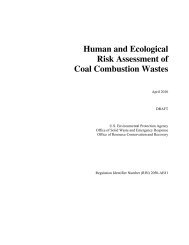

Exhibit 4I Adjustment of Dry Conversion Cost Estimate to Account <strong>for</strong> Utility Industry's Voluntary Impoundment Phase-Out Trend A1 A2 A3 A4 B1 B2 B3 B4 A. Cost of Dry Conversion Trend Without CCR Rule B. Dry Conversion Cost if Mandated by CCR Rule Incremental added Incremental added cost year-by-year ---- Mandatory cost year-by-year ---- Projected Year-by-year regression trendline Regression trendline year-by-year mandatory Mandatory trendline RIA 50-year End Regression trendline incremental dry conversion dry conversion Mandatory wet incremental dry conversion dry conversion year period of of wet disposal phaseout conversion to dry cost projection cumulative cost phaseout within conversion to dry cost projection cumulative cost count analysis year (million tons/year) (million tons/year) without CCR rule without CCR rule 5-years of rule (million tons/year) with CCR rule with CCR rule 1 2005 22.5 Base year Base year Base year 22.5 Base year Base year Base year 2 2006 22.2 0.3 $22,122,377 $22,122,377 22.2 0.3 $22,122,377 $22,122,377 3 2007 21.9 0.3 $22,122,377 $44,244,754 21.9 0.3 $22,122,377 $44,244,754 4 2008 21.7 0.3 $22,122,377 $66,367,131 21.7 0.3 $22,122,377 $66,367,131 5 2009 21.4 0.3 $22,122,377 $88,489,508 21.4 0.3 $22,122,377 $88,489,508 6 2010 21.1 0.3 $22,122,377 $110,611,885 21.1 0.3 $22,122,377 $110,611,885 7 2011 20.8 0.3 $22,122,377 $132,734,262 20.8 0.3 $22,122,377 $132,734,262 8 1 2012 20.5 0.3 $22,122,377 $154,856,640 20.5 0.3 $22,122,377 $154,856,640 9 2 2013 20.2 0.3 $22,122,377 $176,979,017 20.2 0.3 $22,122,377 $176,979,017 10 3 2014 19.9 0.3 $22,122,377 $199,101,394 19.9 4.0 $298,704,663 $475,683,680 11 4 2015 19.6 0.3 $22,122,377 $221,223,771 19.6 4.0 $298,704,663 $774,388,344 12 5 2016 19.3 0.3 $22,122,377 $243,346,148 19.3 4.0 $298,704,663 $1,073,093,007 13 6 2017 19.0 0.3 $22,122,377 $265,468,525 19.0 4.0 $298,704,663 $1,371,797,671 14 7 2018 18.7 0.3 $22,122,377 $287,590,902 18.7 4.0 $298,704,663 $1,670,502,334 15 8 2019 18.4 0.3 $22,122,377 $309,713,279 0 0 $0 $1,670,502,334 16 9 2020 18.1 0.3 $22,122,377 $331,835,656 0 0 $0 $1,670,502,334 17 10 2021 17.8 0.3 $22,122,377 $353,958,033 0 0 $0 $1,670,502,334 18 11 2022 17.5 0.3 $22,122,377 $376,080,410 0 0 $0 $1,670,502,334 19 12 2023 17.2 0.3 $22,122,377 $398,202,787 0 0 $0 $1,670,502,334 20 13 2024 16.9 0.3 $22,122,377 $420,325,164 0 0 $0 $1,670,502,334 21 14 2025 16.6 0.3 $22,122,377 $442,447,541 0 0 $0 $1,670,502,334 22 15 2026 16.4 0.3 $22,122,377 $464,569,919 0 0 $0 $1,670,502,334 23 16 2027 16.1 0.3 $22,122,377 $486,692,296 0 0 $0 $1,670,502,334 24 17 2028 15.8 0.3 $22,122,377 $508,814,673 0 0 $0 $1,670,502,334 25 18 2029 15.5 0.3 $22,122,377 $530,937,050 0 0 $0 $1,670,502,334 26 19 2030 15.2 0.3 $22,122,377 $553,059,427 0 0 $0 $1,670,502,334 27 20 2031 14.9 0.3 $22,122,377 $575,181,804 0 0 $0 $1,670,502,334 28 21 2032 14.6 0.3 $22,122,377 $597,304,181 0 0 $0 $1,670,502,334 29 22 2033 14.3 0.3 $22,122,377 $619,426,558 0 0 $0 $1,670,502,334 30 23 2034 14.0 0.3 $22,122,377 $641,548,935 0 0 $0 $1,670,502,334 31 24 2035 13.7 0.3 $22,122,377 $663,671,312 0 0 $0 $1,670,502,334 32 25 2036 13.4 0.3 $22,122,377 $685,793,689 0 0 $0 $1,670,502,334 33 26 2037 13.1 0.3 $22,122,377 $707,916,066 0 0 $0 $1,670,502,334 34 27 2038 12.8 0.3 $22,122,377 $730,038,443 0 0 $0 $1,670,502,334 35 28 2039 12.5 0.3 $22,122,377 $752,160,821 0 0 $0 $1,670,502,334 36 29 2040 12.2 0.3 $22,122,377 $774,283,198 0 0 $0 $1,670,502,334 37 30 2041 11.9 0.3 $22,122,377 $796,405,575 0 0 $0 $1,670,502,334 38 31 2042 11.6 0.3 $22,122,377 $818,527,952 0 0 $0 $1,670,502,334 39 32 2043 11.3 0.3 $22,122,377 $840,650,329 0 0 $0 $1,670,502,334 40 33 2044 11.0 0.3 $22,122,377 $862,772,706 0 0 $0 $1,670,502,334 41 34 2045 10.8 0.3 $22,122,377 $884,895,083 0 0 $0 $1,670,502,334 42 35 2046 10.5 0.3 $22,122,377 $907,017,460 0 0 $0 $1,670,502,334 43 36 2047 10.2 0.3 $22,122,377 $929,139,837 0 0 $0 $1,670,502,334 44 37 2048 9.9 0.3 $22,122,377 $951,262,214 0 0 $0 $1,670,502,334 45 38 2049 9.6 0.3 $22,122,377 $973,384,591 0 0 $0 $1,670,502,334 46 39 2050 9.3 0.3 $22,122,377 $995,506,968 0 0 $0 $1,670,502,334 47 40 2051 9.0 0.3 $22,122,377 $1,017,629,345 0 0 $0 $1,670,502,334 48 41 2052 8.7 0.3 $22,122,377 $1,039,751,722 0 0 $0 $1,670,502,334 49 42 2053 8.4 0.3 $22,122,377 $1,061,874,100 0 0 $0 $1,670,502,334 50 43 2054 8.1 0.3 $22,122,377 $1,083,996,477 0 0 $0 $1,670,502,334 51 44 2055 7.8 0.3 $22,122,377 $1,106,118,854 0 0 $0 $1,670,502,334 52 45 2056 7.5 0.3 $22,122,377 $1,128,241,231 0 0 $0 $1,670,502,334 53 46 2057 7.2 0.3 $22,122,377 $1,150,363,608 0 0 $0 $1,670,502,334 54 47 2058 6.9 0.3 $22,122,377 $1,172,485,985 0 0 $0 $1,670,502,334 55 48 2059 6.6 0.3 $22,122,377 $1,194,608,362 0 0 $0 $1,670,502,334 56 49 2060 6.3 0.3 $22,122,377 $1,216,730,739 0 0 $0 $1,670,502,334 57 50 2061 6.0 0.3 $22,122,377 $1,238,853,116 0 0 $0 $1,670,502,334 Summary Relative to 2005 Column total = 16.5 $1,238,853,116 $35,307,313,810 22.2 $1,670,502,334 $77,993,470,971 (56 years after base year) Average annual = $630,487,747 $1,392,740,553 Present value (PV) = $4,321,186,852 $12,375,281,254 Annualized PV value = $309,483,860 $886,318,954 Summary Relative to 2010 Column total = 15.3 $1,150,363,608 $35,086,090,039 21.1 $1,582,012,826 $77,772,247,201 (52 years after update) Average annual = $674,732,501 $1,495,620,138 Present value (PV) = $5,426,935,463 $15,984,210,270 Annualized PV value = $391,493,777 $1,153,085,179 Summary Relative to 2012 Column total = 14.7 $1,106,118,854 $34,842,743,891 20.5 $1,537,768,072 $77,528,901,053 (50 years same as RIA) Average annual = $696,854,878 $1,550,578,021 Present value (PV) = $5,962,000,000 $18,049,000,000 Annualized PV value = $432,005,623 $1,307,827,824 Discount rate = 7% Added Cost <strong>for</strong> Conversion to Dry Disposal Under the CCR Proposed Rule Compared to Conversion Trend Without Rule: Present value (PV) = $12,087,000,000 Annualized PV value = $875,822,201 Percent reduction compared to October 2009 draft RIA dry conversion cost estimate: October 2009 draft RIA cost estimate = $23,200,000,000 Reduction in cost estimate compared to RIA = -48% 98

As summarized below in comparison to the initial cost estimate, the updated conversion cost is the difference in the step-1 cost to the electric utility industry <strong>for</strong> continuation of the phase-out trend without the CCR rule, compared to the step-2 cost <strong>for</strong> mandatory phase-out with the rule. Dry conversion cost: Initial cost estimate Updated cost estimate Average annualized cost $1.676 billion/year $0.876 billion/year (48% reduction) Present value (PV) cost $23.2 billion PV $12.1 billion PV (48% reduction) <strong>The</strong> updated cost is also presented below after integrating the updated dry conversion cost back into the overall cost of the CCR proposed rule which contains two other cost categories as estimated <strong>for</strong> the Subtitle C option (i.e., $491 million/year <strong>for</strong> engineering control costs + $107 million/year <strong>for</strong> ancillary regulatory costs). Rule total cost: (i.e., updated dry conversion cost + engineering control cost + ancillary cost) Initial cost estimate Updated estimate Average annualized cost $2.27 billion/year $1.47 billion/year (35% reduction) Present value (PV) cost $31.4 billion PV $20.3 billion PV (35% reduction) As shown above, the composite effect of the two cost update factors is they reduce the initial dry conversion cost estimate by 48%, and reduce by 35% the overall compliance cost estimate (i.e., dry conversion cost plus engineering control costs plus ancillary costs). o Factors Which May Accelerate the CCR Impoundment Phase-Out Trend For the reasons described above, it is clear that there is a significant past and continuing trend toward CCR impoundment phase-out at electric utility plants, regardless of the CCR rule, and that this trend will continue. Described below, EPA has identified seven factors which corroborate continuation of this impoundment phase-out trend, some of which have been quantified in the cost adjustment: 1. Industry conversions to dry CCR disposal: This factor corroborates the phase-out trend applied in the cost update. As discussed above, there is a documented over two-decade long trend 1996 to 2019 away from wet CCR disposal in the electric utility industry. This trend consists of two parts: (a) the 1996-2005 historical data period, plus (b) the more recent (2009) announcements of actual conversions which occurred between 2005 and 2009, and planned conversions to occur within the next 10 years (i.e., by 2019). According to one company (United Conveyor Corporation) who has been supplying dry disposal equipment and conversion services to the electric utility industry, the main historical drivers <strong>for</strong> this voluntary shift have been (1) generating dry fly ash as a saleable coproduct to other industries <strong>for</strong> beneficial uses, and (2) decreasing the volume of fly ash going to impoundments to provide greater capacity <strong>for</strong> bottom ash. Since then, concern over possible future environmental release liabilities associated with CCR impoundments, and pressure from individual state governments, has led electric utility companies to consider dry conversion. TVA is the most prominent example of this trend which publicly announced 100 in 2009 it plans to convert its wet fly ash and wet bottom ash systems to 100 TVA’s 20 August 2009 news release is at http://www.tva.gov/news/releases/julsep09/ccprp_other.htm 99