Sri Lanka Human Development Report 2012.pdf

Sri Lanka Human Development Report 2012.pdf

Sri Lanka Human Development Report 2012.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

An Environment for Business to Prosper<br />

With the end of conflict, <strong>Sri</strong> <strong>Lanka</strong> can now focus on a more<br />

impressive growth trajectory. While public investment<br />

in infrastructure - roads, bridges, ports, airports, etc. -<br />

continues at a rapid pace, private sector investment will be<br />

an important determinant of the ambitious post-conflict<br />

scenario envisaged. For <strong>Sri</strong> <strong>Lanka</strong> to sustain growth at<br />

8 percent in the medium- to long-term, the country will<br />

need to raise its annual rate of investment from the current<br />

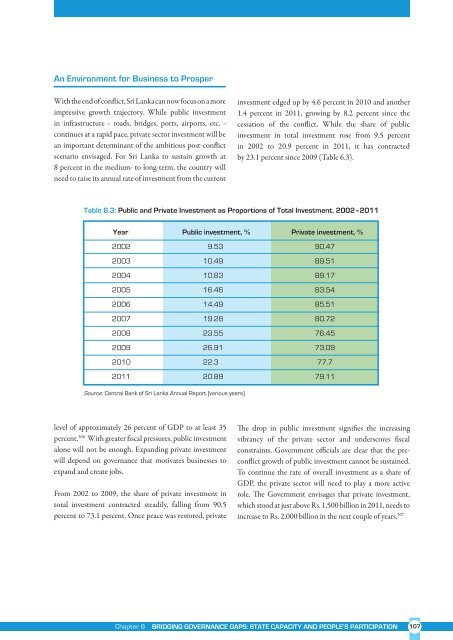

investment edged up by 4.6 percent in 2010 and another<br />

1.4 percent in 2011, growing by 8.2 percent since the<br />

cessation of the conflict. While the share of public<br />

investment in total investment rose from 9.5 percent<br />

in 2002 to 20.9 percent in 2011, it has contracted<br />

by 23.1 percent since 2009 (Table 6.3).<br />

Table 6.3: Public and Private Investment as Proportions of Total Investment, 2002–2011<br />

Year public investment, % private investment, %<br />

2002 9.53 90.47<br />

2003 10.49 89.51<br />

2004 10.83 89.17<br />

2005 16.46 83.54<br />

2006 14.49 85.51<br />

2007 19.28 80.72<br />

2008 23.55 76.45<br />

2009 26.91 73.09<br />

2010 22.3 77.7<br />

2011 20.89 79.11<br />

Source: Central Bank of <strong>Sri</strong> <strong>Lanka</strong> Annual <strong>Report</strong> (various years).<br />

level of approximately 26 percent of GDP to at least 35<br />

percent. 306 With greater fiscal pressures, public investment<br />

alone will not be enough. Expanding private investment<br />

will depend on governance that motivates businesses to<br />

expand and create jobs.<br />

From 2002 to 2009, the share of private investment in<br />

total investment contracted steadily, falling from 90.5<br />

percent to 73.1 percent. Once peace was restored, private<br />

The drop in public investment signifies the increasing<br />

vibrancy of the private sector and underscores fiscal<br />

constraints. Government officials are clear that the preconflict<br />

growth of public investment cannot be sustained.<br />

To continue the rate of overall investment as a share of<br />

GDP, the private sector will need to play a more active<br />

role. The Government envisages that private investment,<br />

which stood at just above Rs. 1,500 billion in 2011, needs to<br />

increase to Rs. 2,000 billion in the next couple of years. 307<br />

Chapter 6 Bridging Governance Gaps: State Capacity and People’s Participation 107