Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

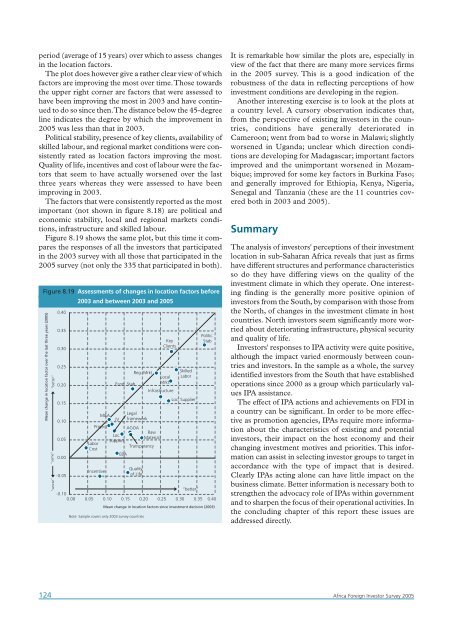

period (average of 15 years) over which to assess changes<br />

in the location factors.<br />

The plot does however give a rather clear view of which<br />

factors are improving the most over time.Those towards<br />

the upper right corner are factors that were assessed to<br />

have been improving the most in 2003 and have continued<br />

to do so since then.The distance below the 45-degree<br />

line indicates the degree by which the improvement in<br />

<strong>2005</strong> was less than that in 2003.<br />

Political stability, presence of key clients, availability of<br />

skilled labour, and regional market conditions were consistently<br />

rated as location factors improving the most.<br />

Quality of life, incentives and cost of labour were the factors<br />

that seem to have actually worsened over the last<br />

three years whereas they were assessed to have been<br />

improving in 2003.<br />

The factors that were consistently reported as the most<br />

important (not shown in figure 8.18) are political and<br />

economic stability, local and regional markets conditions,<br />

infrastructure and skilled labour.<br />

Figure 8.19 shows the same plot, but this time it compares<br />

the responses of all the investors that participated<br />

in the 2003 survey with all those that participated in the<br />

<strong>2005</strong> survey (not only the 335 that participated in both).<br />

Figure 8.19 Assessments of changes in location factors before<br />

2003 and between 2003 and <strong>2005</strong><br />

Mean change in location factor over the last three years (<strong>2005</strong>)<br />

“better”<br />

“worse” “same”<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

0.15<br />

0.10<br />

0.05<br />

0.00<br />

-0.05<br />

Labor<br />

Cost<br />

M&A<br />

Project<br />

Incentive<br />

Reg. Mrkt<br />

Local<br />

Econ. Stab.<br />

Mrkt.<br />

Infrastructure<br />

JV<br />

Loc.<br />

Support<br />

EBA<br />

Legal<br />

framework<br />

AGOA<br />

Transparancy<br />

Quality<br />

of Life<br />

Raw<br />

Material<br />

Key<br />

Clients<br />

Skilled<br />

Labor<br />

Loc. Supplier<br />

Politic.<br />

Stab<br />

“better”<br />

-0.10<br />

0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40<br />

Mean change in location factors since investment decision (2003)<br />

Note: Sample covers only 2003 survey countries<br />

It is remarkable how similar the plots are, especially in<br />

view of the fact that there are many more services firms<br />

in the <strong>2005</strong> survey. This is a good indication of the<br />

robustness of the data in reflecting perceptions of how<br />

investment conditions are developing in the region.<br />

Another interesting exercise is to look at the plots at<br />

a country level. A cursory observation indicates that,<br />

from the perspective of existing investors in the countries,<br />

conditions have generally deteriorated in<br />

Cameroon; went from bad to worse in Malawi; slightly<br />

worsened in Uganda; unclear which direction conditions<br />

are developing for Madagascar; important factors<br />

improved and the unimportant worsened in Mozambique;<br />

improved for some key factors in Burkina Faso;<br />

and generally improved for Ethiopia, Kenya, Nigeria,<br />

Senegal and Tanzania (these are the 11 countries covered<br />

both in 2003 and <strong>2005</strong>).<br />

Summary<br />

The analysis of investors' perceptions of their investment<br />

location in sub-Saharan <strong>Africa</strong> reveals that just as firms<br />

have different structures and performance characteristics<br />

so do they have differing views on the quality of the<br />

investment climate in which they operate. One interesting<br />

finding is the generally more positive opinion of<br />

investors from the South, by comparison with those from<br />

the North, of changes in the investment climate in host<br />

countries. North investors seem significantly more worried<br />

about deteriorating infrastructure, physical security<br />

and quality of life.<br />

<strong>Investor</strong>s' responses to IPA activity were quite positive,<br />

although the impact varied enormously between countries<br />

and investors. In the sample as a whole, the survey<br />

identified investors from the South that have established<br />

operations since 2000 as a group which particularly values<br />

IPA assistance.<br />

The effect of IPA actions and achievements on FDI in<br />

a country can be significant. In order to be more effective<br />

as promotion agencies, IPAs require more information<br />

about the characteristics of existing and potential<br />

investors, their impact on the host economy and their<br />

changing investment motives and priorities. This information<br />

can assist in selecting investor groups to target in<br />

accordance with the type of impact that is desired.<br />

Clearly IPAs acting alone can have little impact on the<br />

business climate. Better information is necessary both to<br />

strengthen the advocacy role of IPAs within government<br />

and to sharpen the focus of their operational activities. In<br />

the concluding chapter of this report these issues are<br />

addressed directly.<br />

124 <strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>