Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

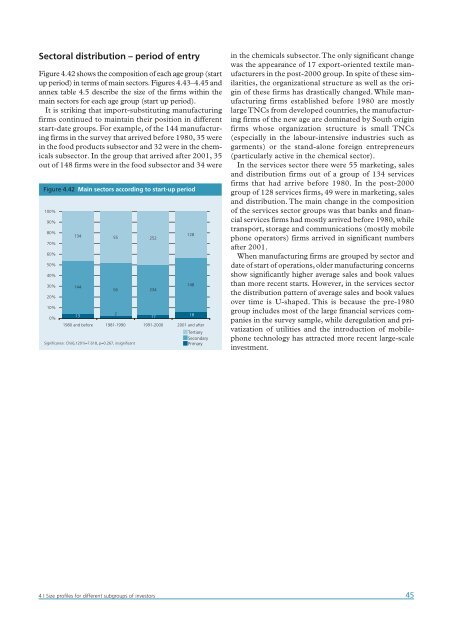

Sectoral distribution – period of entry<br />

Figure 4.42 shows the composition of each age group (start<br />

up period) in terms of main sectors. Figures 4.43–4.45 and<br />

annex table 4.5 describe the size of the firms within the<br />

main sectors for each age group (start up period).<br />

It is striking that import-substituting manufacturing<br />

firms continued to maintain their position in different<br />

start-date groups. For example, of the 144 manufacturing<br />

firms in the survey that arrived before 1980, 35 were<br />

in the food products subsector and 32 were in the chemicals<br />

subsector. In the group that arrived after 2001, 35<br />

out of 148 firms were in the food subsector and 34 were<br />

Figure 4.42 Main sectors according to start-up period<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

134 55 252<br />

144<br />

13<br />

56 234<br />

2<br />

1980 and before 1981-1990 1991-2000 2001 and after<br />

Significance: Chi(6,1201)=7.618, p=0.267, insignificant<br />

17<br />

128<br />

148<br />

18<br />

Tertiary<br />

Secondary<br />

Primary<br />

in the chemicals subsector.The only significant change<br />

was the appearance of 17 export-oriented textile manufacturers<br />

in the post-2000 group. In spite of these similarities,<br />

the organizational structure as well as the origin<br />

of these firms has drastically changed. While manufacturing<br />

firms established before 1980 are mostly<br />

large TNCs from developed countries, the manufacturing<br />

firms of the new age are dominated by South origin<br />

firms whose organization structure is small TNCs<br />

(especially in the labour-intensive industries such as<br />

garments) or the stand-alone foreign entrepreneurs<br />

(particularly active in the chemical sector).<br />

In the services sector there were 55 marketing, sales<br />

and distribution firms out of a group of 134 services<br />

firms that had arrive before 1980. In the post-2000<br />

group of 128 services firms, 49 were in marketing, sales<br />

and distribution. The main change in the composition<br />

of the services sector groups was that banks and financial<br />

services firms had mostly arrived before 1980, while<br />

transport, storage and communications (mostly mobile<br />

phone operators) firms arrived in significant numbers<br />

after 2001.<br />

When manufacturing firms are grouped by sector and<br />

date of start of operations, older manufacturing concerns<br />

show significantly higher average sales and book values<br />

than more recent starts. However, in the services sector<br />

the distribution pattern of average sales and book values<br />

over time is U-shaped. This is because the pre-1980<br />

group includes most of the large financial services companies<br />

in the survey sample, while deregulation and privatization<br />

of utilities and the introduction of mobilephone<br />

technology has attracted more recent large-scale<br />

investment.<br />

4 | Size profiles for different subgroups of investors<br />

45