Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Africa Foreign Investor Survey 2005 - unido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

taking advantage of the opening up of economies that<br />

were previously closed to foreign investors and/or were<br />

affected by severe political instability. Others seem to be<br />

responding to the establishment of freer regional trading<br />

links, for example, the resurrection of the East <strong>Africa</strong>n<br />

Community offering easier access to member countries.<br />

Uganda and the United Republic of Tanzania appear to<br />

be particular beneficiaries. Many of the new investors<br />

originate from Kenya. Mozambique also seems to be<br />

benefiting from a catch-up process, attracting regional<br />

market seekers from Portugal and South <strong>Africa</strong>.<br />

The appearance of this new generation of regional market<br />

seeking investors suggests that it pays off for governments<br />

to reduce the risk premium for investors through<br />

improving the investment climate, and co-operating with<br />

neighbouring countries to reduce regional trade barriers.<br />

The UNIDO survey indicates that foreign entrepreneurs<br />

from around the world, including from Sub-Saharan<br />

<strong>Africa</strong> itself, respond to these opportunities.<br />

5. The fifth group of firms contains the subsidiaries<br />

of small TNCs established after 1990 to service the local<br />

market. More than forty percent originate from SSA or<br />

South <strong>Africa</strong>. Over two-thirds operate in the services sector.These<br />

firms are the second most capital intensive of<br />

the six groups and, as a reflection of this characteristic,<br />

employ the highest proportion of graduates on the payroll.<br />

However the average S-TNC subsidiary is small,<br />

employing less than 130 people.<br />

Sales achieved last year per dollar of capital invested<br />

were comparable to those of post-1990 local market-oriented<br />

L-TNC subsidiaries (Group Three) and were<br />

above the average for the whole sample.The future looks<br />

promising for this group. All relevant future growth indicators<br />

i.e. future sales, employment and investment<br />

growth are above or in keeping with the growth rates of<br />

the whole sample.<br />

6. The last group consists of foreign-owned entrepreneurial<br />

firms (FEs) without formal links to a ‘parent’.<br />

From the UNIDO survey, it would seem to be a form of<br />

enterprise governance that is ubiquitous and becoming<br />

increasingly popular in Sub-Saharan <strong>Africa</strong>, if under<br />

researched and largely ignored by policy makers.<br />

Although FEs are not controlled by a parent company<br />

through a formal governance structure, half of FEs has<br />

associated operations in other countries. Of these associated<br />

firms, some sixty percent are located exclusively in<br />

<strong>Africa</strong> and a quarter of foreign owners manage different<br />

lines of business outside the region. Eighty percent of<br />

owners from SSA or MENA operate exclusively in <strong>Africa</strong>.<br />

Half of the post-1990 FEs operate in the manufacturing<br />

sector, are small in size and operate in labour intensive sub<br />

sectors like chemicals, food and beverages and wood.<br />

Those FEs in the group operating in the services sector are<br />

about the same size as manufacturers, employing on average<br />

around a hundred people. More than forty percent of<br />

these services FEs operate in marketing, sales and distribution<br />

and a fifth provide a variety of professional services.<br />

The most noteworthy feature of FEs from the South,<br />

whether the firms are manufacturers or services<br />

providers, is the high forecast investment rate per dollar<br />

of sales; and this is a good predictor of future sales performance.<br />

FEs from the South, regardless of whether<br />

they are grouped according to their date of establishment,<br />

market orientation or sector, are forecasting invest-<br />

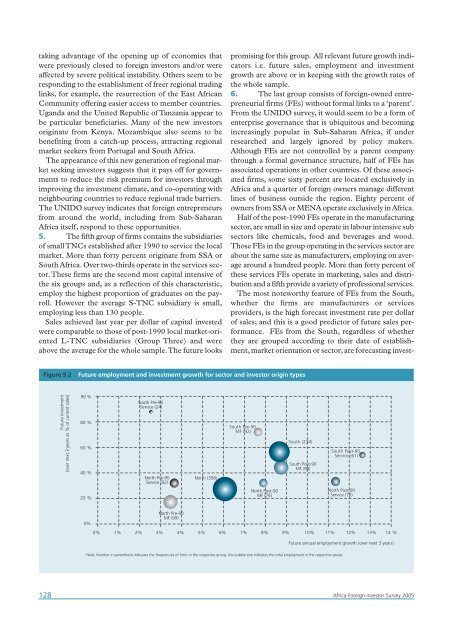

Figure 9.2<br />

Future employment and investment growth for sector and investor origin types<br />

Future investment<br />

(over next 3 years as % of current sales)<br />

90 %<br />

80 %<br />

60 %<br />

40 %<br />

20 %<br />

South Pre-90<br />

Service (24)<br />

North Pre-90<br />

Service (92)<br />

North (358)<br />

South Pre-90<br />

MF (42)<br />

North Post-90<br />

MF (76)<br />

South (234)<br />

South Post-90<br />

MF (98)<br />

South Post-90<br />

Service (61)<br />

North Post-90<br />

Service (70)<br />

0%<br />

North Pre-90<br />

MF (99)<br />

0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14 %<br />

Future annual employment growth (over next 3 years)<br />

Note: Number in parenthesis indicates the frequencies of firms in the respective group, the bubble size indicates the total employment in the respective group<br />

128 <strong>Africa</strong> <strong>Foreign</strong> <strong>Investor</strong> <strong>Survey</strong> <strong>2005</strong>