

from the South were significantly smaller than those from<br />

the North when measured in terms of sales and book<br />

value. In terms of work force the sizes are nearly the<br />

same. South S-TNCs were also mostly new to foreign<br />

investment in the region – only 14 per cent of subsidiaries<br />

were more than 15 years old.<br />

FEs or firms owned by foreign entrepreneurs were of<br />

quite similar average size especially for employment and<br />

19<br />

17<br />

12<br />

57<br />

89<br />

31<br />

31<br />

52<br />

25<br />

18<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

22<br />

94<br />

9<br />

23<br />

51<br />

North<br />

18<br />

17<br />

16<br />

14<br />

96<br />

9<br />

36<br />

55<br />

19<br />

19<br />

30<br />

13<br />

5<br />

South<br />

Figure 4.16 Organizational structure according to<br />

investor origin<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

282<br />

141<br />

214<br />

North<br />

Significance: Chi(2,1182)=39.025, p