Florida Seaport System Plan - SeaCIP

Florida Seaport System Plan - SeaCIP

Florida Seaport System Plan - SeaCIP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Florida</strong> <strong>Seaport</strong> <strong>System</strong> <strong>Plan</strong><br />

How <strong>Florida</strong> and its ports deal with constraints and opportunities is, of course, a<br />

critical policy question. To better address this question, the <strong>Florida</strong> Chamber<br />

Foundation, FDOT, the <strong>Florida</strong> Ports Council (FPC), and other stakeholders<br />

partnered in a comprehensive Trade and Logistics Study of all transportation<br />

modes serving <strong>Florida</strong>. As part of that study, a set of detailed international<br />

cargo forecasts was developed.<br />

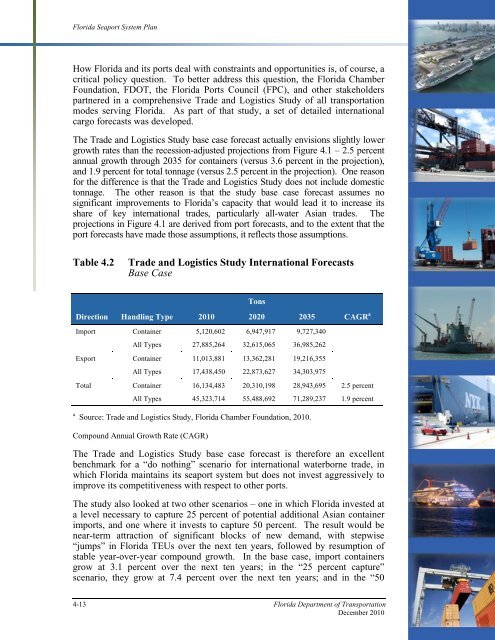

The Trade and Logistics Study base case forecast actually envisions slightly lower<br />

growth rates than the recession-adjusted projections from Figure 4.1 – 2.5 percent<br />

annual growth through 2035 for containers (versus 3.6 percent in the projection),<br />

and 1.9 percent for total tonnage (versus 2.5 percent in the projection). One reason<br />

for the difference is that the Trade and Logistics Study does not include domestic<br />

tonnage. The other reason is that the study base case forecast assumes no<br />

significant improvements to <strong>Florida</strong>’s capacity that would lead it to increase its<br />

share of key international trades, particularly all-water Asian trades. The<br />

projections in Figure 4.1 are derived from port forecasts, and to the extent that the<br />

port forecasts have made those assumptions, it reflects those assumptions.<br />

Table 4.2<br />

Trade and Logistics Study International Forecasts<br />

Base Case<br />

Direction Handling Type 2010<br />

Tons<br />

2020 2035 CAGR a<br />

Import Container 5,120,602 6,947,917 9,727,340<br />

All Types 27,885,264 32,615,065 36,985,262<br />

Export Container 11,013,881 13,362,281 19,216,355<br />

All Types 17,438,450 22,873,627 34,303,975<br />

Total Container 16,134,483 20,310,198 28,943,695 2.5 percent<br />

All Types 45,323,714 55,488,692 71,289,237 1.9 percent<br />

a Source: Trade and Logistics Study, <strong>Florida</strong> Chamber Foundation, 2010.<br />

Compound Annual Growth Rate (CAGR)<br />

The Trade and Logistics Study base case forecast is therefore an excellent<br />

benchmark for a “do nothing” scenario for international waterborne trade, in<br />

which <strong>Florida</strong> maintains its seaport system but does not invest aggressively to<br />

improve its competitiveness with respect to other ports.<br />

The study also looked at two other scenarios – one in which <strong>Florida</strong> invested at<br />

a level necessary to capture 25 percent of potential additional Asian container<br />

imports, and one where it invests to capture 50 percent. The result would be<br />

near-term attraction of significant blocks of new demand, with stepwise<br />

“jumps” in <strong>Florida</strong> TEUs over the next ten years, followed by resumption of<br />

stable year-over-year compound growth. In the base case, import containers<br />

grow at 3.1 percent over the next ten years; in the “25 percent capture”<br />

scenario, they grow at 7.4 percent over the next ten years; and in the “50<br />

4-13 <strong>Florida</strong> Department of Transportation<br />

December 2010